Popular Inc (BPOP) Q1 2024 Earnings: Adjusted Net Income Surpasses Estimates Amidst Tax and ...

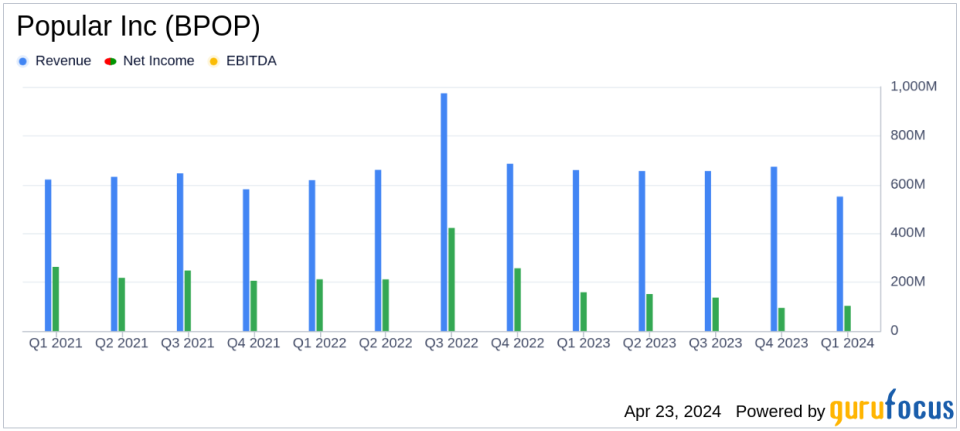

Net Income: Reported $103.3 million for Q1 2024, up from $94.6 million in Q4 2023, falling short of the estimated $134.03 million.

Adjusted Net Income: Adjusted for special items, net income was $135.2 million in Q1 2024, compared to $139.9 million in Q4 2023.

Revenue (Net Interest Income): Reached $550.7 million, up from $534.2 million in the previous quarter, surpassing the estimated $559.81 million.

Earnings Per Share (EPS): Basic and diluted EPS stood at $1.43, exceeding the estimated $1.86 per share.

Net Interest Margin: Increased to 3.16% in Q1 2024 from 3.08% in Q4 2023, indicating improved profitability from lending activities.

Provision for Credit Losses: Totaled $72.6 million in Q1 2024, down from $78.7 million in the previous quarter, reflecting stable credit quality.

Operating Expenses: Decreased to $483.1 million in Q1 2024 from $531.1 million in Q4 2023, contributing to better operational efficiency.

On April 23, 2024, Popular Inc (NASDAQ:BPOP) disclosed its financial results for the first quarter of 2024 through its 8-K filing. The company reported a net income of $103.3 million for the quarter, which, when adjusted for specific one-time charges, resulted in an adjusted net income of $135.2 million, surpassing the analyst's net income estimate of $134.03 million. This performance highlights the company's resilience despite facing increased operational costs due to the FDIC Special Assessment and tax-related expenses.

About Popular Inc

Headquartered in Puerto Rico, Popular Inc is a leading financial holding company with significant operations through its subsidiaries including Banco Popular de Puerto Rico, Banco Popular North America, Evertec, and Popular Financial Holdings. The company primarily operates through two segments: Banco Popular de Puerto Rico and Popular U.S., providing a range of financial services in Puerto Rico, the U.S. Virgin Islands, and the mainland United States.

Financial Performance Insights

The first quarter of 2024 saw Popular Inc navigate through several financial and operational challenges. The company incurred a significant expense due to the FDIC Special Assessment, initially estimated at $71.4 million in Q4 2023, with an additional $14.3 million recorded this quarter based on revised FDIC loss estimates. Moreover, a tax expense of $22.9 million was recognized related to prior period intercompany distributions.

Despite these challenges, Popular Inc managed to increase its net interest income to $550.7 million, up from $534.2 million in the previous quarter, and expanded its net interest margin by eight basis points to 3.16%. This improvement was supported by a stable deposit base and an increase in loan volumes, particularly commercial loans, which bolstered the net interest income for the Banco Popular de Puerto Rico segment.

Operational and Strategic Developments

Popular Inc's operational expenses for Q1 2024 totaled $483.1 million, a decrease from $531.1 million in Q4 2023. This reduction reflects effective cost management despite the financial impacts of additional FDIC assessments and tax adjustments. The company's strategic focus on maintaining robust liquidity and capital ratios significantly contributes to its ability to pursue sustainable business growth.

President and CEO Ignacio Alvarez commented on the results, stating,

We are pleased to report solid earnings for the first quarter after considering the impact of an additional accrual for the FDIC special assessment and a tax related expense associated with prior period intercompany distributions. We continued to benefit from a stable deposit base, increased our net interest income by 3% and expanded our net interest margin by eight basis points."

Looking Ahead

Popular Inc remains cautious yet optimistic about its future performance, emphasizing its well-positioned liquidity and capital to navigate potential economic uncertainties. The company's focus on enhancing its operational efficiencies and risk management practices are expected to support its ongoing success in a challenging economic environment.

For more detailed financial figures and operational insights, investors and stakeholders are encouraged to review the full earnings report and financial statements available through the SEC filing linked above.

Explore the complete 8-K earnings release (here) from Popular Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance