PagerDuty (PD) Shares Jump More Than 11% on Narrower Q3 Loss

PagerDuty PD reported third-quarter fiscal 2022 non-GAAP loss of 7 cents per share, which beat the Zacks Consensus Estimate by 22.22%. The company had reported a loss of 8 cents in the year-ago quarter.

Revenues of $71.8 million increased 33.5% on a year-over-year basis, primarily driven by strong expansion in the enterprise and mid-market. The figure beat the consensus mark for revenues by 2.36%.

Following impressive third-quarter results, PagerDuty shares jumped 11.2% to close at $37.25 on Dec 8. PagerDuty shares are down 10.7% year to date compared with 19.8% decline of the Zacks Internet Software industry. The Zacks Computer & Technology sector rose 25.5% in the same time frame.

During third-quarter fiscal 2022, PagerDuty continued to see strength in the enterprise and mid-market, with total dollar-based net retention of 124%, much higher than 119% reported in the year-ago quarter.

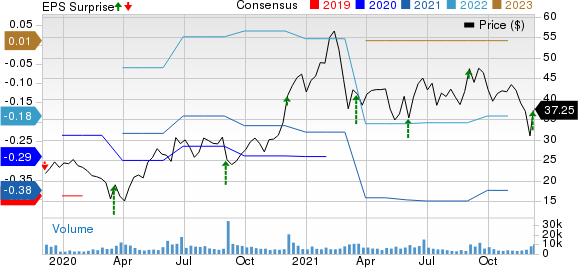

PagerDuty Price, Consensus and EPS Surprise

PagerDuty price-consensus-eps-surprise-chart | PagerDuty Quote

Customer Growth Momentum Continued

PagerDuty ended fiscal third quarter with total paid customers of 14,486 compared with 13,725 in the year-ago quarter.

Customers with annual recurring revenue of more than $100,000 was 543 as of Oct 31, 2021, compared to 401 in the year-ago period.

Operating Details

In third-quarter fiscal 2022, non-GAAP gross profit increased 30.4% year over year to $60.9 million. Gross margin contracted 200 basis points (bps) to 84.8%.

Non-GAAP research & development expenses increased 35.1% to $17.7 million. Non-GAAP sales & marketing expenses rose 26.9% year over year to $34.8 million. Non-GAAP general & administrative expenses increased 10.9% to $13.4 million.

Non-GAAP operating loss of $5 million was narrower than the year-ago quarter’s loss of $5.9 million.

Balance Sheet & Cash Flow

As of Oct 31, 2021, PagerDuty had cash & cash equivalents and investments of $545.2 million.

Net cash provided by operating activities was $2.7 million compared with $4.8 million reported in the year-ago quarter. Free cash flow was $1.8 million compared with $4.5 million reported in the year-ago quarter.

Guidance

For fourth-quarter fiscal 2022, revenues are anticipated between $75.5 million and $76.5 million, indicating year-over-year growth of 27-29%. Non-GAAP loss is expected between 5 cents and 6 cents per share.

For fiscal 2022, revenues are anticipated between $278.5 million and $279.5 million. Non-GAAP loss is expected between 33 cents and 34 cents per share.

Zacks Rank & Stocks to Consider

PagerDuty currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Computer & Technology sector are Arrow Electronics ARW, Salesforce CRM and Advanced Micro Devices AMD.

Currently, Arrow Electronics sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here. The long-term earnings growth rate is pegged at 27.36%.

ARW shares have returned 29.4% year to date compared with the Zacks Electronics-Parts Distribution industry’s growth of 33.6% and the Computer & Technology sector’s return of 25.5%.

Salesforce, another Zacks Rank #1 stock, has a long-term earnings growth rate of 16.75%.

CRM is up 19.7% against the Zacks Computer Software industry’s growth of 39.5% and Computer & Technology sector’s return of 25.5% year to date.

The long-term earnings growth rate for AMD, a Zacks Rank #2 (Buy) stock, is currently pegged at 46.2%.

AMD shares have surged 58.4% year to date compared with the Electronics-Semiconductors industry’s growth of 38.8% and the Computer & Technology sector’s return of 25.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

salesforce.com, inc. (CRM) : Free Stock Analysis Report

Arrow Electronics, Inc. (ARW) : Free Stock Analysis Report

PagerDuty (PD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance