Nucor's (NUE) Earnings, Revenues Trail Estimates in Q2

Nucor Corporation NUE witnessed higher profits (on a reported basis) in second-quarter 2018. The steel giant delivered net earnings of $683.2 million or $2.13 per share compared with $323 million or $1.00 per share registered a year ago.

Barring one-time items, earnings per share for the reported quarter came in at $2.07, which missed the Zacks Consensus Estimate of $2.10.

Nucor reported revenues of $6,460.8 million for the quarter, up roughly 24.9% year over year from $5,174.8 million. The figure however, trailed the Zacks Consensus Estimate of $6,492.9 million.

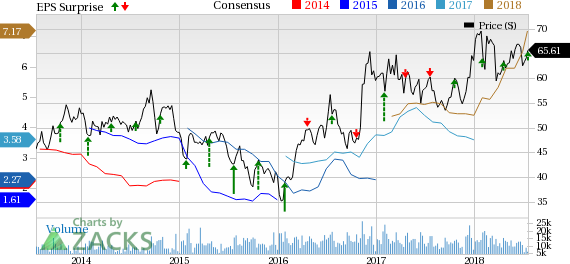

Nucor Corporation Price, Consensus and EPS Surprise

Nucor Corporation Price, Consensus and EPS Surprise | Nucor Corporation Quote

Operating Stats

Total steel mills shipments in the second quarter were 6,440,000 tons, up 6% year over year. Total tons shipped to outside customers were up 7% year over year to 7,197,000 tons. Average sales price in the quarter was up 17% year over year.

Steel mill operating rates increased to 95% in the second quarter from 89% a year ago.

Segment Highlights

Nucor’s profitability in the steel mills segment in the second quarter of 2018 improved on sequential basis. Higher average selling prices and increased profitability across all steel mill product groups were the primary factors driving the segment. It also witnessed strongest increase in profitability at its sheet mills.

Performance of steel products and raw materials unit also improved sequentially. Per the company, these improvements were driven by stronger market conditions that have been positively impacted by tax reform, deregulation and higher, stable oil prices.

Financial Position

As of Jun 30, 2018, Nucor had cash and cash equivalents of around $1.5 billion compared with $1.6 billion a year ago. Long-term debt was $4,232.2 million, down roughly 30.6% year over year.

Outlook

Nucor expects third-quarter earnings to improve sequentially. Steel mills unit’s performance is likely to remain strong in third quarter and the company expects margin expansion primarily at its sheet and plate mills.

Based on current steel market conditions, Nucor believes that there is sustainable strength in steel end-use markets. It anticipates third-quarter 2018 performance of its steel products segment to be similar to the second quarter. However, performance of its raw materials segment is likely to decline in the third quarter due to margin compression.

Price Performance

Shares of Nucor have gained 3.3% in the past three months against the industry’s decline of 8.1%.

Zacks Rank & Other Stocks to Consider

Nucor currently carries a Zacks Rank #2 (Buy).

A few other top-ranked stocks in the basic materials space are KMG Chemicals, Inc. KMG, Methanex Corp. MEOH and BHP Billiton Ltd. BHP, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

KMG Chemicals has an expected long-term earnings growth rate of 28.5%. Its shares have returned 44.3% in a year.

Methanex has an expected long-term earnings growth rate of 15%. Its shares have rallied 59% in a year.

BHP Billiton has an expected long-term earnings growth rate of 5.3%. Its shares have gained 24% in a year.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6% and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Methanex Corporation (MEOH) : Free Stock Analysis Report

KMG Chemicals, Inc. (KMG) : Free Stock Analysis Report

BHP Billiton Limited (BHP) : Free Stock Analysis Report

Nucor Corporation (NUE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance