October Buybacks at S$60M, Seven Stocks Begin New Mandates

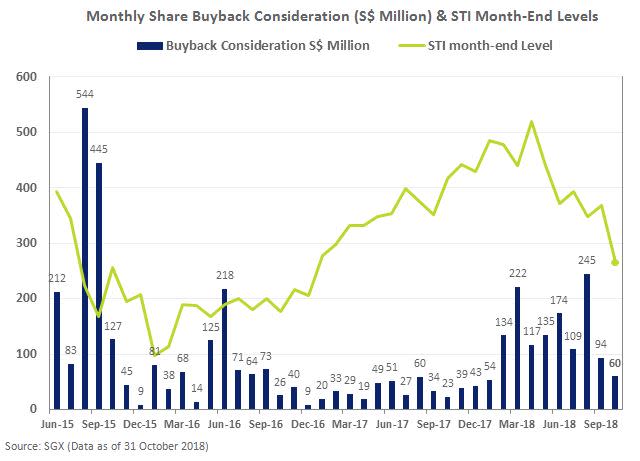

In October, 29 SGX-listed stocks repurchased 31 million shares for a total consideration of S$60 million. This brought the total buyback consideration over the first 10 months of 2018 to SS$1.34 billion, which is more than three times the total buyback consideration in 2017.

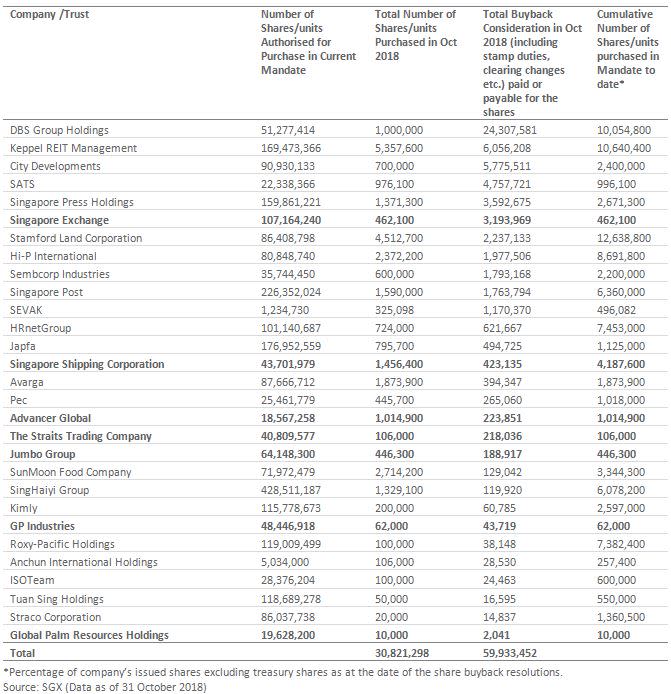

The 29 stocks included six STI constituents – DBS, CDL, SATS, SPH, SGX & Sembcorp Industries. Buybacks by these STI stocks made up as much as S$43 million, or 72%, of the S$60 million consideration. STI Reserve stock Keppel REIT bought back S$6 million in units.

Seven stocks commenced new buyback mandates in October – Advancer Global, Avarga, Global Palm Resources Holdings, GP Industries, Jumbo Group, Singapore Exchange and The Straits Trading Company.

Total share buyback consideration for the month of October totaled S$59.9 million. A total of 29 SGX-listed stocks reported buybacks on their SGX-listings over the month, buying back a total of 30.8 million in shares or units. The S$59.9 million in buyback consideration was just less than two-thirds the September buyback consideration of S$93.6 million.

As highlighted overnight (click here) 2018 is going to be a record year for buybacks in the United States (“US”). In Singapore, the total buyback consideration over the first 10 months of 2018 was S$1.34 billion, which is more than three times the total buyback consideration in 2017.

In the course of the month of October seven SGX-listed stocks commenced new buyback mandates. These included Advancer Global, Avarga, Global Palm Resources Holdings, GP Industries, Jumbo Group, Singapore Exchange and The Straits Trading Company. As many as nine stocks commenced new mandates in September (click here) with nine stocks also commencing new buyback mandates in August (click here).

During the month of October, the STI declined 7.3% from to 3257.1 to 3018.8, with regional declines across the board led by volatility in US equity markets.

During October, a number of stocks embarked on blackout periods – which means they cannot conduct buybacks ahead of releasing their earnings. The five largest buyback considerations in October were maintained by four STI stocks – DBS Group Holdings, City Developments, SATS, Singapore Press Holdings, in addition to the Manager of Keppel REIT – Keppel REIT Management. Two other STI stocks bought back their shares in October – Singapore Press Holdings and Sembcorp Industries.

Keppel REIT, which is a part of the STI Reserve List, is one of Asia’s leading Real Estate Investment Trusts (REITs) listed on the SGX with assets under management of over S$8 billion.Its portfolio comprises interests in nine premium office assets strategically located in the central business districts of Singapore, as well as key Australian cities of Sydney, Melbourne, Brisbane and Perth. Its current unit buyback mandate was approved back on 20 April 2018 and commenced on 27 July.

Between 27 July and 31 October, the Manager, Keppel REIT Management Limited had bought back 10,640,400 units, representing 0.3139% of the issued units as of the approved buyback resolution on 20 April. As noted in the filings, all 10,640,400 units that were repurchased will be cancelled.

The table below summarises the buyback considerations in October 2018. The table is sorted by the value of the total consideration amount for the month, which combines the amount of shares or units purchased and the purchasing price of the transactions.

Share buyback transactions involve share issuers repurchasing some of their outstanding shares from shareholders through the open market. Once the shares are bought back, they will be converted into treasury shares, which means they are no longer categorised as shares outstanding. Other motivations for share buybacks include companies moving to align stock valuations with balance sheet objectives.

The date of the relevant share buyback mandate is also provided in the table above, in addition to the amount of shares authorised to be bought back under the mandate. The total number of shares purchased under the mandate and the percentage of the companies that issued shares that have been repurchased under the mandate are also provided.

Share buyback information can be found on the company disclosure page on the SGX website, using the Announcement category and sub-category of Share Buy Back-On Market (click here).

Yahoo Finance

Yahoo Finance