Overstock.com (OSTK) Q2 Earnings Miss Mark, Revenues Down Y/Y

Overstock.com OSTK reported second-quarter 2022 earnings of 19 cents per share, which lagged the Zacks Consensus Estimate by 40.63%. The company had reported a loss of 54 cents per share in the year-ago quarter.

Revenues of $528.1 million decreased 33.5% year over year. The top line also lagged the consensus mark by 16.99%.

Active customers reached 6.49 million at the end of second-quarter 2022, down 29.2% year over year.

Orders placed through a mobile device were 50% of gross merchandise sales in the second quarter.

The average order value was $247 in the reported quarter, an increase of 16% year over year. However, orders delivered were 2.138 million, down 42.8% year over year.

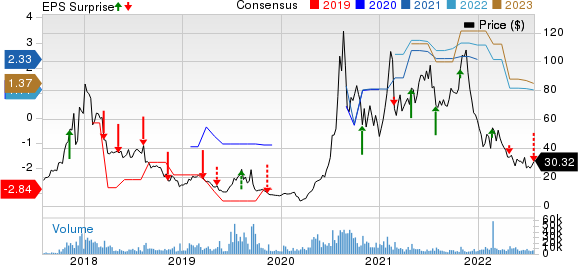

Overstock.com, Inc. Price, Consensus and EPS Surprise

Overstock.com, Inc. price-consensus-eps-surprise-chart | Overstock.com, Inc. Quote

Operating Details

Gross margin expanded 90 basis points (bps) to 22.9% in the reported quarter.

Sales & marketing (S&M) expenses decreased 32.1% year over year to $57.9 million. As a percentage of revenues, S&M expenses increased 20 bps to 11%.

Technology expenses were $30.5 million, up 0.5% year over year. As a percentage of revenues, technology expenses jumped 200 bps on a year-over-year basis to 5.8%.

General & administrative (G&A) expenses decreased 7% year over year to $21.1 million. As a percentage of revenues, G&A increased 110 bps to 4%.

Adjusted EBITDA was $20.8 million, which declined 53.2% from the year-ago quarter.

Operating income was $7.1 million compared with $82.4 million reported in the year-ago quarter.

Balance Sheet

As of Jun 30, 2022, Overstock.com had cash and cash equivalents worth $442.7 million compared with $493.5 million as of Mar 31, 2022.

Long-term debt, as of Jun 30, 2022, was $36.2 million compared with $37.1 million as of Mar 31, 2022.

During the three months ended Jun 30, Overstock.com repurchased $34.9 million of its common stock and $50,000 of its Series A-1 preferred stock under the Repurchase Program at an average price of $30.69 and $31.30 per share, respectively.

As of Jun 30, 2022, Overstock.com had approximately $39.9 million remaining under the current repurchase authorization.

Zacks Rank & Stocks to Consider

Overstock.com currently carries a Zacks Rank #5 (Strong Sell).

TravelCenters of America TA, Potbelly PBPB and Portillo’s PTLO are some better-ranked stocks in the broader Retail-wholesale sector.

All three stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

TravelCenters of America is set to report its second-quarter 2022 results on Aug 1.

The TA stock has been up 43.2% year to date.

Potbelly is set to report its second-quarter fiscal 2022 results on Aug 4.

The PBPB stock has declined 28.9% year to date.

Portillo is scheduled to report second-quarter 2022 results on Aug 4.

PTLO stock has declined 22.7% year to date.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TravelCenters of America LLC (TA) : Free Stock Analysis Report

Overstock.com, Inc. (OSTK) : Free Stock Analysis Report

Potbelly Corporation (PBPB) : Free Stock Analysis Report

Portillo's Inc. (PTLO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance