Nasdaq (NDAQ) and IDX Strengthen Technology Partnership

Nasdaq NDAQ recently announced that it has expanded its partnership with the Indonesia Stock Exchange (IDX) in a bid to upgrade its capital market structure. Under this partnership, IDX will upgrade its core trading platform to adopt Nasdaq’s most advanced matching engine. This deal also extends NDAQ’s market surveillance partnership with IDX and includes an agreement to improve IDX’s Index business.

This move bodes well for NDAQ as an upgraded platform that will quadruple transaction capacity and enhance trading experience and IDX’s ability to work with increased volumes, thereby improving growth in the country. Increased market activity is expected to benefit NDAQ in the form of more demand for its services.

More partnerships like this are expected to boost the company’s Financial Technology segment’s revenues. The partnership also highlights Nasdaq’s strategy to rely more on income generated from stable streams than other sources, such as trading income. NDAQ aims to become a financial services-based company and would benefit from expanded market reach and robust client relationships as a result of this collaboration.

NDAQ is also aiding IDX to accommodate a broader plethora of asset classes like fixed income, equities, digital assets and derivatives with its scalable and modular platform. Moreover, NDAQ is also bringing flexible architecture to IDX’s Index business. This will enable IDX to launch new indices per growth opportunities. NDAQ is helping IDX to align with Indonesia’s regulatory goals of achieving a sustainable and robust capital market.

In conclusion, NDAQ is expected to play an important role in Indonesia’s journey toward modernization and drive market transparency and operational efficiency for IDX, benefiting all the parties involved.

Zacks Rank & Price Performance

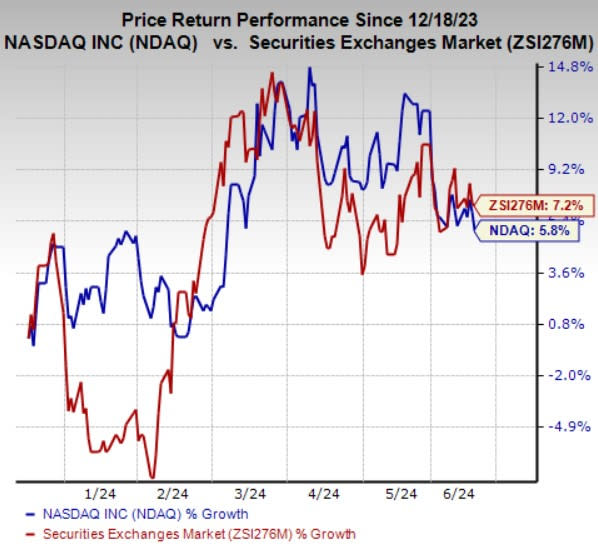

Nasdaq currently carries a Zacks Rank #4 (Sell). In the past six months, the stock has gained 5.8% compared with the industry’s rise of 7.2%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the broader Finance space are Coinbase Global, Inc. COIN, Euronet Worldwide, Inc. EEFT and Brown & Brown, Inc. BRO. While Coinbase Global sports a Zacks Rank #1 (Strong Buy) at present, Euronet and Brown & Brown carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Coinbase’s current-year earnings implies a 1,840.5% year-over-year surge. It has witnessed five upward estimate revisions against none in the opposite direction in the past month. COIN beat earnings estimates in each of the past four quarters, with an average surprise of 364.6%.

The Zacks Consensus Estimate for Euronet Worldwide’s 2024 earnings is pegged at $8.64 per share, which increased 17 cents in the past 60 days. It beat earnings estimates in each of the past four quarters, with an average surprise of 9.3%. The consensus mark for EEFT’s revenues in 2024 is pegged at $4 billion.

The Zacks Consensus Estimate for Brown & Brown’s current-year earnings is pegged at $3.61 per share, which indicates 28.5% year-over-year growth. BRO beat earnings estimates in each of the past four quarters, with an average surprise of 11.9%. Also, the consensus mark for BRO’s 2024 revenues suggests 9.1% year-over-year growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nasdaq, Inc. (NDAQ) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Euronet Worldwide, Inc. (EEFT) : Free Stock Analysis Report

Coinbase Global, Inc. (COIN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance