OHR – OCBC’s New Home Loan Package: Is It Better Than DBS’s FHR?

Sick of playing catching with DBS’ home loan rate, OCBC has dropped their fixed deposit-linked home loan rate, the OCBC FDMR, and introduced a new OCBC Home Rate, or OHR.

Yes, Singapore has yet another acronym to deal with, but in this case, it’s a very good thing. Here’s why you should definitely consider the new OHR when getting a new home loan or refinancing your existing one.

What is OHR?

The OCBC Home Rate is the “long-term average of 1-month and 3-month SIBOR”. That’s the official definition of the OHR that’s been publicly advertised. Currently the interest rate is set at 1.00%.

Which two kinds of OHR home loan packages is OCBC offering?

To introduce the OCBC Home Rate, you can choose from a fixed rate and a floating rate.

That means that regardless of your preference – whether you prefer the stability of a fixed rate, or the cheaper floating rate that’s subject to change – you can find a suitable OCBC home loan.

OHR Fixed | OHR Floating | |

Year 1 | OHR + 0.75% = 1.75% | OHR + 0.60% = 1.60% |

Year 2 | OHR + 0.75% = 1.75% | OHR + 0.65% |

Year 3 | OHR + 0.70% | OHR + 0.70% |

Year 4 | OHR + 0.80% | OHR + 0.80% |

(Table updated 11 January 2018)

What else is offered in the OCBC Home Rate package?

OCBC is offering one free conversion if the OHR changes, as well as up to 50% prepayment of the loan without penalty during the 2-year lock-in period for completed properties.

Here’s what a “free conversion” means:

If you find that the OCBC rates ever go up beyond your ability to pay, you can negotiate a new non-OHR package with the bank without any penalty.

This is not the first time OCBC has included this safety net, and all it means is that it puts pressure on OCBC not to adjust their rates too drastically. The last thing they want is for all their customers to take advantage of their free conversion.

As for the prepayment of up to 50%, it simply means that if you want to take advantage of the low OCBC Home Rate to pay off as much of your loan as you can, you can do so without any penalty, during the 2-year lock-in period. That’s a huge bonus.

Which package should I choose – fixed or floating?

Although you may enjoy the stability of a 2-year fixed rate, there’s a chance it’s going to be the more expensive option, since the rate is at least 0.30% more than the alternative at first.

However, after the first 2 years, the fixed rate becomes consistently more expensive than the floating rate. Do take note of this if you’re keen on the fixed rate.

But here’s the thing, because of the way the OHR is calculated, a floating rate actually might be just as stable as a fixed rate. And that’s what makes the new OCBC home loan so impressive.

Here’s how OHR will change the Singapore home loan landscape

Officially, the OCBC Home Rate is a “long-term average of 1-month and 3-month SIBOR”. However, what we understand is that “long-term average” is defined by OCBC as the average over a 12-year period.

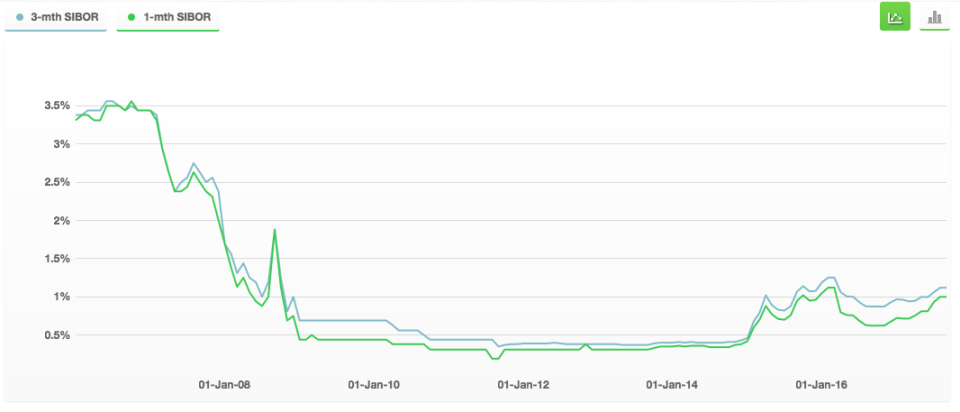

This is where it gets interesting, because both the 1-month and 3-month SIBOR have dropped below 1% for most of the period between December 2008 and May 2017. That’s almost a decade!

This means that the OCBC Home Rate is more likely to hover around 1% for a significant point of time, regardless of how high the SIBOR climbs in the near future. Imagine that! By introducing this, OCBC has come up with an even more stable home loan rate than a fixed deposit-linked rate.

The other important thing to notice is the very high SIBOR rate pre-2008, which was around 2.5% in 2007, and 3.5% in 2008! This is very good for customers who take up OHR home loan packages, because it averages the 1-month and 3-month SIBOR over a period of 12 years.

Just to put it in perspective, for the OCBC Home Rate just to remain at 1%, SIBOR needs to go above 3% in the next year!

In other words, if SIBOR is any less than 3% in 2018, the OHR will drop below 1% over the next 2 years!

Wow! Can it really be too good to be true?

Unfortunately, yes. OCBC is smart to not announce publicly how the OHR is calculated. This means they reserve the right to change the definition of the OCBC Home Rate anytime they want. And changing the definition will of course affect how volatile the rate can get.

Think about it this way – if “long-term average” is defined as over a 10-year period instead of over 12 years, then every increase in SIBOR after two years will lead to an increase of the OCBC Home Rate.

Ultimately, you have to remember that OHR is a board rate. That means that the final decision on what the OCBC Home Rate is, is solely defined by the bank, not by external factors. While there’s a certain level of transparency because SIBOR values are public knowledge, ultimately, the transparency stops short of spelling out exactly how the OCBC Home Rate is determined.

But let’s be fair here… most home loan packages today are board rates

Just look at the fixed deposit-linked home loan rates and how popular they’ve become over the past 3 years. Despite being board rates, they’ve managed to capture the imagination of homeowners and have quickly dominated the home loan market. The key is the perceived stability of the fixed deposit-linked home loan rates, that the bank will not raise their fixed deposit account interest rates unnecessarily.

Keeping that in mind, the OCBC Home Roate is simultaneously the most stable of all home loan rates (because SIBOR was far below 1% for over a decade) and yet still ultimately a board rate (because OCBC has not revealed exactly how OHR is calculated).

So, does that mean I should switch over to the OCBC Home Rate?

We would definitely recommend it, especially if you’re still on a SIBOR-linked rate. You definitely have nothing to lose, especially if SIBOR is expected to continue to rise in 2018.

If you’re on a fixed deposit-linked home loan rate, you might prefer a wait-and-see approach.

Either way, the OCBC home loan packages have a 2-year lock in period for completed properties, which means you can definitely enjoy some of the lowest interest rates in the market today for at least the first two years.

(UPDATE 19/10/2017: In response to some queries, please note: This is not a sponsored post. We were not paid by external parties to write this. The views shared above are the shared opinions of the MoneySmart team, with our readers’ best interest in mind.)

Are you considering the OCBC Home Rate? Let our mortgage specialists assist you for free and walk you through the whole home loan process.

The post OHR - OCBC's New Home Loan Package: Is It Better Than DBS's FHR? appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

More From MoneySmart

Yahoo Finance

Yahoo Finance