S’pore prime residential rents down 3.3% in Q4 2016

Luxury residential rents in Singapore are still falling.

Singapore saw prime residential rents drop 3.3 percent in the fourth quarter of 2016 from the previous year, according to a Knight Frank report.

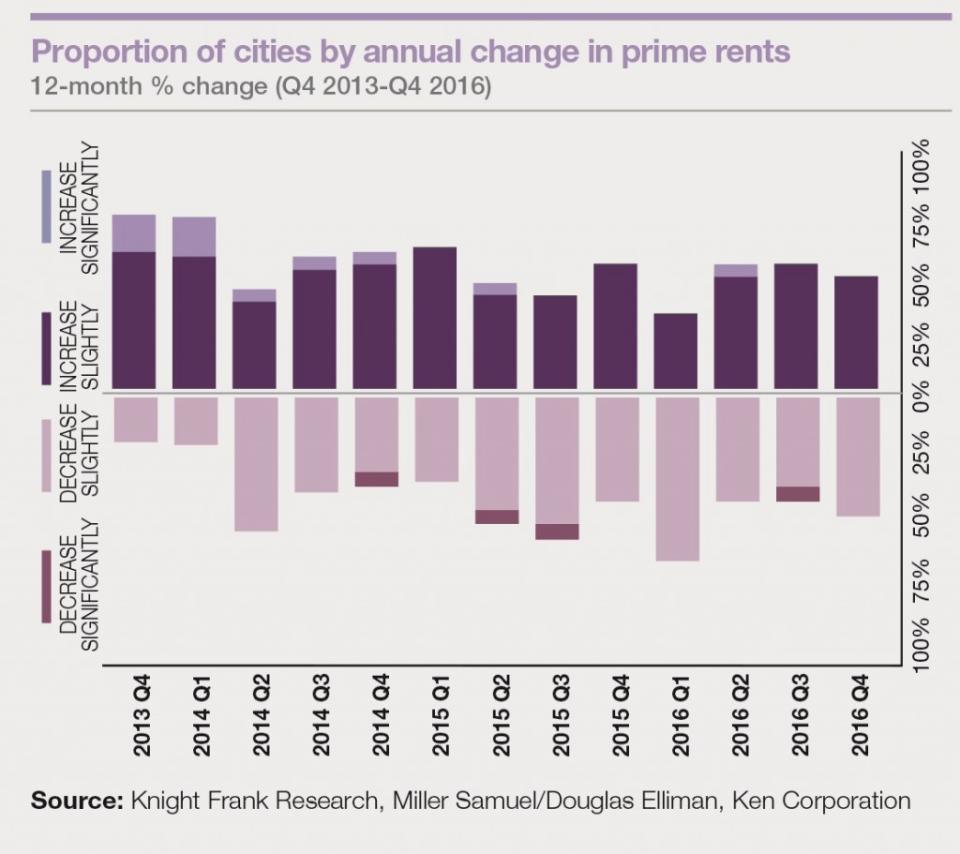

This comes as Knight Frank’s Prime Global Rental Index fell marginally by 0.4 percent in 2016.

The report noted that while rents generally declined in 2016, 10 of the 17 cities tracked in the index registered rental growth last year, up from seven in 2015.

However, the difference between the strongest and the weakest performing markets also increased to 14 percent from 12.5 percent previously.

Topping the list is Toronto, with prime rents increasing eight percent year-on-year in Q4 2016. This was followed by Cape Town and Guangzhou with rental growth of 6.3 percent and 3.9 percent, respectively.

Completing the top five list are Zurich (3.3 percent) and Tel Aviv (2.4 percent).

For five years in a row, North America emerged as the strongest performing region, with prime rents increasing by 5.2 percent in 2016.

Europe, on the other hand, displaced Africa as the weakest performing region, with prime rents there dropping 2.1 percent last year.

“With increasingly active fiscal and monetary policies in the US, such as President Trump’s proposed US$1 trillion infrastructure plan and tax cuts, as well as the decision by the Federal Reserve to raise interest rates, we may see other central banks and governments follow suit to either support currency or to deal with any spill-over of inflation,” said Taimur Khan, Senior Research Analyst at Knight Frank.

“Higher interest rates would negatively impact on market affordability, a process which could lead to an increase in the demand for rental accommodation, as prospective buyers opted to rent for a period.”

Romesh Navaratnarajah, Senior Editor at PropertyGuru, edited this story. To contact him about this or other stories, email romesh@propertyguru.com.sg

Yahoo Finance

Yahoo Finance