PPG Industries Launches Next-Generation Electrocoat in China

PPG Industries, Inc. PPG has unveiled its next-generation electrocoat (e-coat) primer — PPG Enviro-Prime 8000 — for automotive original equipment manufacturers (OEMs) serving China’s market. The company expects to supply the product across China’s domestic OEM locations by the end of this year.

The new cathodic dip primer boosts the company’s capabilities to address the unique demands of domestic OEMs in China. Built on the success of its first global hyper-throw electrocoat, PPG Enviro-Prime 7000, this new product will add value by delivering superior workability and better appearance characteristics for easier management on the production line. Moreover, PPG Enviro-Prime 8000 offers throwpower for the hyper-throw e-coat segment along with best-in-class corrosion resistance.

PPG Industries’ shares have lost 6.7% in the past three months against the industry’s rise of roughly 1.4%.

The company expects a boost in overall economic growth. It is on track with its restructuring actions that are expected to provide cost savings between $50 million and $55 million in 2018, higher than what it had expected earlier.

However, PPG Industries is exposed to raw materials cost pressure that is expected to affect its margins in the second quarter. Moreover, some of its end markets including wood and marine still remain sluggish.

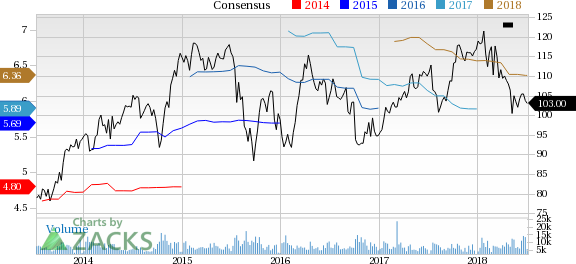

PPG Industries, Inc. Price and Consensus

PPG Industries, Inc. Price and Consensus | PPG Industries, Inc. Quote

Zacks Rank & Stocks to Consider

PPG Industries currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Methanex Corporation MEOH, Westlake Chemical Corporation WLK and United States Steel Corporation X, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Methanex has an expected long-term earnings growth rate of 15%. Its shares have rallied 66.6% in a year.

Westlake Chemical has an expected long-term earnings growth rate of 12.2%. Its shares have gained 62% in a year.

U.S. Steel has an expected long-term earnings growth rate of 8%. Its shares have moved up 61.7% in a year.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

Methanex Corporation (MEOH) : Free Stock Analysis Report

Westlake Chemical Corporation (WLK) : Free Stock Analysis Report

United States Steel Corporation (X) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance