O'Reilly Automotive Inc (ORLY) Reports First Quarter Earnings: A Close Alignment with Analyst ...

Revenue: Reached $3.98 billion, up 7% year-over-year, meeting estimates of $3.98 billion.

Net Income: Increased to $547 million, up 6% from the previous year, slightly exceeding estimates of $545.91 million.

Earnings Per Share (EPS): Reported at $9.20, an 11% increase year-over-year, slightly below the estimate of $9.26.

Comparable Store Sales: Grew by 3.4%, continuing strong performance following a 10.8% increase in the prior year.

Gross Profit Margin: Improved to 51.2% of sales from 51.0% in the same period last year.

Store Expansion: Opened 37 new stores across 20 U.S. states and Mexico, and began operating 23 stores in Canada after an acquisition.

Share Repurchase: Repurchased 0.3 million shares for $270 million at an average price of $1,029.24 per share during the quarter.

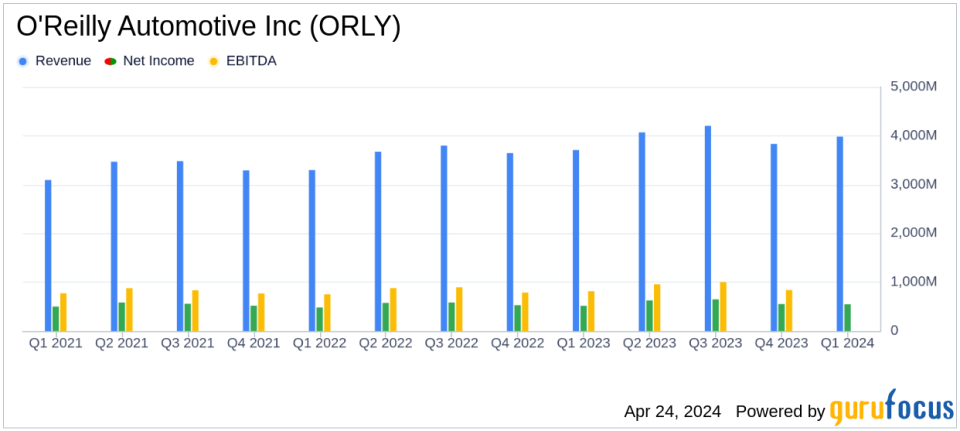

O'Reilly Automotive Inc (NASDAQ:ORLY) released its 8-K filing on April 24, 2024, unveiling its financial results for the first quarter ended March 31, 2024. The company reported a first quarter diluted earnings per share (EPS) of $9.20, closely aligning with analyst estimates of $9.26 per share. ORLY's net income for the quarter stood at $547 million, slightly surpassing the estimated $545.91 million. Furthermore, the company achieved a revenue of $3.98 billion, closely meeting the expectations of $3.98 billion forecasted by analysts.

Company Overview

Founded in 1957, O'Reilly Automotive Inc is a premier aftermarket automotive parts retailer in the United States and Mexico, boasting nearly $16 billion in annual sales. Operating over 6,000 stores, ORLY serves both do-it-yourself (DIY) and professional service providers. The company is renowned for its exceptional customer service and a robust hub-and-spoke distribution network, ensuring wide product availability across various vehicle makes and models.

Q1 Performance Highlights

The first quarter saw ORLY achieving a 3.4% increase in comparable store sales, building on a strong 10.8% increase from the previous year. This growth was supported by mid-single digit increases in professional sales and low-single digit growth in DIY sales. The company's gross profit rose by 8% to $2.03 billion, representing 51.2% of sales, compared to 51.0% in the prior year. However, selling, general, and administrative expenses also saw a 9% increase, totaling $1.28 billion or 32.2% of sales.

Strategic Expansions and Financial Strategy

During the quarter, ORLY expanded its footprint by opening 37 new stores across the U.S. and Mexico and began operations in 23 stores in Canada following the acquisition of Vast Auto. The company's CEO, Brad Beckham, highlighted the successful integration of the Vast Auto team and the positive momentum in the Canadian market. ORLY remains focused on increasing its market share and reinforcing its industry leadership in customer service.

Share Repurchase and Financial Outlook

The company continued its share repurchase program, buying back 0.3 million shares at an average price of $1,029.24 per share. Looking ahead, ORLY provided an updated full-year 2024 guidance, anticipating total revenue between $16.8 billion and $17.1 billion and a diluted EPS range of $41.35 to $41.85.

Balance Sheet and Cash Flow

As of March 31, 2024, ORLY reported total assets of $14.21 billion and total liabilities of $14.21 billion, with a shareholders' deficit of $1.39 billion. The company generated $704 million in net cash from operating activities, a slight decrease from $714 million in the previous year. Capital expenditures for the quarter amounted to $249 million, primarily directed towards property and equipment investments.

Conclusion

O'Reilly Automotive's first quarter results demonstrate a solid financial performance and strategic growth through market expansion, particularly in the Canadian automotive aftermarket. The company's adherence to its core values and operational strategies continues to yield positive financial outcomes, aligning closely with market expectations and setting a robust foundation for future growth.

For detailed financial figures and future projections, investors and interested parties are encouraged to view the full 8-K filing.

Explore the complete 8-K earnings release (here) from O'Reilly Automotive Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance