Parsons Corp (PSN) Q1 2024 Earnings: Surpasses Revenue Forecasts Despite Net Loss

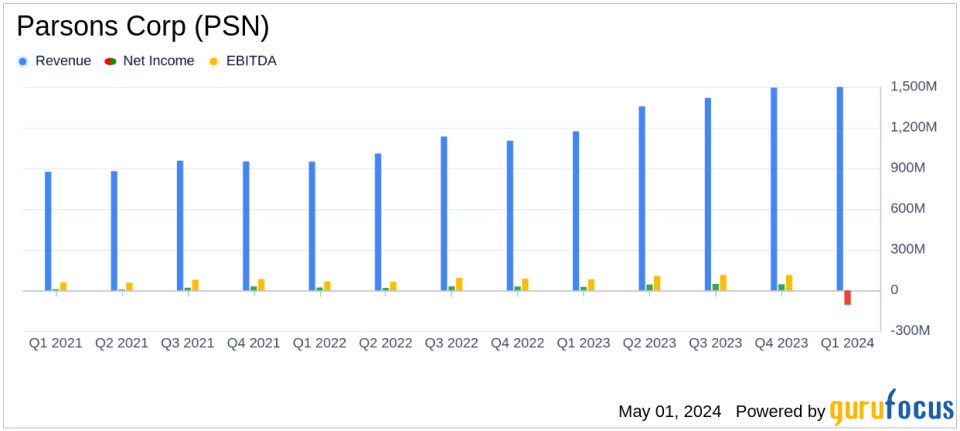

Revenue: Reached $1.5 billion, a 31% increase year-over-year, surpassing the estimate of $1.376 billion.

Adjusted EBITDA: Grew by 56% to $141 million, with margin expansion of 150 basis points to 9.2%.

Net Loss: Reported at $107 million due to a $214 million charge related to convertible notes repurchase, contrasting with an estimated net income of $62.7 million.

Adjusted EPS: Recorded at $0.70, exceeding the quarterly estimate of $0.62.

Book-to-Bill Ratio: Strong performance at 1.4x, indicating healthy future revenue potential.

Total Backlog: Increased by 8% to $9.0 billion, supporting future growth visibility.

Cash Flow: Operating activities used $63 million in cash, a significant increase from $9 million in the previous year.

Parsons Corp (NYSE:PSN) announced its first quarter financial results for 2024, revealing a significant increase in revenue and strategic achievements, alongside a net loss due to a sizable pre-tax charge. The details were disclosed in the company's recent 8-K filing on May 1, 2024.

Parsons, a technology-focused defense, intelligence, and critical infrastructure provider, reported a record-breaking revenue of $1.5 billion this quarter, marking a 31% increase year-over-year. This growth was primarily fueled by a 29% rise in organic revenue, continuing a trend of robust organic growth exceeding 20% for four consecutive quarters.

Financial Performance Overview

The company's revenue outperformance was shadowed by a net loss of $107 million, primarily due to a $214 million pre-tax charge related to the repurchase of a portion of its 2025 convertible notes. The repurchase was influenced by the company's strong performance, which elevated its stock price above the conversion threshold of the bonds.

Adjusted EBITDA saw a significant rise, reaching $141 million, a 56% increase from the previous year, with the adjusted EBITDA margin expanding by 150 basis points to 9.2%. Adjusted earnings per share (EPS) also grew to $0.70 from $0.43 in the prior year, driven by the increase in adjusted EBITDA.

Segment Performance and Strategic Developments

The Federal Solutions segment experienced a remarkable 43% increase in revenue, reaching approximately $910 million, while the Critical Infrastructure segment grew by 16%, totaling around $626 million in revenue. Both segments benefited from organic growth and strategic acquisitions, such as SealingTech, enhancing Parsons' capabilities and market position.

Noteworthy contracts secured during the quarter include a significant role in the $16 billion Hudson Tunnel Project, expected to receive substantial federal funding. Additionally, Parsons won several other high-value contracts across its operating segments, reinforcing its strategic positioning in national security and infrastructure development.

Challenges and Forward-Looking Statements

Despite the financial uplift, Parsons faced challenges, notably the substantial cash used in operating activities, which increased to $63 million from $9 million in the previous year. This uptick was attributed to the timing of receipts and higher incentive compensation costs due to strong performance in fiscal 2023.

The company has adjusted its fiscal year 2024 guidance upwards for revenue, adjusted EBITDA, and cash flow from operations, reflecting confidence in sustained strong performance throughout the year.

Corporate Recognition and Ethical Standing

Parsons' commitment to ethical business practices and community engagement was highlighted by several accolades, including its 15th consecutive recognition as one of the World's Most Ethical Companies by Ethisphere. The company was also celebrated for project excellence and its efforts in diversity, equity, and inclusion.

In conclusion, Parsons Corp's first quarter of 2024 demonstrated a dynamic balance of revenue growth and strategic advancements against financial challenges related to its convertible notes. With a strong backlog and a series of significant contract wins, Parsons is well-positioned to maintain its growth trajectory and enhance shareholder value in the evolving landscapes of national security and global infrastructure.

Explore the complete 8-K earnings release (here) from Parsons Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance