POOL Relies on Expansion Initiatives Amid High Inflation

Pool Corporation POOL benefits from strategic expansion moves and solid brand presence. Also, regular maintenance and repair demand bodes well for the company.

However, this wholesale distributor of swimming pool supplies, equipment and related products is facing headwinds in the form of high costs and macroeconomic risks.

Let us delve deeper into the factors

What is Favoring POOL?

Pool is focused on expansion to drive revenues. It is foraying into newer geographic locations, expanding in existing markets and launching innovative product categories that will boost its market share. During first-quarter 2022, the company boosted its presence in the DIY segment of the market with the acquisition of Pinch A Penny. Given the synergies coupled with its robust development pipeline, the company expects the initiative to drive growth going ahead. During the first quarter of 2023, Pinch A Penny retail sales increased 10% year over year. During the quarter, POOL opened five new franchise locations.

POOL benefits from its market-leading position that offers cost advantage and allows it to generate a higher return on investment than smaller companies. Further, the housing market continues to boost demand for Pool’s products despite numerous competitors and low barriers to entry. The company generates a large portion of its earnings from existing pools.

More than half of its gross profits are generated from products related to the maintenance and repair of pools, while the remainder is derived from the construction and installation of pools and landscaping.

Headwinds

POOL has been witnessing increased expenses lately. Notably, inflationary cost increases in areas of facilities, freight, insurance, IT, advertising and marketing are leading to higher expenses. During the first quarter, selling and administrative expenses increased 5.9% year over year to $224 million. For 2023, the company anticipates inflationary pressure in the range of 4-5%.

POOL’s business is susceptible to weather changes. During the first quarter of 2023, the company’s operations were affected by unfavorable weather conditions in California, Arizona and Canada, which have about 50% of the company’s branches and sales operations, including Texas. So far this year, the company reported the impact of weather challenges on revenues (in the Western U.S.) of $60-$70 million.

The company conducts business internationally, which increases its dependence on other economies. Thus, unfavorable political and regulatory conditions in the market where it functions, as well as negative currency translation, might dent the company’s international sales. During the first quarter of 2023, the company’s European operations were negatively impacted by macroeconomic pressures, spiraling energy costs and the war in Ukraine. During the quarter, net sales from European markets were down 25% year over year. Given the headwinds, the company expects European operations to be under pressure for some time.

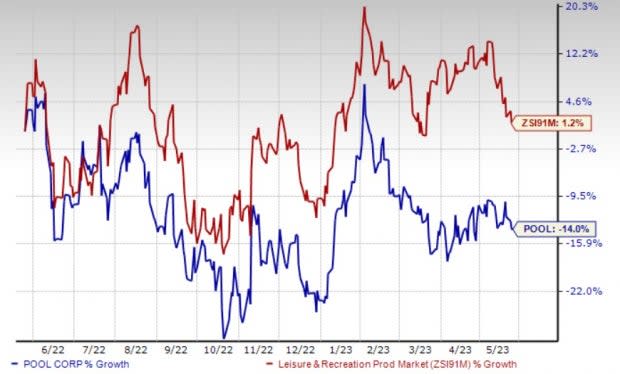

Image Source: Zacks Investment Research

Shares of POOL have declined 14% in the past year against the Zacks Leisure and Recreation Products industry’s growth of 1.2%.

Zacks Rank & Key Picks

POOL currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Here are some better-ranked stocks from the Zacks Consumer Discretionary sector.

Royal Caribbean Cruises Ltd. RCL sports a Zacks Rank #1. RCL has a trailing four-quarter earnings surprise of 26.4%, on average. The stock has increased 32.1% in the past six months.

The Zacks Consensus Estimate for RCL’s 2023 sales and EPS indicates a rise of 47.9% and 158.3%, respectively, from the year-ago period’s levels.

MGM Resorts International MGM currently sports a Zacks Rank #1. MGM delivered a trailing four-quarter earnings surprise of 81%, on average. Shares of the company have increased 12.5% in the past six months.

The Zacks Consensus Estimate for MGM’s 2023 sales indicates a rise of 15.4%, while the same for EPS indicates a decline of 45.9% from the year-ago period’s levels.

Crocs, Inc. CROX carries a Zacks Rank #2 (Buy). CROX has a trailing four-quarter earnings surprise of 19.6%, on average. Shares of the company have increased 11.8% in the past six months.

The Zacks Consensus Estimate for CROX’s 2023 sales and EPS indicates a rise of 13.2% and 5.7%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Pool Corporation (POOL) : Free Stock Analysis Report

MGM Resorts International (MGM) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance