Should you ONLY invest in blue chip stocks in Singapore?

Why some people invest only in Singapore blue chip stocks

“Sean ah,” approached my auntie during Chinese New Year. “Eh, ask you…you work in investing right? So which stocks are good to buy now?” I’ve always liked this auntie. She provides the best food of all the relatives I visit during this festive period, and I’ve never been one to turn down a good free lunch.

“Umm…” I paused, wondering how to politely tell her that I needed to understand her financial goals and risk profile before I could provide any sort of meaningful advice, all while stuffing my face with her ayam buah keluak.

“I only buy Singapore blue chip stocks,” she continued.

“Oh…why ah?” I asked.

“Safer lah.”

After she said that, I realized that I had heard a few people tell me the same thing before – that they only bought Singapore blue chip stocks. The reason was usually that they felt that they were safer than other stocks.

Blue chip companies are generally large, well-known companies with a reputation for being financially sound, and are usually among the market leaders in their industry. Additionally, a number of the blue chip companies in Singapore are government-linked. Temasek Holdings owns about 52% of Singtel, 29% of DBS and 20% of Keppel Corp, just to name a few. So there is also a perception that in challenging economic times, the government will support these companies – thus the risk of investment loss is lower. Singapore blue chip companies also tend to give decent dividends.

For these reasons, it is certainly understandable why some people invest only in Singapore blue chip stocks.

The returns for Singapore blue chip stocks

Do Singapore blue chip stocks deliver good returns over the long term though? I decided to take a look at how these investors would have fared with this strategy in the past. I also wanted to compare how these investors would have done if they had invested in stocks globally instead of just limiting their investments to Singapore. After all, the total market value of Singapore’s blue chip stocks amounts to less than 0.5% of stocks worldwide, and there are thousands of other great companies beyond Singapore’s tiny shores.

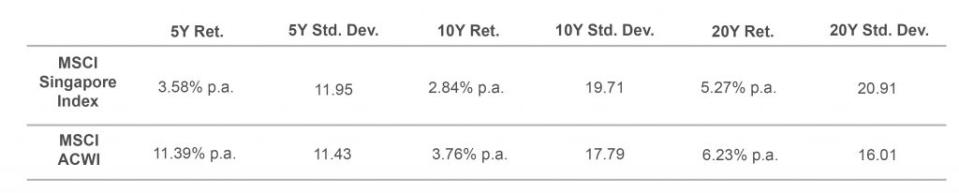

To measure the performance of Singapore blue chip stocks, I used the MSCI Singapore Index as a proxy. For global stocks, I decided to use the MSCI All Country World Index (MSCI ACWI) for comparison, as it includes companies from all over the world (including Singapore), such as well-known ones like Apple, Exxon Mobil, Johnson & Johnson, HSBC and many others.

Other than the returns, I also wanted to see how much risk these investors took. To measure this risk, I looked at the standard deviation of the indices. Standard deviation is a measure of volatility, which in turn is a measure of risk. For the sake of brevity, it is sufficient to know that the higher the standard deviation, the higher the volatility, and therefore the higher the risk.

These were the results:

Source: Bloomberg Terminal. Periods were measured up to 28th February 2017. Returns are in SGD and are inclusive of dividends.

Let’s take a look at the past five years first. The standard deviation for the MSCI Singapore Index over the past five years was slightly higher than the MSCI ACWI. The difference in returns, however, was vast – the MSCI ACWI delivered a little more than three times the returns of the MSCI Singapore Index – despite the lower volatility.

Looking at the ten and twenty year track records, the pattern is similar. Singapore’s blue chip companies were more volatile than global companies, and yet global companies delivered higher returns.

A Global portfolio vs Singapore portfolio

Why was this the case? Firstly, it is important to point out that past performance is not necessarily indicative of future returns. That said, the fact that the MSCI ACWI had lower volatility than the MSCI Singapore Index makes logical sense. The simple explanation is that the MSCI ACWI is made up of more than 2,400 global companies, so each company makes up a very small percentage of the entire index. By spreading out one’s investment among thousands of companies, the movements of a single stock’s price have a relatively small effect. Even if a single company was to go bankrupt, there is very little impact on the entire portfolio. In contrast, if one of the 27 companies in the MSCI Singapore Index was to fail, the impact on the portfolio would be much more significant.

While the returns of the global portfolio were superior to the Singapore portfolio in the data shown, it is important to note that this might not always be the case. In any given year, it is impossible to know whether Singapore will deliver higher or lower returns than U.S., European, or other Asian stocks. However, keeping in mind that there are limitations in drawing conclusions from snapshots of time periods, the data shown above is suggestive that over the long term, one could obtain better returns from a global stock portfolio than a Singapore-only portfolio. At the very least, when you invest into thousands of companies, of which many such as JP Morgan, General Electric, Unilever, Toyota are much bigger than Singapore’s biggest companies, produce greater revenues and have access to much larger domestic and global markets, your odds of having a positive investment experience can only be better.

As noted earlier, there is nothing wrong per se with just investing into Singapore’s blue chip stocks. They are generally well-run companies with good management in place. However, if I can get a higher return per unit of risk from investing into global stocks, well, that’s just the kind of free lunch I love to have.

This article is contributed by Sean Cheng, Portfolio Manager at Providend.

Providend is a licensed financial advisory firm and a registered fund management company with the Monetary Authority of Singapore.

Over the last 17 years, we have come to be known as a specialist in retirement planning and the first and probably still the only fee-only independent financial advisory firm in Singapore.

As a family of people driven by passion, we exist to serve our families of clients to fulfil their dreams and achieve their life purpose by providing them with the most honest, independent and competent advice.

(By Sean Cheng, Portfolio Manager of Providend Ltd)

Related Articles

- Behavioral Investing: Understanding investor behaviour to make better investing decisions

- The unique features of CPF that work for Singapore

- How Rising Interest Rates Can Affect You and What To Do About It

Yahoo Finance

Yahoo Finance