How Parsons (PSN) Is Placed Ahead of Q1 Earnings?

Parsons Corporation PSN will report its first-quarter 2024 results on May 1, before market open.

Let’s check out how PSN has been doing.

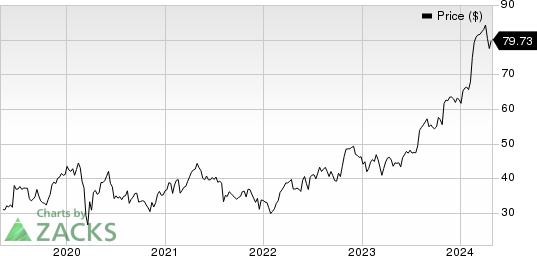

Stock Performance & Valuation

The stock has gained 82.4% compared with 55% growth of the industry it belongs to and the Zacks S&P 500 Composite’s rise of 23.5% over the past year.

Parsons Corporation Price

Parsons Corporation price | Parsons Corporation Quote

Based on EV-to-EBITDA, PSN is currently trading at 20.53X compared with the industry’s 60.02X. If we look at the Price/Earnings ratio, PSN shares currently trade at 27.30X forward earnings, below the industry’s 38.92X.

Sales and Margin Performance

The company had an exceptional year in 2023. Total revenues of the company surged 30% to $5.4 billion, indicating a strong demand for its services. Adjusted EBITDA gained 32% year over year, reaching $465 million. An increment as such demonstrates improved operational efficiency. Adjusted EBITDA margin increased to 8.5%, indicating an uptick of 13 basis points. Growth in Net Income Margin had been witnessed as well, where the metric increased to 3.8%, up 80 basis points from the preceding year.

Liquidity

PSN’s current ratio (a measure of liquidity) was 1.52 at the end of fourth-quarter 2023, higher than the prior quarter’s 1.45. A current ratio of more than 1 often indicates the company’s efficiency in paying off its short-term debt obligations.

Sales and EPS Growth Prospects

The Zacks Consensus Estimate for PSN’s first-quarter 2024 sales and earnings per share (EPS) implies year-over-year growth of 9.2% and 15.6%, respectively. The estimate for EPS has remained consistent over the past 30 days.

Conclusion

PSN trades at a discount relative to its industry based on EV-to-EBITDA and seems cheaper based on P/E. The company’s liquidity position based on the current ratio remains healthy.

Since the stock has risen a whopping 82.4% in the past year, it may be poised for continued growth going forward for the first-quarter driven by tailwinds like strong demand for its services and cost-containment efforts.

Moreover, PSN seems to be well-poised for an earnings beat. Our quantitative model suggests that the combination of two key elements — a positive Earnings ESP and a Zacks Rank #3 (Hold) or better — increases the odds of a positive earnings surprise. This is the case with PSN at present, as it has an Earnings ESP of +1.07% and a Zacks Rank of 3.

Given this backdrop, it may not be a bad idea to buy this fundamentally strong stock that might continue growing post an earnings beat as well after May 1.

Other Stocks to Consider

Here are a few other stocks from the broader Business Services sector, which, according to our model, also have the right combination of elements to beat on earnings this season.

Automatic Data Processing ADP: The Zacks Consensus Estimate for the company’s first-quarter 2024 revenues is pegged at $5.2 billion, indicating year-over-year growth of 6%. For earnings, the consensus mark is pegged at $2.8 per share, suggesting a 9.5% rise from the year-ago quarter’s actual. The company beat the consensus estimate in the past four quarters, with an average surprise of 2.8%.

ADP currently has an Earnings ESP of +1.72% and a Zacks Rank of 3. The company is scheduled to declare its first-quarter results on May 1. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Marathon Digital MARA: The Zacks Consensus Estimate for the company’s first-quarter 2024 revenues is pegged at $193.9 million, indicating a rise of more than 100% from the year-ago quarter. The consensus mark for earnings is pegged at 2 cents per share, suggesting a rise of more than 100% from the year-ago quarter. The company beat the consensus estimate in one of the past four quarters and missed in three instances, with an average negative surprise of 107.1%.

MARA has an Earnings ESP of +125.00% and a current Zacks Rank of 3. The company is scheduled to post its first-quarter results on May 9.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Marathon Digital Holdings, Inc. (MARA) : Free Stock Analysis Report

Parsons Corporation (PSN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance