Oceaneering (OII) Q1 Earnings and Revenues Miss Estimates

Oceaneering International OII reported first-quarter 2024 adjusted profit of 14 cents per share, which missed the Zacks Consensus Estimate of 30 cents. This underperformance was due to lower-than-expected operating income from the Offshore Projects Group segment.

However, the bottom line outpaced the year-ago quarter’s reported figure of 5 cents. This can be attributed to year-over-year strong operating income from certain segments — Subsea Robotics, Manufactured Products, Integrity Management & Digital Solutions, and Aerospace and Defense Technologies.

Total revenues were $599.1 million, which missed the Zacks Consensus Estimate of $614 million. The top line increased approximately 11.6% from the year-ago quarter’s level of $537 million.

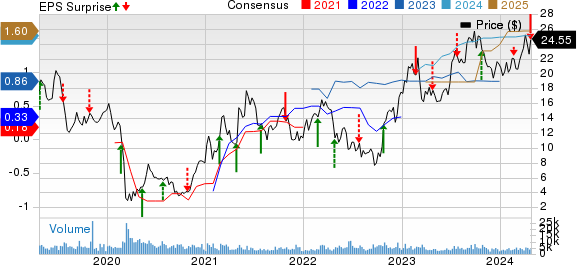

Oceaneering International, Inc. Price, Consensus and EPS Surprise

Oceaneering International, Inc. price-consensus-eps-surprise-chart | Oceaneering International, Inc. Quote

Segmental Information

Subsea Robotics: The unit provides remotely operated submersible vehicles for drill support, vessel-based inspection, subsea hardware installation, pipeline surveys and maintenance services.

Revenues totaled $186.9 million compared with the year-ago quarter’s figure of $169.2 million. The top line was below our projection of $195.4 million. The segment also reported an operating income of $44.2 million compared with $33.7 million a year ago. The figure was lower than our estimate of $45.5 million.

Manufactured Products: The segment focuses on the manufactured products business, theme park entertainment systems and automated guided vehicles.

Revenues amounted to $129.5 million, up substantially from the prior-year figure of $112.9 million. The top line beat our projection of $127.6 million. Moreover, the segment posted an operating profit of about $13.2 million in the first quarter, up from the year-ago quarter’s level of $11.3 million. The reported figure was above our estimate of $9.5 million. Meanwhile, the backlog rose to $597 million as of Mar 31, 2024, from $446 million as of Mar 31, 2023.

Offshore Projects Group: This segment involves Oceaneering’s former Subsea Projects unit, excluding survey services and global data solutions, and the service and rental business, excluding ROV tooling.

Revenues increased about 10.4% to $115.1 million from $104.3 million in the year-ago quarter. However, the figure was lower than our projection of $152.2 million. The unit’s operating income totaled $844,000 compared with the prior-year quarter’s level of $5.5 million. The figure was lower than our estimate of $17 million.

Integrity Management & Digital Solutions: This segment mainly covers Oceaneering’s Asset Integrity unit, along with its global data solutions business.

Revenues of $69.7 million increased from the year-ago quarter’s reported figure of $60.1. million. The figure also above our projection of $61 million. The segment reported an operating income of $3.6 million, up from the prior-year quarter’s figure of $3.1 million. The figure was below our estimate of $4.6 million.

Aerospace and Defense Technologies: The segment is engaged in Oceaneering’s government business, which focuses on defense subsea technologies, marine services and space systems.

Revenues totaled $98 million, up from $90.5 million recorded in the first quarter of 2023. The figure was also above our estimate of $61 million. The operating income rose to $12.8 million from $8.5 million in the year-ago quarter. The figure beat our estimate of $11.3 million.

Capital Expenditure & Balance Sheet

The capital expenditure in the first quarter, including acquisitions, totaled $25 million. As of Mar 31, 2024, OII had cash and cash equivalents worth $354.7 million and $461.6 million, respectively, along with a long-term debt of about $478.2 million. The debt-to-total capital was 43.2%.

Outlook

Oceaneering expects Offshore Projects Group activity levels and operating profitability to experience a significant increase during the second quarter of 2024. It also expects Subsea Robotics and Manufactured Products activity levels and operating profitability to rise during the same time frame.

However, Integrity Management & Digital Solutions and Aerospace and Defense Technologies activity levels are projected to remain flat, with operating profitability slightly lower than the year-ago period’s level. Unallocated Expenses are estimated to be in the $40 million range, aligning with the prior guidance. Overall, second-quarter 2024 operating results are expected to show improvement on a consolidated basis, with EBITDA in the range of $80-$90 million, reflecting a mid-teens percentage increase in revenues.

Oceaneering expects Subsea Robotics revenues to grow in the low to mid-teens percentage range for 2024. Additionally, OII projects a Manufactured Products book-to-bill ratio of 1.1-1.3 for the entire year.

Zacks Rank and Key Picks

Currently, OII carries a Zacks Rank #3 (Hold).

Investors interested in the energy sector might look at some better-ranked stocks like Hess Corporation HES and SM Energy Company SM, each sporting a Zacks #1 Rank (Strong Buy), and Sunoco LP SUN, carrying a Zacks #2 Rank (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Hess Corporation is valued at approximately $49.03 billion. In the past year, the company’s shares have surged 14%.

HES is a leading oil and natural gas exploration and production company. The upstream energy player primarily operates in the prolific offshore Guyana resources.

SM Energy is valued at $5.79 billion. The company currently pays a dividend of 72 cents per share, or 1.44% on an annual basis.

SM engages in the acquisition, exploration, development and production of oil, gas and natural gas liquids in the state of Texas.

Sunoco is valued at $5.69 billion. It is a major wholesale motor fuel distributor in the United States, distributing over 10 fuel brands through long-term contracts with more than 10,000 convenience stores, thereby ensuring consistent cash flow.

SUN’s extensive distribution network across 40 states provides a robust and reliable source of income, and the Brownsville terminal expansion should add to its revenue diversification.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hess Corporation (HES) : Free Stock Analysis Report

Sunoco LP (SUN) : Free Stock Analysis Report

SM Energy Company (SM) : Free Stock Analysis Report

Oceaneering International, Inc. (OII) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance