MSA Safety Inc (MSA) Reports Q1 2024 Earnings: Aligns with Analyst EPS Projections

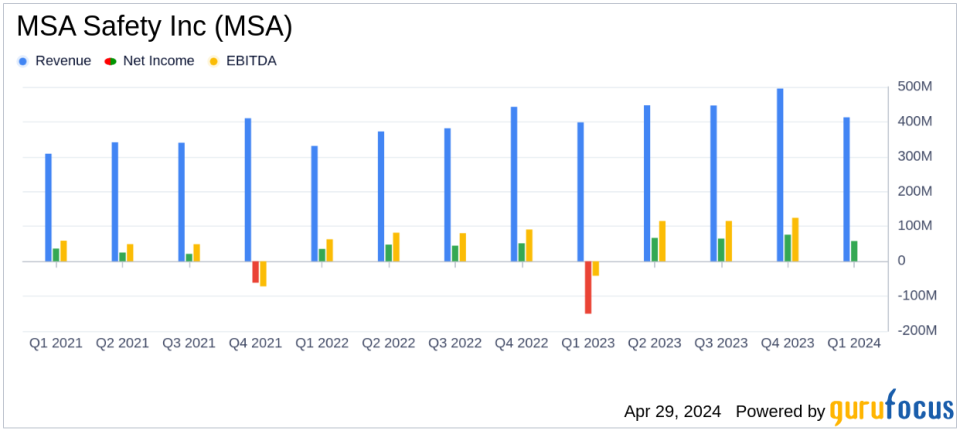

Revenue: Reported $413 million, up 4% year-over-year, falling short of estimates of $428.37 million.

Net Income: Achieved $58 million, a significant recovery from a loss of $150 million in the previous year, surpassing estimates of $61.86 million.

Earnings Per Share (EPS): Recorded $1.47 per diluted share, below the estimated $1.56.

Adjusted Earnings Per Share (EPS): Reported $1.61, exceeding the estimated $1.56.

Operating Income: GAAP operating income was $80 million, marking a recovery from a loss of $60 million in the prior year.

Capital Expenditures: Invested $11 million, an increase from $8.4 million in the previous year.

Dividends: Returned $18 million to shareholders through dividends.

On April 29, 2024, MSA Safety Inc (NYSE:MSA), a global leader in the development, manufacture, and supply of safety products, announced its financial results for the first quarter of 2024. The company reported a quarterly net income of $58 million, or $1.47 per diluted share, and adjusted earnings of $63 million, or $1.61 per diluted share, aligning closely with analyst expectations of $1.56 per share. MSA Safety's performance reflects a steady demand for its safety products amid challenging global market conditions. The full details of the earnings can be viewed in their 8-K filing.

Company Overview

MSA Safety Inc is renowned for its comprehensive range of safety products designed to protect workers in high-risk industries such as oil and gas, mining, and construction. Their product line includes sophisticated breathing apparatuses, fall protection gear, portable gas detection systems, and more. The company primarily operates through its geographic segments in the Americas and internationally, with a significant portion of its revenue generated in North America.

Financial Performance Insights

The reported net sales for the quarter stood at $413 million, marking a 4% increase from the previous year's $398 million. This growth is attributed to strong execution and strategic initiatives that have enhanced MSA Safety's market position. The GAAP operating income was notably high at $80 million, or 19.4% of sales, with an adjusted figure of $88 million, or 21.3% of sales, demonstrating robust margin expansion.

Strategic Execution and Market Position

According to Nish Vartanian, MSA Safety's Chairman and CEO, the company's solid start to 2024 is a result of diligent strategy implementation and a resilient business model that leverages product and market diversity. Vartanian praised the team's commitment to continuous improvement and customer service, which he believes will drive sustained shareholder value.

Financial Health and Future Outlook

Lee McChesney, the CFO of MSA Safety, highlighted the disciplined execution that led to the reported sales growth and margin expansion. With a strong start in both sales and orders, the company maintains a positive growth outlook in the mid-single digits for the full year. MSA Safety's robust balance sheet and consistent cash flow performance position it well for ongoing success in 2024 and beyond.

Upcoming Events and Investor Relations

MSA Safety has scheduled an Investor Day on May 22, 2024, and will also present at the Oppenheimer 19th Annual Industrial Growth Conference on May 7, 2024. These events will provide further insights into the company's strategy and market positioning.

Conclusion

MSA Safety Inc's first-quarter results for 2024 reflect a company that is not only managing to navigate through global economic uncertainties but also excelling by leveraging its core strengths. The alignment of its quarterly earnings per share with analyst estimates underscores the predictability and stability of its business model. Investors and stakeholders can likely expect continued robust performance based on the company's strategic initiatives and market adaptability.

For detailed financial figures and future projections, interested parties are encouraged to review the official earnings release and stay tuned for the upcoming investor presentations.

Explore the complete 8-K earnings release (here) from MSA Safety Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance