NZD/USD Technical Analysis: Short Trade Triggered Above 0.68

DailyFX.com -

To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

NZD/USD Technical Strategy: Short at 0.6863

Kiwi Dollar drops below monthly trend support, hints at deeper losses ahead

Short trade triggered, aiming for a move below the 0.68 figure vs. US Dollar

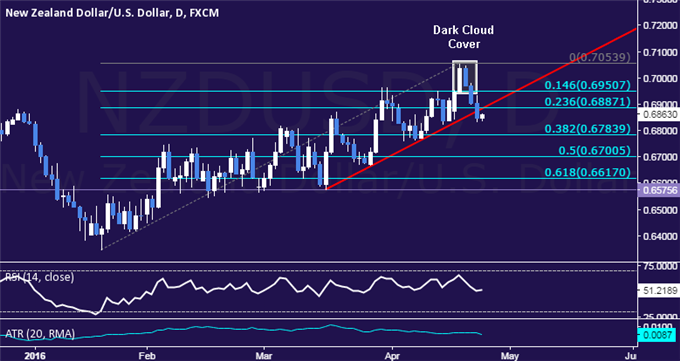

The New Zealand Dollar moved lower against its US counterpart as expected after putting in a bearish Dark Cloud Cover candlestick pattern. Prices have now broken below support capping the downside since mid-March, hinting a larger bearish reversal may be in the works.

A daily close below the 38.2% Fibonacci retracement at 0.6784 opens the door for a test of the 50% level at 0.6701. Alternatively, a move back above 0.6887 – the intersection of the 23.6% Fib and trend line support-turned-resistance – paves the way for a challenge of the 14.6% retracement at 0.6951.

Positioning hints the long-term NZD/USD down trend may be resuming in line with our 2016 fundamental forecast and we will enter short, initially targeting 0.6784. A stop-loss will be activated on a daily close above 0.6887. We will take profit on half of the trade and move the stop-loss to breakeven once the first objective is met.

DailyFX SSI bolsters the case for NZD weakness. Learn why and download the app here!

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance