Recruiter slashes jobs as UK vacancies dry up

A leading recruiter has slashed its staff numbers as UK employers’ hiring has slowed, according to its results.

PageGroup (PAGE.L) said Brexit uncertainty and disruption had hit confidence among its clients in the UK, with a knock-on effect on employers’ recruitment spending.

It said in its latest trading update on Tuesday it expects Brexit uncertainty to be “ongoing” in 2020, and to continue to make trading harder.

A report last week said Britain’s tight labour market, with official figures showing employment at record highs, had also significantly limited the number of workers looking to switch jobs.

The global company, whose arms include Michael Page and Page Personnel, said its group profit had dipped to £205.6m in its fourth quarter , 2.6% lower than a year earlier.

READ MORE: 21,000 UK retail jobs slashed in 2019 as household names collapsed

Its UK profits slid by 4.8% to £31.9m, with low confidence also limiting candidate numbers for senior jobs and particularly affecting Michael Page.

The number of ‘fee earners,’ who generate income, employed by Michael Page fell by 27 in the quarter. PageGroup’s global fee earner headcount was down by 54, and support staff numbers were reduced by 37.

China saw the bulk of the rest of the reduction in headcount, the company said, with profits falling more in the Asia Pacific region than anywhere else. Asia Pacific profits crashed by 8.8% in the quarter, with the company blaming uncertainty over tariffs in China, protests in Hong Kong and the fires in Australia.

READ MORE: UK ‘generations away’ from equality for women in top jobs

PageGroup also released its full-year profits for 2019, with the UK the only area where profits declined. They were down by 2.4% year-on-year to £135.1m, but total profits were up 5% to £856m

It said it expected “tough trading conditions” to continue across much of the world. The update warned that the “weak financial services market” in New York and unrest in Chile could hit results in the Americas.

But Steve Ingham, PageGroup’s CEO, said its Germany, India and the US arms had performed well. “We have a flexible and highly diversified business model that enables us to react quickly to changes in market conditions,” he said.

The results still appeared to beat investors’ expectations, sending PageGroup shares 1.1% higher at around 9am in London.

He said the company would continue to focus on aiming for headcount of 10,000 and £1bn of gross profit. He added that full-year operating profits in 2019 would be in line with previous guidance of £140-150m.

READ MORE: UK employment at record high despite alarm bells over UK economy

It comes after a survey by the Recruitment & Employment Confederation and consultancy KPMG last week showed vacancy growth stuck near a decade low.

Permanent staff appointments ticked upwards at the end of 2019 for the first time in a year, but demand for temps softened further.

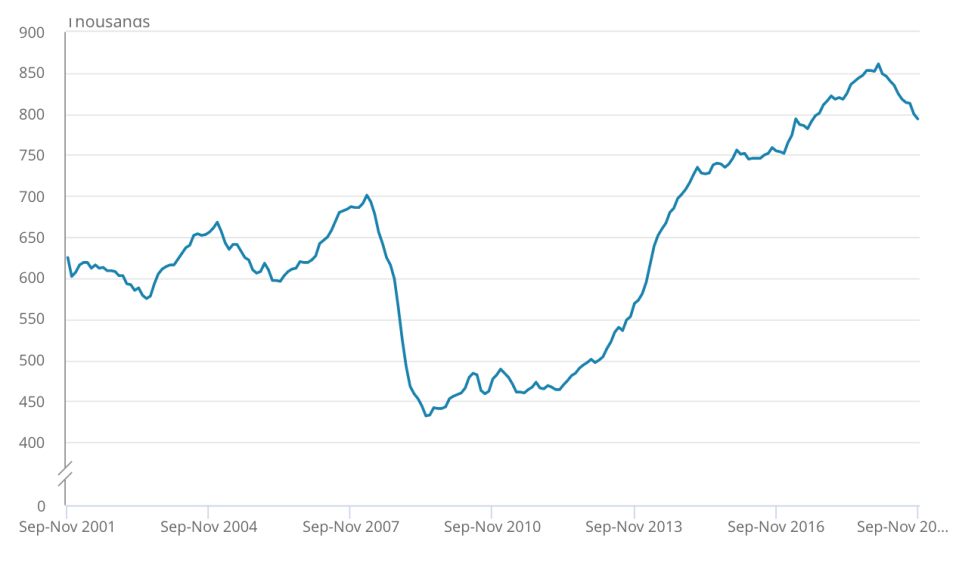

Official figures also show vacancies on a downward slide for the past year.

But behind the apparently robust headline numbers, warning lights are beginning to glow. The total number of vacancies is shrinking as Britain’s job creation boom slowly runs out of steam.

“The UK narrowly escaped a recession in 2019, and business confidence remains fragile, meaning many employers have put off hiring decisions.

“As the UK steps into its non-EU future, few expect a sudden jump in employers’ willingness to hire,” said jobs site Indeed’s UK economist Pawel Adrjan last month.

Yahoo Finance

Yahoo Finance