Olin (OLN) to Close Epoxy Facilities in Restructuring Program

Olin Corporation OLN has announced that it will close its Epoxy facilities as part of an ongoing restructuring program. The company has decided to cease operations at its Cumene facility in Terneuzen, the Netherlands and epoxy resin production at its facilities in Gumi, South Korea and Guaruja, Brazil. These actions are expected to result in approximately $57 million of restructuring charges in the first quarter of 2023, out of which $15 million represents non-cash asset impairment charges. The company plans to pay the cash charges over the next three years.

The company is currently facing a global softness in demand for epoxy and oversupply in the market. As part of its ongoing efforts to ensure the sustainability of its Epoxy business earnings, Olin has taken steps to address this situation. The company remains committed to evaluating and implementing further measures to optimize its business and achieve reinvestment economics throughout its Epoxy portfolio.

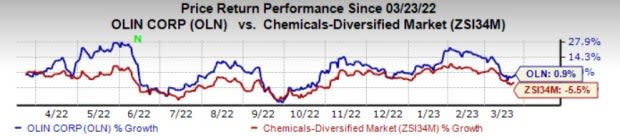

Shares of Olin have gained 0.9% over the past year against a 5.5% fall recorded by its industry.

Image Source: Zacks Investment Research

Revenues in the company’s Epoxy division went down around 39% year over year to $484.2 million on lower volumes in the fourth quarter of 2022.

The company, on its fourth-quarter call, stated that it expects weak economic conditions to continue. It sees adjusted EBITDA for 2023 in the range of $1.5-$2 billion. The company also projects its adjusted EBITDA to decline modestly sequentially in the first quarter.

The company expects its chemical businesses to remain exposed to European and North American epoxy demand weakness and soft demand in vinyl intermediate in early 2023, made worse by high levels of Chinese exports due to lingering weak domestic demand in China.

Olin Corporation Price and Consensus

Olin Corporation price-consensus-chart | Olin Corporation Quote

Zacks Rank & Key Picks

Olin currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are ATI Inc. ATI, Olympic Steel, Inc. ZEUS and Cal-Maine Foods, Inc. CALM. ATI currently carries a Zacks Rank #2 (Buy), while ZEUS and CALM sport a Zacks Rank #1(Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

ATI’s shares have gained 38.8% in the past year. The Zacks Consensus Estimate for ATI’s current-year earnings has been revised 1.9% upward in the past 60 days. The company has an earnings growth rate of 9% for the current year.

ATI topped Zacks Consensus Estimate in all the last four quarters. It delivered a trailing four-quarter earnings surprise of 32.4% on average.

Olympic Steel’s shares have gained 47.7% in the past year. The Zacks Consensus Estimate for ZEUS’ current-year earnings has been revised 61% upward in the past 60 days. It topped Zacks Consensus Estimate in all the last four quarters. It delivered a trailing four-quarter earnings surprise of 26.2% on average.

Cal-Maine’s shares have gained 9.4% in the past year. The company has an earnings growth rate of 515.8% for the current year. The Zacks Consensus Estimate for CALM’s current-year earnings has been revised 19% upward in the past 60 days.

CALM topped Zacks Consensus Estimate in three of the last four quarters. It delivered a trailing four-quarter earnings surprise of 15.3% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ATI Inc. (ATI) : Free Stock Analysis Report

Cal-Maine Foods, Inc. (CALM) : Free Stock Analysis Report

Olympic Steel, Inc. (ZEUS) : Free Stock Analysis Report

Olin Corporation (OLN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance