Oracle Takes the JEDI Fight to the Federal Court of Appeals

Oracle ORCL has recently decided to appeal the Federal Court’s ruling regarding the U.S. Department of Defense’s (DoD) Joint Enterprise Defense Infrastructure (JEDI) cloud contract.

Per the statement of general counsel at Oracle, Dorian Daley, the company claims that the JEDI cloud contract infringes on federal procurement laws. Further, the company is of the opinion that the contract involves “many significant conflicts of interest,” reportedly hinting at Amazon’s AMZN cloud computing arm, Amazon Web Services or AWS.

Oracle maintains its stance that a single cloud vendor winner policy is “unfair” and dents public trust.

Notably, around mid-July, the company lost the legal battle at the Federal Claims Court. Per Bloomberg, Eric Bruggink, Federal Claims Court senior judge, ruled that Oracle’s failure to meet the required qualifying criteria to secure JEDI contact, “cannot demonstrate prejudice as a result of other possible errors in the procurement process.”

Lawsuits and Complaints to Delay the Contract Closure

DoD, headquartered at Pentagon, intends to develop JEDI cloud by means of a 10-year contract estimated to be worth $10 billion.

The announcement, which was made around January 2018, intensified the cloud war. Concerns pertaining to President Trump’s anti-Amazon tweets or Oracle’s anxiety regarding the policies have been doing rounds since then.

However, Pentagon assured that the contract will be finalized in a fair and transparent manner.

Around April 2019, it was announced that Amazon and Microsoft MSFT are reportedly the only remaining contenders to secure the Pentagon’s JEDI cloud contract. According to sources, International Business Machines IBM and Oracle were ruled out for failing to meet the minimum criteria.

Notably, Google had willingly opted out from bidding for the JEDI deal citing value and ethics concerns.

Now, that Oracle has taken the fight to the Federal Court of Appeals, the closure of the contract with the announcement of a single winner might take longer time. Moreover, Pentagon is reportedly receiving complaints regarding procurement, which require addressing and investigation and are likely to delay the process.

How Promising are Oracle’s JEDI Ambitions?

Oracle, has been striving to enhance government services portfolio, despite its late entry in the cloud market. Notable agencies, comprising Department of Finance, Abu Dhabi; New South Wales Department of Justice, among others, already leverage the company’s cloud solutions.

Moreover, Oracle reportedly sells maintenance licenses to the DOD which generates “millions of dollars” for the company.

In this regard, it is also important to note that, the fiscal 2019 defense budget of $716 billion — the largest allotted to defense in U.S. history — is extremely lucrative. Out of the total tally, $686 billion is allotted to the DoD and $13.7 billion is proposed to be invested “in science and technology to further innovation.”

Further, per psmarketresearch data, the global government cloud services market is projected to hit $49.2 billion in 2023, at a CAGR of 15.4% between 2018 and 2023. Increasing government spend on cloud infrastructure services present lucrative business opportunities for Oracle.

Nevertheless, dragging the lawsuit is likely to pose a threat of losing out on business opportunities with DoD, which in turn will not bode well for the company’s top line and might impact the stock performance.

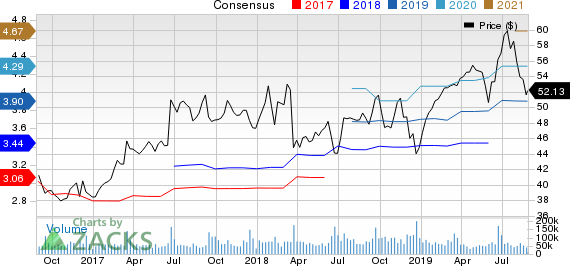

Oracle Corporation Price and Consensus

Oracle Corporation price-consensus-chart | Oracle Corporation Quote

Do Azure and AWS Capabilities Undermine Oracle’s JEDI Dreams?

Competition for JEDI battle is tough as Microsoft is leaving no stone unturned to enhance Azure Government services portfolio with intelligent capabilities. In fact, the company announced the availability of Azure Government Secret regions, which are enabled to support Level 6 workloads, from the first quarter of 2019. Notably, DoD’s Impact Level 6 workloads are touted to be Pentagon’s and U.S. military’s highest level of classified information.

Microsoft has also crafted Azure Government for the US Department of Defense, specifically to handle DoD related workflows. Moreover, Microsoft’s HoloLens is being utilized by DoD and the company has secured several deals with DoD.

Further, AWS’ dominance in the cloud market can’t be ignored. Notably, AWS is also authorized to host DoD’s Impact Level 6 workloads. AWS also has several portals dedicated to DoD compliant implementation. AWS has assisted governments and agencies alike with its high security and compliant cloud capabilities, including Government of Singapore, agencies like NASA, UK Ministry of Justice, to mention a few.

Meanwhile, Oracle has reportedly not met FedRAMP Moderate "Authorized" criteria and is yet to achieve authorization to host DoD’s Impact Level 6 workloads, which are likely to hinder its JEDI ambitions.

Zacks Rank

Oracle currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Oracle Corporation (ORCL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance