Analysts still bullish on Netflix despite Disney challenge, Q2 warning

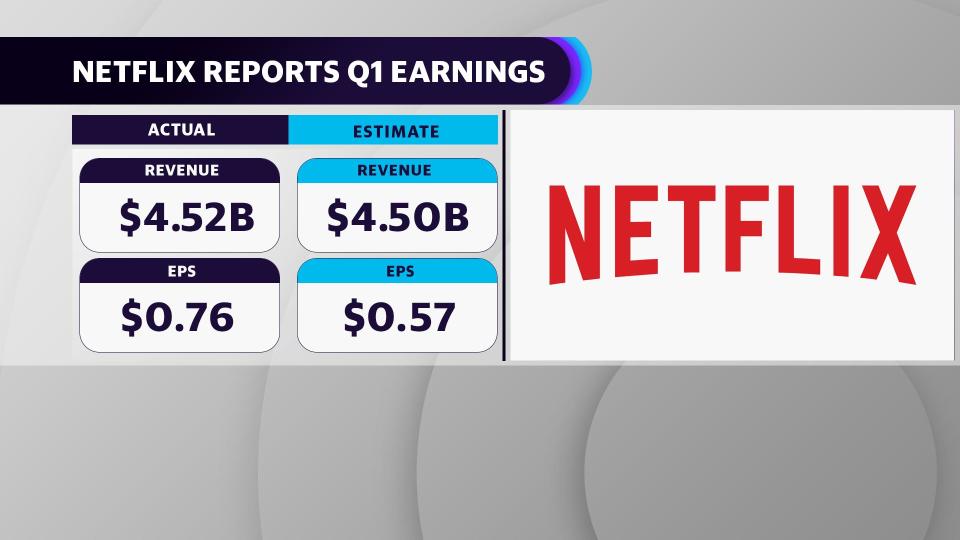

Despite increased competition and lower-than-expected second-quarter guidance, many analysts remain bullish on Netflix (NFLX) following the company’s first-quarter 2019 earnings on Tuesday afternoon.

The Los Gatos, California streaming giant, which reported first-quarter 2019 earnings largely in-line with Wall Street estimates and a record number of new subscribers for a single quarter, disclosed second-quarter guidance indicating the pace of new subscriber additions would slow down during that period. Netflix’s guidance raised some concerns, with Netflix shares dipping up to 4% in after-hours trading on Tuesday, but at least 18 Wall Street analysts remain bullish on the stock.

Andy Hargreaves, an analyst with Keybanc Capital Markets, reiterated his positive long-term outlook for the streaming giant in a note published on Tuesday.

“We maintain Netflix is well-positioned to expand its global subscriber base, in part by filling out the demand curve with a larger variety of package options,” Hargreaves wrote, referring to Netflix’s experimentation with lower-priced mobile-only plans for markets like India.

Meanwhile, Raymond James analyst Justin Patterson adds that Netflix’s record number of new subscribers for the first quarter shouldn’t be overlooked. It added 9.6 million total new subscribers during the period: 1.74 million new domestic subscribers in the U.S. and 7.86 million in international markets. Netflix also has a “strong content slate” in the works for the second half of this year, Patterson emphasized, including new seasons of “Stranger Things,” “13 Reasons Why,” “The Crown” and films such as “The Irishman,” directed by Martin Scorsese and produced by Robert De Niro.

A competitive second-half of 2019

Indeed, the second half of 2019 should be far more interesting for Netflix, as competition increases from Apple (AAPL), which plans on launching its Apple TV+ service later this year, as well as Disney’s (DIS) own Disney+, due out mid-November.

Although some analysts, including Needham’s Laura Martin and Dan Medina, expressed some concern that those services could potentially chip away at Netflix’s user base over the medium-to-long term, many more expressed confidence that Netflix would remain the market leader, in part because Netflix is projected to outspend the competition on original content over the next several years. To that end, BMO Capital Markets analyst Daniel Salmon expects Netflix to spend $15 billion on original content this year versus say, Disney+, which plans on spending $1 billion annually on content over the next year and raise that spend to “mid $2 billion” by 2024. Meanwhile, Apple was estimated to have spent at least $1 billion on developing its own original content in 2018, according to the Wall Street Journal.

Both Disney+ and Apple TV are more family-focused in their content, a narrower focus that Barclay’s analyst Kannan Venkateshwar contends actually works in Netflix’s favor.

“It is interesting to us that OTT [over-the-top broadcast] services being launched by legacy media companies are focused on addressing the needs of a particular demo (adults, family, sports fans, etc,) which make them similar to legacy cable networks,” wrote Venkateshwar. “As these services proliferate, Netflix effectively becomes the only pure play service to address almost all demographics and in that sense, its role becomes akin to a legacy broadcaster. Therefore, we believe in some ways, the launch of multiple new services ironically helps further emphasize the value of Netflix for consumers.”

Certainly, that’s a best-case scenario for Netflix that depends on how compelling consumers actually find the competition once they launch later this year.

More from JP:

Yahoo Finance

Yahoo Finance