Nasdaq (NDAQ) to Report Q3 Earnings: What's in the Offing?

Nasdaq, Inc. NDAQ is slated to report third-quarter 2021 results on Oct 20, before the opening bell. The company delivered an earnings surprise in each of the last four quarters, the average being 9.21%.

Factors to Consider

Nasdaq’s third-quarter performance is likely to have benefited from organic revenue growth and accretion from strategic acquisitions.

Non-trading revenues are expected to have been aided by better performance of Market Technology, and continued strong growth of Market Data, Index and Analytics businesses. Higher SaaS revenues are likely to have driven Market Technology.

The Zacks Consensus Estimate for Analytics businesses revenues is pegged at $51 million, indicating an increase of 13.3% from the year-ago reported figure. The consensus estimate for Index revenues is pegged at $107 million, suggesting growth of 24.4% from the year-ago reported figure.

Marketing Technology segment revenues are likely to have been driven by higher marketplace infrastructure technology as well as anti-financial crime technology revenues. The Zacks Consensus Estimate for Marketing Technology revenues is pegged at $125 million, suggesting growth of 45.3% from the prior-year reported figure.

The Investment Intelligence segment is expected to have benefited from organic growth in proprietary data products driven by new sales, higher assets under management (AUM) in exchange-traded products linked to Nasdaq indexes, and increased futures trading linked to the Nasdaq-100 Index as well as growth in eVestment platform driven by new sales, strong retention, and higher average revenue per client from expanded offerings. The Zacks Consensus Estimate for Investment Intelligence segment revenues is pegged at $264 million, indicating a 10.9% increase from the year-ago reported figure.

Higher U.S. listings revenues courtesy of an increase in IPOs and higher Nasdaq private market revenues coupled with an increase in both Investor Relations, Intelligence and ESG advisory services revenues might have favored the Corporate Services segment. The Zacks Consensus Estimate for Corporate Services segment revenues is pegged at $152 million, indicating a 15.2% increase from the year-ago reported figure.

The consensus estimate for listing revenues is pegged at $96 million, suggesting growth of 21.5% from the year-ago reported figure.

Expenses are likely to have increased to account for strong and broad-based organic revenue growth.

Accelerated share buyback is likely to have provided an additional boost to the bottom line.

The Zacks Consensus Estimate for earnings stands at $1.72, indicating 12.4% increase from the prior-year reported figure.

What Our Quantitative Model States

Our proven model does not conclusively predict an earnings beat for Nasdaq this time around. This is because the stock needs to have the right combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold). This is not the case as you can see below.

Earnings ESP: Nasdaq has an Earnings ESP of -0.08%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter

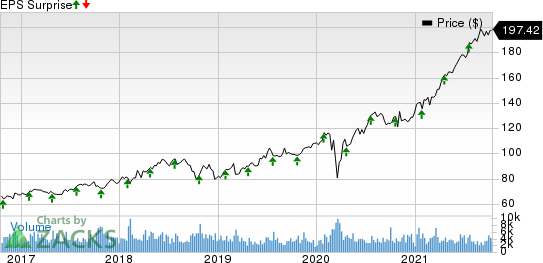

Nasdaq, Inc. Price and EPS Surprise

Nasdaq, Inc. price-eps-surprise | Nasdaq, Inc. Quote

Zacks Rank: Nasdaq currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

Here are some stocks from the finance sector with the perfect combination of elements to surpass estimates in their upcoming releases.

Intercontinental Exchange ICE has an Earnings ESP of +2.99% and a Zacks Rank #3.

CME Group CME has an Earnings ESP of +0.14% and a Zacks Rank #3.

Aflac Incorporated AFL has an Earnings ESP of +2.55% and a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intercontinental Exchange Inc. (ICE) : Free Stock Analysis Report

CME Group Inc. (CME) : Free Stock Analysis Report

Nasdaq, Inc. (NDAQ) : Free Stock Analysis Report

Aflac Incorporated (AFL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance