Opendoor Technologies Inc (OPEN) Q1 2024 Earnings: A Detailed Review Against Analyst Expectations

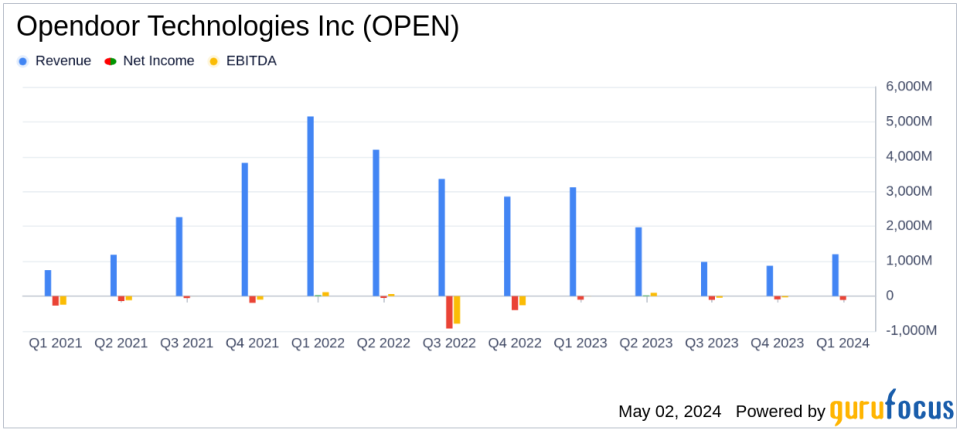

Revenue: $1.2 billion, a decrease of 62% from Q1 2023 but an increase of 36% from Q4 2023, exceeding the estimated $1.093 billion.

Net Loss: $(109) million, widened from $(101) million in Q1 2023 and $(91) million in Q4 2023, exceeding the estimated $(103.32) million.

Gross Margin: Improved to 9.7% from 5.4% in Q1 2023 and from 8.3% in Q4 2023.

Homes Sold: Totaled 3,078, marking a decrease of 63% from Q1 2023 but an increase of 30% from Q4 2023.

Inventory Balance: Ended at $1.9 billion, representing 5,706 homes, showing a decrease of 11% from Q1 2023 but an increase of 6% from Q4 2023.

Adjusted EBITDA: Reported at $(50) million, improved from $(341) million in Q1 2023 and $(69) million in Q4 2023.

Contribution Margin: Improved to 4.8%, up from -7.7% in Q1 2023 and 3.4% in Q4 2023.

Opendoor Technologies Inc (NASDAQ:OPEN), a prominent player in the digital residential real estate platform, disclosed its financial outcomes for the first quarter ended March 31, 2024. The company's performance, which is detailed in its 8-K filing, surpassed the upper end of its own forecasts in terms of revenue, Contribution Margin, and Adjusted EBITDA. Despite facing a significant year-over-year revenue drop, improvements were noted from the previous quarter.

Opendoor, which has revolutionized the way people buy and sell homes by providing a streamlined online platform, reported a revenue of $1.2 billion for the quarter. This figure represents a 62% decline from the first quarter of 2023 but shows a 36% increase from the fourth quarter of 2023. The net loss widened to $109 million from $101 million year-over-year. Despite these challenges, the company managed to improve its gross margin to 9.7% from 5.4% in the same quarter the previous year, showcasing enhanced operational efficiency.

Financial Performance and Market Dynamics

The company's financial health is reflected through various metrics. Opendoor ended the quarter with an inventory balance of $1.9 billion, representing 5,706 homes. This inventory level marks an 11% decrease compared to the first quarter of 2023 but shows a 6% increase from the previous quarter. The number of homes purchased rose dramatically by 98% year-over-year, indicating aggressive market acquisitions despite a challenging environment.

On the profitability front, Opendoor reported a Contribution Profit of $57 million, a significant improvement from a $241 million loss in the same quarter last year. This was accompanied by an Adjusted EBITDA of $(50) million, better than the $(341) million recorded in the first quarter of 2023. These figures suggest that while the company is still navigating through losses, the magnitude of financial bleeding has substantially reduced.

Strategic Moves and Industry Outlook

CEO Carrie Wheeler highlighted the company's strategic initiatives and market adaptation in response to evolving consumer preferences towards digital real estate transactions. Wheeler's commentary underscores a strategic pivot focusing on ramping up acquisitions and optimizing the cost structure to align with market realities and consumer expectations. The proposed settlement with the National Association of Realtors (NAR) also indicates a potential shift in industry dynamics favoring platforms like Opendoor.

Looking ahead, Opendoor anticipates second-quarter revenue to be between $1.4 billion and $1.5 billion, with a Contribution Profit forecast of $75 million to $85 million and an Adjusted EBITDA ranging from $(35) million to $(25) million. These projections reflect the company's cautious optimism about its operational strategies and market conditions.

Conclusion

Opendoor's first-quarter results for 2024 reflect a company in transition, grappling with market volatilities but also making significant strides in operational efficiency and strategic market positioning. While the road ahead involves navigating through market uncertainties and evolving consumer preferences, Opendoor's latest financials indicate a resilient model capable of adapting and potentially thriving in the changing landscape of residential real estate transactions.

For detailed financial insights and further information, investors and stakeholders are encouraged to refer to the full earnings report and supplementary materials provided by Opendoor Technologies Inc.

Explore the complete 8-K earnings release (here) from Opendoor Technologies Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance