Netflix (NFLX) Inks Deal With Game of Thrones Creators

Netflix NFLX has signed a multi-year deal with television writer-producers, David Benioff and D.B. Weiss, the names behind HBO’s popular show Game of Thrones. Per MarketWatch report, the deal, worth $200 million, will see the creators coming up with movies and series exclusively for the streaming giant.

Notably, the duo has also signed a contract with Disney DIS to write and produce a Star Wars movie trilogy, the first of which is scheduled to release in 2022.

The collaboration with Benioff and Weiss is expected to provide an impetus to Netflix’s original content expansion strategy, which has been its key catalyst. Previously, the company signed similar contracts with Ryan Murphy ($300 million deal) and Shonda Rhimes ($100 million deal) to produce original content.

These additions are expected to help Netflix maintain its dominant market share in the streaming space, which is becoming increasingly competitive due to the entrance of Disney+, Apple TV+ and others.

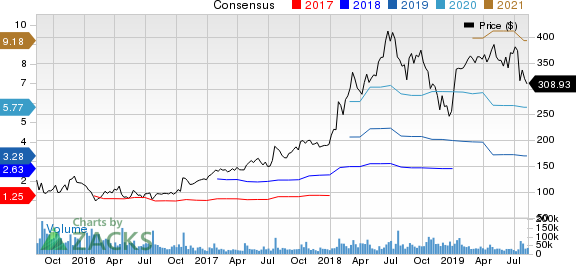

Netflix, Inc. Price and Consensus

Netflix, Inc. price-consensus-chart | Netflix, Inc. Quote

Focus on Subscriber Growth & Retention

At the end of second-quarter 2019, Netflix had 151.56 million paid subscribers globally, up 21.9% from the year-ago quarter. However, the streaming giant managed to add only 2.70 million paid subscribers, down 50.5% year over year.

Moreover, the company lost paid subscribers in the domestic market, probably due to the hike in subscription prices. Notably, Netflix’s subscription price is higher compared to Disney’s upcoming service Disney+, ESPN+ and Hulu bundle.

Further, intensifying competition in the streaming space from the likes of Amazon’s AMZN Prime video service and Hulu along with upcoming services from Disney+, Apple TV+, AT&T’s T HBO Now and Comcast’s CMCSA upcoming NBC pose a threat to Netflix’s dominance.

The company also blamed weak content slate for lower subscriber growth in the second quarter. Netflix is set to lose a couple of its most popular shows like Friends and The Office as new rivals Warner and NBC reclaim their content by the end of 2020.

Disney is also set to pull its movies and shows from the platform ahead of the launch of Disney+ in November. Soon, BBC might also reclaim its content from Netflix as it launches Britbox.

Conclusion

Netflix’s focus on expanding its original content portfolio, as indicated by the recent hiring, is a major growth driver. We believe its expanding content portfolio is likely to aid subscriber retention in the near term. Moreover, content strength, particularly regional, will boost its international user base.

Currently, Netflix has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Walt Disney Company (DIS) : Free Stock Analysis Report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

AT&T Inc. (T) : Free Stock Analysis Report

Comcast Corporation (CMCSA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance