Pitting The CPF Special Account Against Other Types Of Investment Instruments

The question we sometimes get from our friends is this:

“I am looking at retirement planning. Investing my CPF funds is one of the options. Since the CPF Ordinary Account (CPF-OA) is stashed for my HDB purchase, what can i invest with my CPF-SA (Special Account) funds?”

For us to answer the question above, we need to first understand more about the CPF Investment Scheme and their return rates. But first, let’s look at the eligibility criteria.

Who can invest under CPF Investment Scheme (“CPFIS” in short)?

According to the CPF board, you can invest under CPFIS, if you:

are at least 18 years old;

are not an undischarged bankrupt;

have more than $20,000 in your OA; and/or

have more than $40,000 in your SA.

Currently, the basic interest rate for the Special and Medisave Accounts is 4%, while the rate for the Ordinary Account (OA) is 2.5%. While there is also an additional 1% interest given on the first S$60,000 of a CPF member’s combined balances, the fact that you can only invest what’s after the minimum threshold of S$60,000 nullifies the extra interest.

Should you invest using CPF-SA monies?

For a start, let’s zoom right in to the various types of investment products under the CPF Investment Scheme shown at this link. Some of these include Fixed Deposits, Exchange Traded Funds, Unit Trusts, Investment-Linked Insurance and many more, Do note that that funds of higher risk ratings, corporate bonds and gold-related products aren’t included under the CPFIS-SA.

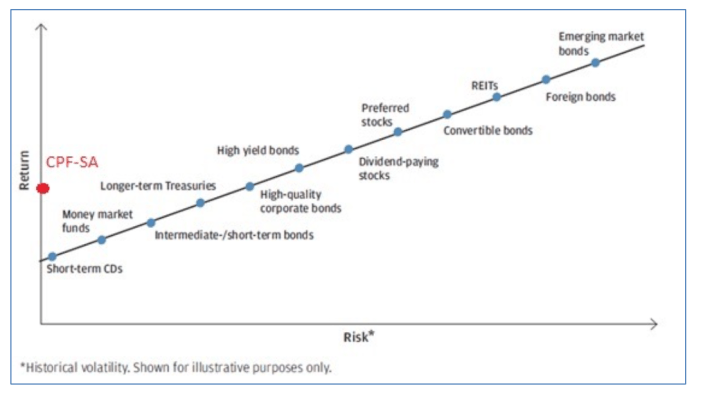

In order to answer the question of whether you should utilize a portion of your CPF-SA to invest in other financial instruments, we take a look at a simple illustration of the risk-return trade-off. With CPF-SA providing 4% risk-free returns backed by the staunch credibility of our government, we will allocate it as the risk-free rate to the red dot shown in the chart.

If you are a finance student and this chart looks strange to you (hint: think CAPM), fear not. It is a little strange indeed.

This chart points out a simple flaw to investors intending to invest their CPF-SA. And that is, you should never invest in anything that gives you a return which is less than 4% over the long run. Not only do you get less interest, you also incur more risk.

At the same time, simply beating the returns of the CPF-SA by 1-2% is no immediate justification to invest. A person still have to weigh the risk-return trade-off that he or she would get. It will boil down to each individual’s risk profile and their willingness to stomach higher risk for a potentially higher return.

Our Take: Keep your CPF-SA right where it is

We often hear that most retail investors are worse off when they invest the money in their CPF accounts due to their lack of financial knowledge and discipline.

Hence, we believe that for most people (including financially savvy people), leaving their CPF-SA monies untouched is probably a pretty good deal after all. At the very least, you get a convenient way to accumulate wealth over the long run at a 4% return rate without the need for any knowledge, strategies, or to lose any sleep worrying about fluctuating stock prices.

If you like what you read, subscribe to our DollarsAndSense.sg newsletter. We have more exclusive content written just for it.

The post Pitting The CPF Special Account Against Other Types Of Investment Instruments appeared first on DollarsAndSense.sg.

Yahoo Finance

Yahoo Finance