Olin's (OLN) Earnings Surpass Estimates in Q3, Sales Lag

Olin Corporation OLN posted a profit of $315.2 million or $2.18 per share in third-quarter 2022, down from $390.7 million or $2.38 per share in the year-ago quarter. The figure beat the Zacks Consensus Estimate of $1.86.

The chemical maker’s revenues fell roughly 0.8% year over year to $2,321.7 million in the quarter. It missed the Zacks Consensus Estimate of $2,384.7 million. The company’s chemical businesses faced headwinds from European and North American epoxy and vinyls intermediate demand slowdown and higher Asian exports. However, it benefited from higher pricing in the quarter.

Olin Corporation Price, Consensus and EPS Surprise

Olin Corporation price-consensus-eps-surprise-chart | Olin Corporation Quote

Segment Review

Chlor Alkali Products and Vinyls: Revenues in the division rose roughly 19% year over year to $1,263.5 million in the reported quarter. The upside can be attributed to higher pricing, partly offset by lower volumes.

Epoxy: Revenues in the division went down around 27% year over year to $644.1 million on lower volumes, partly offset by higher pricing.

Winchester: Revenues increased around 4% year over year to $414.1 million on higher commercial ammunition pricing.

Financials

Olin ended the third quarter with cash and cash equivalents of $163.6 million, down roughly 47% year over year. Long-term debt was $2,580.4 million at the end of the quarter, down around 9% year over year.

The company repurchased roughly 8.2 million shares of common stock worth $410.9 million during the quarter.

Outlook

The company expects results in its Chlor Alkali Products and Vinyls unit in the fourth quarter of 2022 to be modestly lower than third-quarter levels as it expects vinyls intermediates pricing to remain under pressure offset by continued improvement in chlorine and caustic soda pricing.

The results in the Epoxy segment are forecast to decline from third-quarter levels due to increased Chinese exports caused by continuing weak domestic demand in China.

Olin expects fourth-quarter results in Winchester to be seasonally lower than third-quarter levels due to its holiday shutdowns. Overall, it expects fourth-quarter adjusted EBITDA to decline roughly 15-20% from third-quarter 2022 levels.

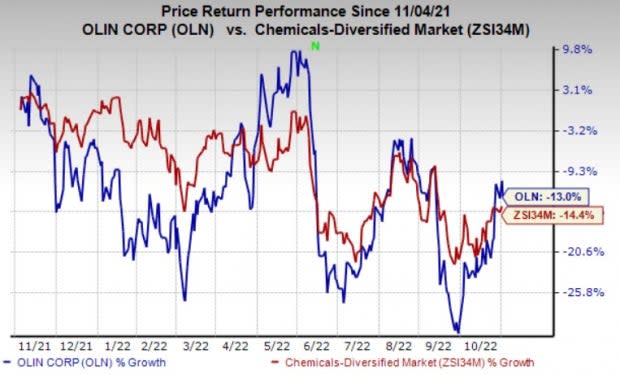

Price Performance

Shares of Olin have declined 13% in the past year against a 14.4% decline of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Olin currently carries a Zacks Rank #5 (Strong Sell).

Better-ranked stocks worth considering in the basic materials space include Sociedad Quimica y Minera de Chile S.A. SQM, Ryerson Holding Corporation RYI and Reliance Steel & Aluminum Co. RS.

Sociedad has a projected earnings growth rate of 530.7% for the current year. The Zacks Consensus Estimate for SQM’s current-year earnings has been revised 2.1% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Sociedad has a trailing four-quarter earnings surprise of roughly 27.2%. SQM has rallied roughly 38% in a year. The company currently carries a Zacks Rank #1.

Ryerson Holding, currently carrying a Zacks Rank #2 (Buy), has an expected earnings growth rate of 74.2% for the current year. The consensus estimate for RYI's earnings for the current year has been revised 3.2% upward in the past 60 days.

Ryerson Holding’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 28.9%. RYI has gained around 15% over a year.

Reliance Steel, currently carrying a Zacks Rank #2, has a projected earnings growth rate of 29.7% for the current year. The Zacks Consensus Estimate for RS's current-year earnings has been revised 0.1% upward in the past 60 days.

Reliance Steel’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 13.6%, on average. RS has gained around 24% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Reliance Steel & Aluminum Co. (RS) : Free Stock Analysis Report

Sociedad Quimica y Minera S.A. (SQM) : Free Stock Analysis Report

Olin Corporation (OLN) : Free Stock Analysis Report

Ryerson Holding Corporation (RYI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance