Now might be a great time to dive into the stock market

Investors shouldn’t be spooked by the recent bout of volatility in the markets.

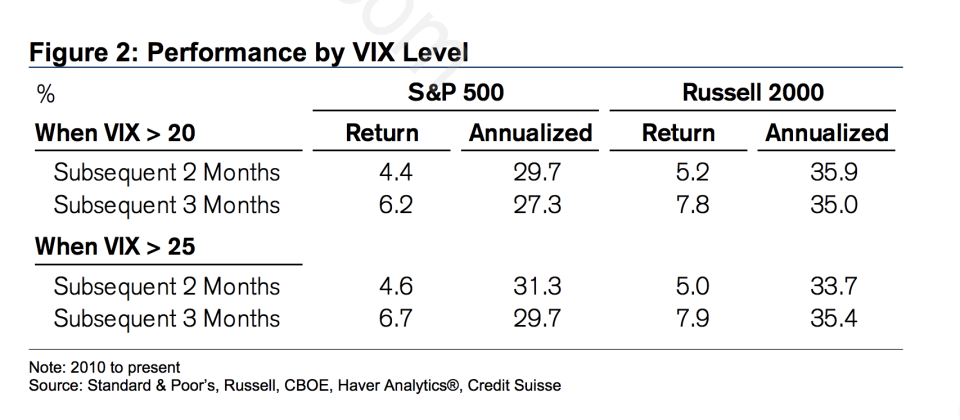

“Historically, investing on volatility spikes leads to above average returns in subsequent months,” Credit Suisse’s chief U.S. equity strategist, Jonathan Golub said in a new note to clients.

Stocks got crushed again on Thursday as all three of the major indexes had their worst two-day stretch in 8 months. The S&P 500 (^GSPC) fell 2.1% and closed below its 200-day moving average for the first time since April, and the Dow (^DJI) fell 550 points bringing its combined two day losses to more than 1,300 points.

The Cboe Volatility Index (VIX), also known as the fear gauge, jumped to 28.84 during Thursday’s session. This was its highest level since February.

All of this might actually be good for investors in the coming months, Golub said.

“Volatility and stock prices have moved in opposite directions, with an 8% move in the VIX leading to a 1% move in the S&P 500,” Golub said.

Additionally, he explained that since 2010 when the VIX jumps above 20, in the subsequent 2 months, the S&P 500 and Russell 2000 will climb a respective 4.4% and 5.2%. In the subsequent 3 months, the S&P and small caps have risen by 6.2% and 7.8%.

“[We] believe that investors should opportunistically extend risk against this higher volatility,” Golub said.

Heidi Chung is a reporter for Yahoo Finance. Follow her on Twitter @heidi_chung

Yahoo Finance

Yahoo Finance