Oakmark International's Biggest 1st-Quarter Trades

David Herro (Trades, Portfolio)'s Oakmark International Fund recently released its portfolio update for the first quarter of 2020.

The Oakmark International Fund is a Chicago, Illinois-based global investment fund that holds a diversified portfolio of stocks in companies outside of the U.S. Managed by Herro, the fund is a subset of Harris Associates, an investment company with over $118 billion in assets under management. The fund employs a focused approach of investing in relatively few individual securities that are trading at a discount to intrinsic value and show strong potential to increase value for shareholders.

Based on the above criteria, the fund's most significant buys for the quarter were Prudential PLC (LSE:PRU) and Bunzl PLC (LSE:BNZL), while its most significant sells were in Bayer AG (XTER:BAYN) and Prosus NV (XAMS:PRX).

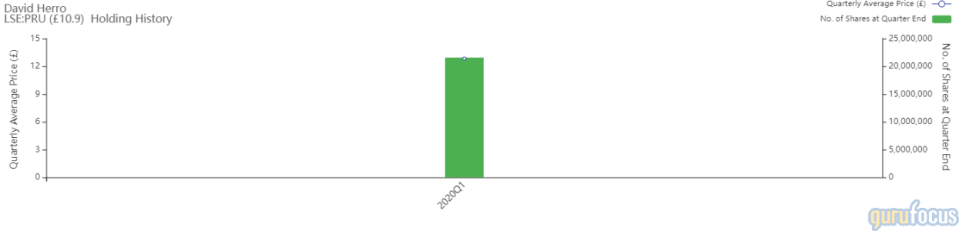

Prudential

The fund established a new stake of 21,570,000 shares in Prudential, impacting the equity portfolio by 1.47%. During the quarter, shares traded for an average price of 12.85 pounds ($16.13).

Prudential is a London-based multinational life insurance and financial services company. It operates primarily in the U.K., Asia and Africa.

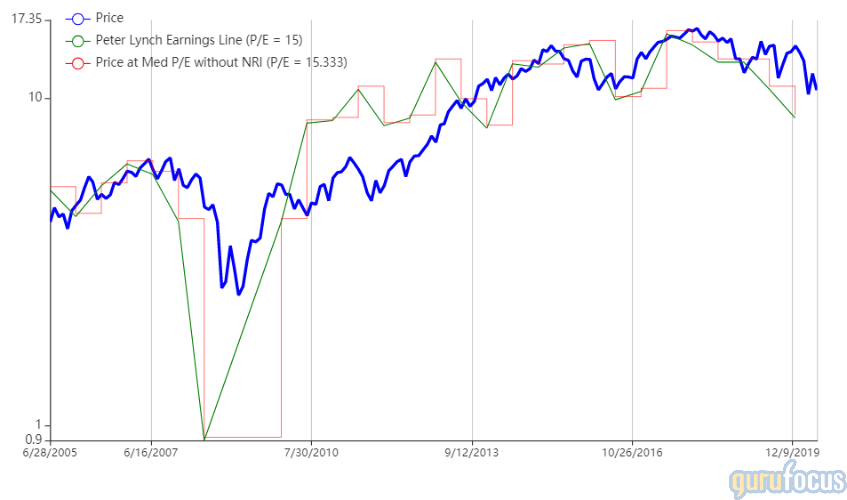

On June 3, shares of Prudential traded around 10.99 pounds for a market cap of 28.66 billion pounds and a price-earnings ratio of 43.78. According to the Peter Lynch chart, the stock is trading above its intrinsic value.

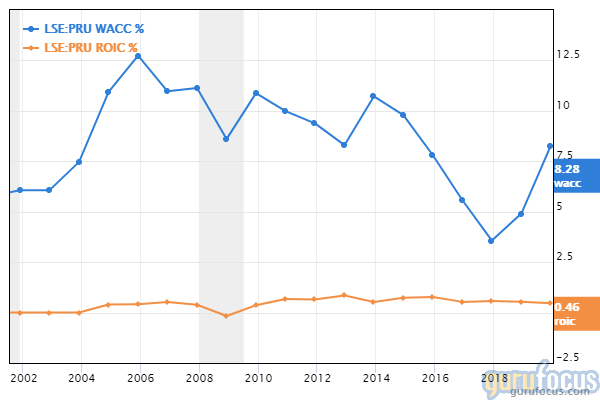

GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rating of 4 out of 10. The cash-debt ratio of 0.85 is lower than 69.56% of competitors. The weighted average cost of capital is significantly higher than the return on invested capital, indicating that the company earns less than it spends.

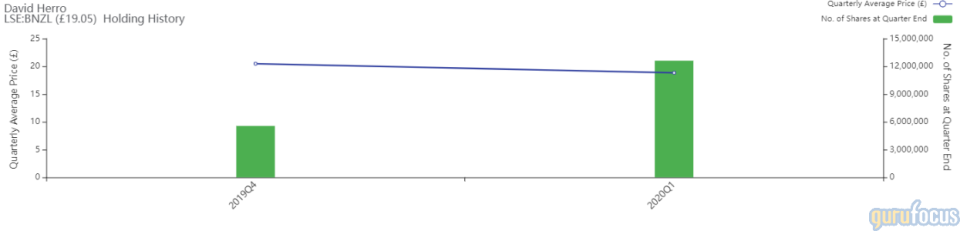

Bunzl

The fund increased its stake in Bunzl by 7,041,000 shares, or 126.59%, bringing the total number of shares owned to 12,603,000 and impacting the equity portfolio by 0.77%. Shares traded for an average price of 18.83 pounds during the quarter.

London-based Bunzl is a multinational distribution and outsourcing company. It aims to support business through a range of sourcing, consolidating and distributing operations.

On June 3, shares of Bunzl traded around 19.21 pounds for a market cap of 6.47 billion pounds and a price-earnings ratio of 18.38. The Peter Lynch chart indicates that the stock is trading above its intrinsic value but below its median historical valuation.

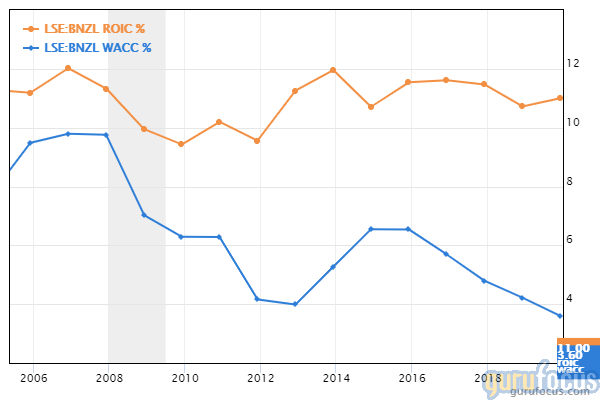

GuruFocus gives the company a financial strength rating of 6 out of 10 and a profitability rating of 7 out of 10. The cash-debt of 0.26 is slightly below the industry median of 0.32, while the Altman Z-Score of 3.3 indicates that the company is unlikely to go bankrupt. The operating margin of 5.85% is higher than 80.94% of competitors, and the ROIC exceeds the WACC, indicating profitability.

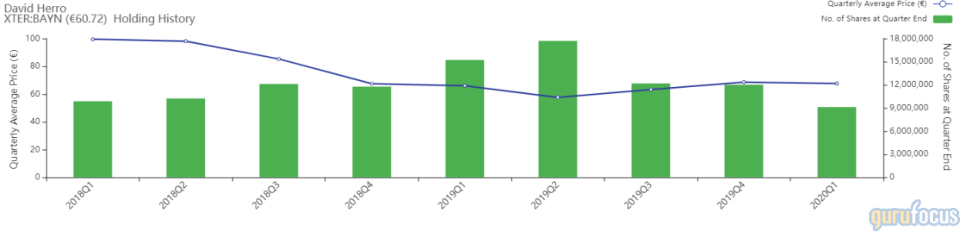

Bayer

The fund cut its stake in Bayer by 2,904,000 shares, or 24.17%, leaving a total holding of 9,112,000 shares. The trade had a -0.74% impact on the equity portfolio. During the quarter, shares traded for an average price of 67.58 euros ($75.50).

Bayer is a German pharmaceutical and life sciences giant that develops and manufactures products for humans, animals and plants. Its most well-known pharmaceutical brands include Aleve, Aspirin, Claritin and Alka Seltzer. In terms of agricultural products, the company produces fungicides, herbicides and insecticides as well as some varieties of crops.

On June 3, shares of Bayer AG traded around 63.94 euros for a market cap of 62.82 billion euros and a price-earnings ratio of 14.47. According to the Peter Lynch chart, the stock is trading above its intrinsic value.

GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rating of 7 out of 10. The cash-debt ratio of 0.13 is lower than 82.56% of competitors, while the Altman Z-Score of 1.07 suggests the company could be at risk of bankruptcy. The three-year revenue growth rate of 1.9% occurred alongside a drop in ROIC to below the WACC, indicating lower profitability.

Prosus

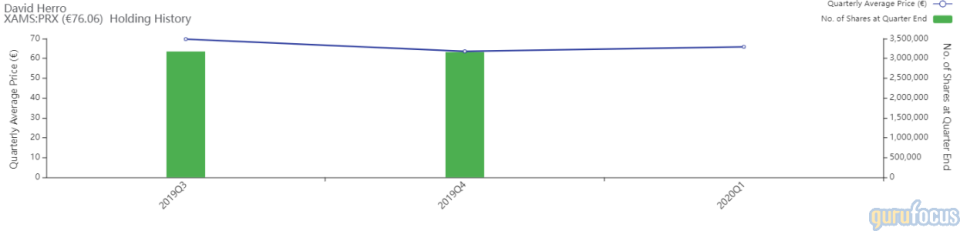

The fund sold out of its 3,160,000-share stake in Prosus, impacting the equity portfolio by -0.73%. Shares traded for an average price of 65.84 euros during the quarter.

In mid-September 2019, Prosus spun off from its parent company Naspers (JSE:NPN), which maintained a 73% stake. Prosus is the largest consumer internet company in Europe and one of the biggest tech investors in the world.

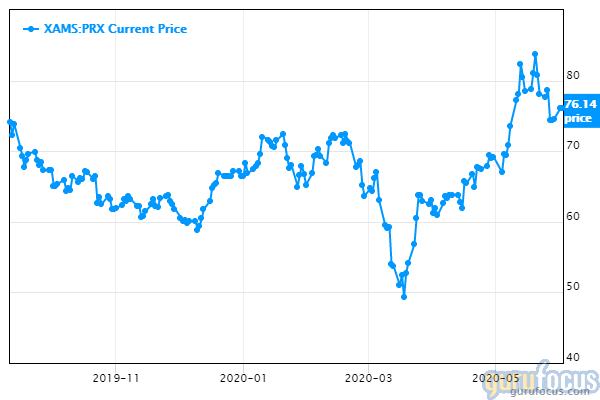

On June 3, shares of Prosus traded around 76.14 euros for a market cap of 123.78 billion euros and a price-earnings ratio of 23.71. The stock has gained 29.71% from its pre-spinoff reference price of 58.70 euros.

GuruFocus gives the company a financial strength rating of 6 out of 10 and a profitability rating of 1 out of 10. The cash-debt ratio of 2.51 and Altman Z-Score of 15.92 show that the company has a fortress-like balance sheet. The return on capital of 3,197.3% is higher than 98.81% of competitors, but the operating margin of -14.59% indicates an overall lack of profitability.

Portfolio overview

As of the quarter's end, the Oakmark International Fund held shares in 61 stocks valued at $18.39 billion. Its top holdings were Daimler AG (XTER:DAI) with a 3.97% portfolio weight, Glencore PLC (LSE:GLEN) with 3.91% and Bayerische Motoren Werke AG (XTER:BMW) with 3.89%.

In terms of sector weighting, the fund was most heavily invested in consumer cyclical, financial services and industrials.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Portfolio updates reflect only common stock positions as per the regulatory filings for the quarter in question and may not include changes made after the quarter ended.

Read more here:

Why the Stock Market Often Rises Amidst Turmoil

The 5 Most-Sold Guru Stocks of the 1st Quarter

Top 5 Most Popular Guru Buys of the 1st Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance