Nine REITs in the New FTSE ST Singapore Shariah Index

The FTSE ST Singapore Shariah Index was launched last week, with 48 constituents that are selected from the FTSE ST All-Share Index, meeting criteria involving both business activity screenings and financial ratios screenings.

The Index includes nine REITs with a combined market capitalisation of S$11.8 billion. The property assets of the REITs, span industrial, e-commerce, commercial and retail space. The nine REITs average an indicative distribution yield of 6.7%.

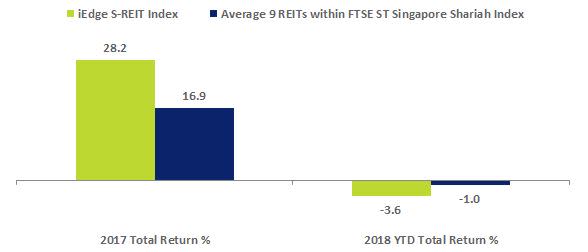

After averaging a 16.9% total return in 2017, the nine REITs have averaged a 1.0% decline in total return in the 2018 YTD. As a group, the nine REITs have seen less swings than the broader REIT Sector in both 2017 and the 2018 YTD.

The FTSE ST Singapore Shariah Index was launched last week on 5 October, at Singapore Exchange (“SGX”). The Index is comprised of 48 stocks that are FTSE ST All-Share Index constituents and Shariah Compliant, meeting business activity and financial ratio screens as established by Yasaar Limited.

Globally, there is a large universe of Index stocks that meet Shariah screens. The Shariah FTSE All-World Index comprises of 1,493 stocks with a combined free float capitalisation of S$18.9 trillion. This is approximately 40% to 45% of the number of stocks of FTSE All World Index and its respective free-float capitalisation.

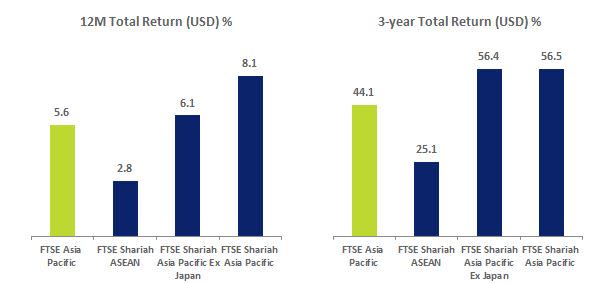

Performances of the Shariah FTSE All-World Index and the FTSE All World Index have been almost identical over the 12 months and for the three years ending September 2018. As illustrated below more diversified returns have been observed within the region.

Source: FTSE Asia Monthly Index Performance Report – September 2018 (Asia Pacific). Click here for more.

FTSE ST Singapore Shariah Index Includes Nine REITs

As noted above, the FTSE ST Singapore Shariah Index is composed of FTSE ST All-Share Index constituents that are Shariah Compliant according to the Yasaar organisation, which is a global network of expert scholars. More information on the organisation can be found here. Note to qualify for inclusion in the FTSE ST All-Share Index, stocks must pass investability and liquidity screens.

Of the 48 stocks selected from the FTSE ST All-Share Index for the FTSE ST Singapore Shariah Index there are 14 Real Estate stocks, of which nine are Real Estate Investment Trusts (“REITs”). Of the nine REITs, Mapletree Industrial Trust has the largest weighting in the Index, with a 2.9% weighting as of the end of September.

When comparing returns of these nine REITs to the iEdge S-REIT Index, the nine REITs have exhibited less beta, or volatility risk, over 2017 in addition to the 2018 year to date. On average the nine REITs generated three-fifths of the total returns of the iEdge S-REIT Index in 2017, while generating approximately one-quarter of the losses of the Index in the 2018 year-to-date.

Comparative Total Returns (SGD) %

Source: SGX StockFacts, Bloomberg (Data as of 9 October 2018). Total Returns in SGD terms assume dividend distributions are reinvested.

The individual performances of the nine REITs with the FTSE ST Singapore Shariah Index are tabled below.

Source: SGX StockFacts, Bloomberg (Data as of 9 October 2018). Total Returns in SGD terms assume dividend distributions are reinvested. For more details, clickhere.

FTSE ST Singapore Shariah Index Screening Methodology

As outlined in the Index ground rules, the Yasaar/FTSE Russell stock screening criteria includes both business screenings and financial ratios screenings:

For business screenings – stocks involved in the following activities will be considered to be non-permitted business sectors: Conventional Finance (non-Islamic Banking, Finance and Insurance, etc.), Alcohol, Pork related products and non-halal food production, packaging and processing or any other activity related to pork and non-halal food, Entertainment (Casinos, Gambling, Cinema, Music, Pornography and Hotels) in addition to Tobacco and Weapons, arms and defence manufacturing. Note this list is not exhaustive and is provided as a basic guidance to the broad principles involved.

For financial ratio screenings – after companies have been screened by their business sector activity, the remaining companies are further examined on their finances to ensure that those companies are Shariah compliant. Only those companies that pass the following financial ratios will be considered Shariah complaint, which includes –

Debt less than 33.333% of total assets

Cash and Interest bearing items are less than 33.333% of total assets

Accounts receivable and cash are less than 50% of total assets

Total interest and non-compliant activities income should not exceed 5% of total revenue

More details on procedures for when companies that change financial compliance between two successive quarters in addition to the appropriate purification of dividends can be found here.

Did you know?

Of the nine REITs in the New FTSE ST Singapore Shariah Index – two REITs are exclusively investing in Singapore properties – ESR-REIT and Sabana Shari’ah Compliant REIT.

Yahoo Finance

Yahoo Finance