Philippines Decision Guide: Stage Set for a Pause in Rate Hikes

By Siegfrid Alegado

After five successive interest-rate increases, the Philippine central bank may be ready to pause.

Bangko Sentral ng Pilipinas will keep its benchmark rate at 4.75 percent on Thursday, according to all 18 economists in a Bloomberg survey — the first time since September 2017 that analysts are unanimous in theirs views. The central bank has delivered 175 basis points of rate hikes since May, making it one of the most aggressive in Asia this year.

“Policy moves this year have been all about trying to anchor inflation and inflation expectations,” said Euben Paracuelles, an economist at Nomura Holdings Inc. in Singapore. “We expect headline inflation to fall relatively sharply in the coming months.”

Here’s a look at what to watch out for from the central bank on Thursday:

Inflation Outlook

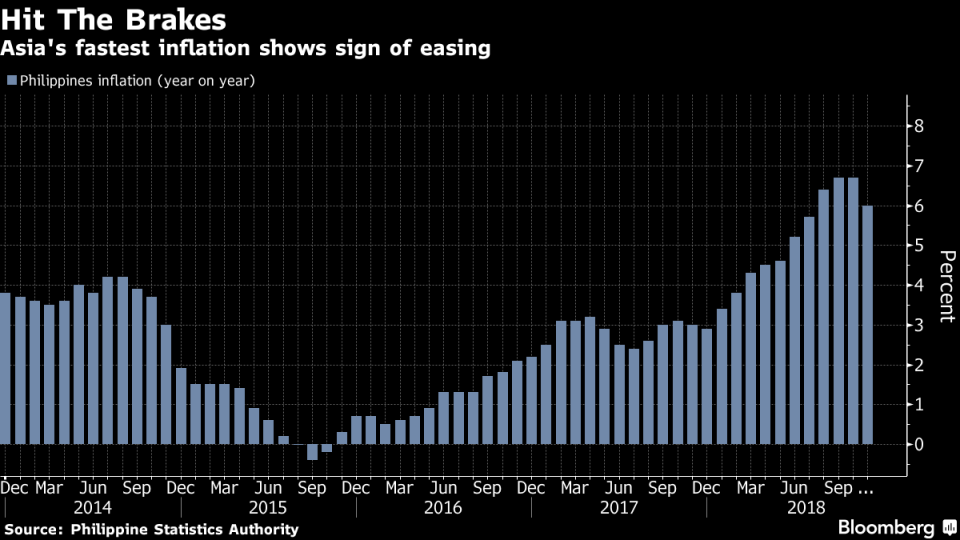

Surging prices have plagued the Philippines this year after taxes were increased and oil and rice costs rose. President Rodrigo Duterte has implemented a range of measures, from police checks for overpricing to easing food import restrictions, to ease the burden on consumers.

Inflation was 6 percent in November, easing for the first time in 11 months. The central bank’s target is for annual inflation to average 2 percent to 4 percent until 2020. It estimated in November price gains to average 3.5 percent in 2019 and 3.3 percent in 2020.

Policy Outlook

Market participants are on the lookout for clues on whether Thursday’s decision will be a temporary pause or will mark the end to the tightening round. Governor Nestor Espenilla, who’s undergoing cancer treatment and limiting public appearances, has flagged the need to remain vigilant on prices, citing core inflation, which continued to accelerate in November.

Espenilla will chair the policy meeting but he won’t be attending the media briefing because of speaking limitations from his treatment.

Analysts are split on the outlook for rates, with those from Nomura, Barclays Plc and ING Groep N.V. seeing the hiking cycle as over.

“Our call is that the tightening cycle has come to an end,” said Rahul Bajoria, a senior economist at Barclays in Singapore, adding that inflation – while still elevated – will “materially drop.”

Not everyone is convinced, given that inflation risks will continue to mount because of another round of tax increases on oil and cigarettes starting in January.

“It is clearly not out of the woods just yet,” said Noelan Arbis, an economist at HSBC Holdings Plc. in Hong Kong, who predicts another 25-basis point hike in the first quarter.

© 2018 Bloomberg L.P

Yahoo Finance

Yahoo Finance