S&P 500 Technical Analysis: Down Move Set to Resume?

DailyFX.com -

Talking Points:

S&P 500 Volatility Surges to Highest Levels Since 2008 Crisis

Hanging Man Candlestick May Precede Reversal Downward

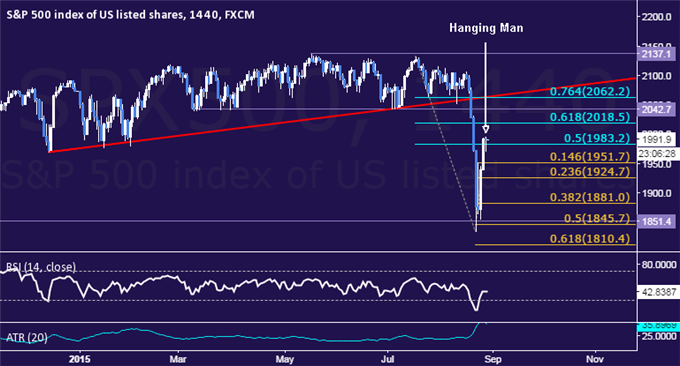

The S&P 500 paused to digest gains after launching higher as expected following the appearance of an Inverted Hammer candlestick. Prices recovered to within a hair of the 2000 figure in a mere two days having dropped to a 10-month low above the 1800 threshold from a range just below record highs in only four sessions. The rapid see-saw swings made for the most dramatic volatility since late 2008, when markets were gripped by the global financial crisis.

Near-term resistance is now at 2018.50, the 61.8% Fibonacci retracement. A daily close above this threshold clears a path to test range floor support-turned-resistance at 2042.70, followed by the 76.4% level at 2062.20. The formation of a Hanging Man candlestick may precede the return of selling pressure however. A reversal back below the 50% retracement at 1983.20 opens the door for a challenge of the 14.6% Fib expansion at 1951.70.

KEY UPCOMING EVENT RISK:

01 SEP 2015, 01:00 GMT – China Mfg PMI (AUG) – Expected: 49.7, Prev: 50.0

01 SEP 2015, 14:00 GMT – US ISM Manufacturing (AUG) – Expected: 52.5, Prev: 52.7

03 SEP 2015, 11:45 GMT – ECB Interest Rate Decision – Expected: 0.05%, Prev: 0.05%

04 SEP 2015, 12:30 GMT – US Nonfarm Payrolls (AUG) – Expected: 220K, Prev: 215K

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance