PG&E Corp. (PCG) Meets Q1 Earnings, Reaffirms 2023 View

PG&E Corporation’s PCG adjusted earnings per share (EPS) of 29 cents in the first quarter of 2023 came in line with the Zacks Consensus Estimate. However, the bottom line decreased 3.3% from the year-ago quarter’s reported figure.

The company reported GAAP earnings of 27 cents per share compared with 22 cents in the prior-year quarter.

Revenue Update

In the first quarter, PSEG reported total revenues of $6,209 million compared with $5,798 million in the year-ago period. Operating revenues came almost in line with the Zacks Consensus Estimate of $6,210.3 million.

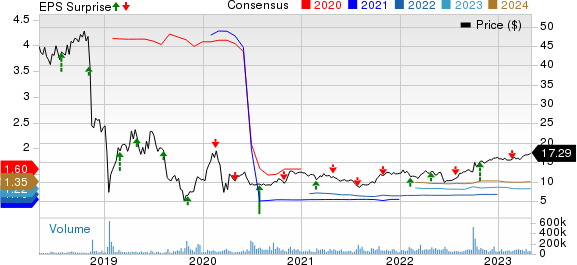

Pacific Gas & Electric Co. Price, Consensus and EPS Surprise

Pacific Gas & Electric Co. price-consensus-eps-surprise-chart | Pacific Gas & Electric Co. Quote

Operational Highlights

Total operating expenses in the first quarter summed at $5,580 million, which increased 6% from the prior-year quarter. The rise was due to the higher cost of electricity, natural gas and depreciation, amortization and decommissioning.

The company reported an operating income of $629 million for the quarter compared with $536 million in the year-ago period.

Interest expenses totaled $602 million compared with $419 million in the prior-year quarter.

Financials

As of Mar 31, 2023, cash and cash equivalents totaled $1,028 million compared with $734 million as of Dec 31, 2022.

Cash flow from operating activities amounted to $1,185 million for the three months ended Mar 31, 2023 compared with $1,661 million in the year-ago period.

Capital expenditures were $2,288 million for the three months ended Mar 31, 2023 compared with $2,310 million in the prior year period.

The long-term debt was $48,508 million as of Mar 31, 2023 compared with $47,472 million as of Dec 31, 2022.

Guidance

PG&E Corp. reaffirmed its 2023 adjusted EPS guidance in the range of $1.19-$1.23. The Zacks Consensus Estimate for 2023 earnings, pegged at $1.22 per share, is higher than the midpoint of the company’s guided range.

Zacks Rank

PG&E Corp. currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Utility Releases

Edison International EIX reported first-quarter 2023 adjusted earnings of $1.09 per share, which beat the Zacks Consensus Estimate by 4.8%. The bottom line also increased 1.9% from $1.07 in the year-ago quarter.

Edison International's first-quarter revenues totaled $3,966 million, which missed the Zacks Consensus Estimate of $4,111 million by 3.5%. However, the top line was almost in line with the year-ago quarter’s revenues of $3,968 million.

Entergy Corporation ETR reported first-quarter 2023 earnings of $1.14 per share, which missed the Zacks Consensus Estimate of $1.34 by 14.9%. The reported figure also declined 13.6% from $1.32 per share in the year-ago quarter.

Entergy’s reported revenues of $2,981.1 million beat the Zacks Consensus Estimate of $2,804.2 million by 6.4%. The figure also improved 3.6% from $2,877.9 million in the year-ago quarter due to higher Electric revenues.

CenterPoint Energy, Inc. CNP reported first-quarter 2023 adjusted earnings of 50 cents per share, which beat the Zacks Consensus Estimate of 48 cents by 4.2%. The bottom line also improved 6.4% from the year-ago quarter’s figure of 47 cents.

CNP generated revenues of $2,779 million, up 0.6% from the year-ago figure. However, the top line missed the Zacks Consensus Estimate of $2,792 million by 0.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Entergy Corporation (ETR) : Free Stock Analysis Report

Edison International (EIX) : Free Stock Analysis Report

Pacific Gas & Electric Co. (PCG) : Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance