NuVasive (NUVA) Earnings and Revenues Beat Estimates in Q4

NuVasive, Inc. NUVA delivered fourth-quarter 2019 adjusted earnings per share (EPS) of 73 cents, reflecting a 5.8% improvement from the year-ago quarter. The figure also surpassed the Zacks Consensus Estimate by 15.9%. On a reported basis, EPS came in at 55 cents, highlighting a 139.1% surge from the year-ago number.

Full-year adjusted EPS came in at $2.47, reflecting a 10.8% increase from the year-ago period. The figure exceeded the Zacks Consensus Estimate by 3.8%.

Revenues in the fourth quarter totaled $310.4 million, up 7.6% on a reported basis (up 7.8% at constant exchange rate or CER), year on year. The top line also beat the Zacks Consensus Estimate by 2.1%.

Full-year revenues came in at $1.17 billion, reflecting a 6% increase from the year-ago period (up 6.6% at CER), beating the Zacks Consensus Estimate of $1.16 billion by a close margin.

Geographical & Segmental Details

In the reported quarter, the U.S. Spinal Hardware business revenues increased 7.9% year over year to $268.9 million. This upside was driven by continued surgeon adoption of differentiated X360 system and Advanced Materials Science implants.

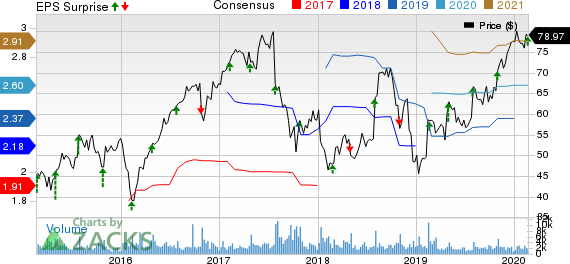

NuVasive, Inc. Price, Consensus and EPS Surprise

NuVasive, Inc. price-consensus-eps-surprise-chart | NuVasive, Inc. Quote

Revenues in the U.S. Surgical Support business were $77.3 million in the fourth quarter, up 2.7% year over year. The Biologics business returned to growth in the fourth quarter, up 5% year over year.

In the December-end quarter, the company registered international revenues of $64.1 million, reflecting 14.3% year-over-year growth at CER.

Margin Details

In the reported quarter, gross profit improved 12.3% year over year to $227.1 million. Gross profit margin expanded 305 basis points (bps) to 73.2%. Adjusted operating profit improved 11% from the year-ago period to $47.6 million. Accordingly, adjusted operating margin expanded 47 bps to 15.3% in the October-December quarter.

Operational Update

The company exited 2019 with cash and cash equivalents of $213 million compared with the $117.8 million at the end of 2018. Full-year net cash, provided by operating activities, totaled $235.3 million compared with the prior year’s $219.2 million.

Guidance for 2020

NuVasive has issued its 2020 full-year guidance.

The company projects revenues to be up 4-6%. The Zacks Consensus Estimate for 2020 revenues is pegged at $1.23 billion.

Adjusted EPS are expected in the band of $2.55 to $2.65. The Zacks Consensus Estimate for this metric stands at $2.60.

Our Take

NuVasive exited the final quarter of 2019 on a promising note. We are encouraged to note that the company witnessed solid revenue growth across its U.S. Spinal Hardware business, on increased surgeon adoption of lateral single-position surgery and X360 system. Robust sales figures in some of the key international markets buoy optimism.

Earnings of Other MedTech Majors at a Glance

NuVasive carries a Zacks Rank #3 (Hold).

Some better-ranked stocks, which have reported solid results this earnings season, are Stryker Corporation SYK, STERIS plc STE and ResMed Inc. RMD.

Stryker delivered fourth-quarter 2019 adjusted EPS of $2.49, outpacing the Zacks Consensus Estimate by 1.2%. Its fourth-quarter revenues of $4.13 billion surpassed the consensus estimate by 0.7%. The company currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

STERIS reported third-quarter fiscal 2020 adjusted EPS of $1.45, outpacing the Zacks Consensus Estimate by 1.4%. Net revenues of $774.3 million beat the consensus estimate by 3.3%. The company carries a Zacks Rank of 2, at present.

ResMed currently holds a Zacks Rank #2. It reported second-quarter fiscal 2020 adjusted EPS of $1.21, surpassing the Zacks Consensus Estimate by 19.8%. Its revenues of $736.2 million exceeded the consensus mark by 1.5%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

STERIS plc (STE) : Free Stock Analysis Report

NuVasive, Inc. (NUVA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance