Orion SA (OEC) Q1 2024 Earnings: Misses on Net Income, Aligns with Revenue Forecasts

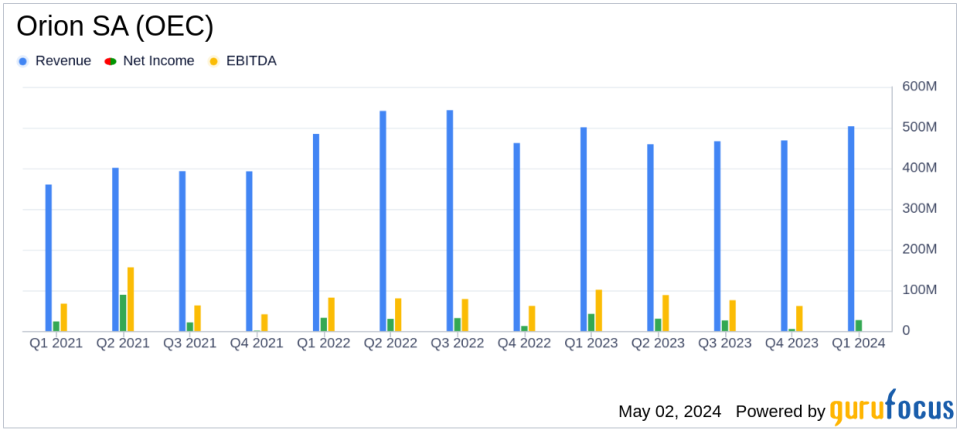

Revenue: Reported at $502.9 million, a slight increase of 0.4% year-over-year, falling short of the estimated $506.43 million.

Net Income: Totaled $26.7 million, down 36.9% from the previous year, and below the estimated $28.34 million.

Earnings Per Share (EPS): Diluted EPS recorded at $0.45, a decrease from $0.70 year-over-year, and below the estimated $0.48.

Adjusted EBITDA: Reached $85.3 million, reflecting a decrease of 15.6% year-over-year.

Gross Profit: Declined by 10.4% to $122.2 million compared to the previous year, indicating reduced profitability.

Volume: Increased by 6.4% to 248.4 thousand metric tons, driven by higher demand in both specialty and rubber segments.

Net Debt: Stood at $773.1 million, slightly reduced by $8 million from the end of 2022, with a net debt to adjusted EBITDA ratio of 2.44 times.

On May 2, 2024, Orion SA (NYSE:OEC), a prominent manufacturer of carbon black products, disclosed its financial results for the first quarter ended March 31, 2024. The company reported a net sales of $502.9 million, slightly above analyst expectations of $506.43 million, and a net income of $26.7 million, falling short of the estimated $28.34 million. The 8-K filing revealed a diluted EPS of $0.45, underperforming against the forecasted $0.48.

Orion SA operates primarily through two segments: Specialty Carbon Black and Rubber Carbon Black, with the latter generating the majority of its revenue. The company's products are integral in various industries, providing essential properties to materials ranging from tires to coatings and plastics.

Financial Performance and Market Challenges

The first quarter saw a modest year-over-year increase in net sales by $2.2 million, or 0.4%. However, net income experienced a significant decline of $15.6 million or 36.9% compared to the same period last year. This drop was attributed to non-repeating favorable items from Q1 2023, which inflated the previous year's results. Adjusted EBITDA also decreased by 15.6% to $85.3 million, reflecting the ongoing challenges in operational costs and market pricing pressures.

The Specialty Carbon Black segment witnessed a volume increase of 19.4%, yet faced a 25.2% reduction in Adjusted EBITDA, indicating pressure on profit margins despite higher sales volumes. Similarly, the Rubber Carbon Black segment reported a slight volume increase but saw a 10% decline in Adjusted EBITDA, impacted by lower cogeneration pricing and unfavorable market conditions.

Strategic Moves and Future Outlook

CEO Corning Painter highlighted the strategic developments, including the groundbreaking of a new conductive additives facility in Texas, aimed at bolstering the company's position in materials for electrification. Despite the current economic headwinds, Orion SA reaffirmed its 2024 guidance, expecting an Adjusted EBITDA between $340 million and $360 million and an Adjusted Diluted EPS of $2.05 to $2.20.

Orion SA's financial stability is further evidenced by a net debt to adjusted EBITDA ratio of 2.44, within the targeted range of 2.0 to 2.5 times, suggesting a balanced approach to growth and shareholder returns.

Investor and Analyst Perspectives

While the first quarter results show alignment with revenue forecasts, the decline in net income and adjusted EBITDA could concern investors looking for stability in profit margins. The company's strategic investments and market positioning, however, provide a solid foundation for potential growth, aligning with long-term market trends in electrification and material innovation.

For detailed insights into Orion SA's financial health and strategic direction, investors and stakeholders are encouraged to view the full earnings release and join the upcoming conference call.

Explore the complete 8-K earnings release (here) from Orion SA for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance