Is Now The Time To Put Hock Lian Seng Holdings (SGX:J2T) On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Hock Lian Seng Holdings (SGX:J2T). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Hock Lian Seng Holdings with the means to add long-term value to shareholders.

Check out our latest analysis for Hock Lian Seng Holdings

How Fast Is Hock Lian Seng Holdings Growing Its Earnings Per Share?

Hock Lian Seng Holdings has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. Hock Lian Seng Holdings' EPS shot up from S$0.032 to S$0.052; a result that's bound to keep shareholders happy. That's a impressive gain of 61%.

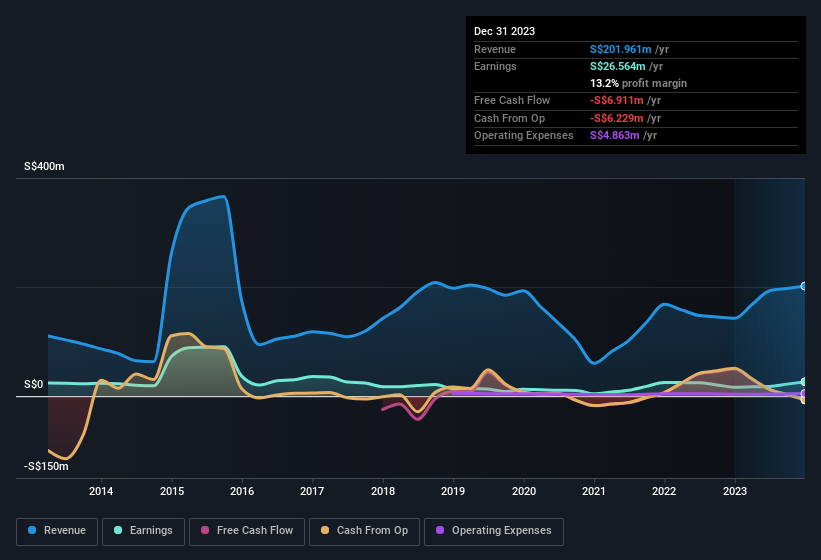

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of Hock Lian Seng Holdings shareholders is that EBIT margins have grown from 3.5% to 8.4% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Since Hock Lian Seng Holdings is no giant, with a market capitalisation of S$169m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Hock Lian Seng Holdings Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So as you can imagine, the fact that Hock Lian Seng Holdings insiders own a significant number of shares certainly is appealing. Indeed, with a collective holding of 77%, company insiders are in control and have plenty of capital behind the venture. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. In terms of absolute value, insiders have S$130m invested in the business, at the current share price. So there's plenty there to keep them focused!

Does Hock Lian Seng Holdings Deserve A Spot On Your Watchlist?

You can't deny that Hock Lian Seng Holdings has grown its earnings per share at a very impressive rate. That's attractive. Further, the high level of insider ownership is impressive and suggests that the management appreciates the EPS growth and has faith in Hock Lian Seng Holdings' continuing strength. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. Even so, be aware that Hock Lian Seng Holdings is showing 2 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

Although Hock Lian Seng Holdings certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with insider buying, then check out this handpicked selection of Singaporean companies that not only boast of strong growth but have also seen recent insider buying..

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance