Mosaic (MOS) Announces Idling of Colonsay Mine Indefinitely

The Mosaic Company MOS announced plans to keep the Colonsay potash mine in Saskatchewan, Canada, idled for the foreseeable future.

The decision will likely impact the company’s workers. However, it will allow Mosaic to optimize its production assets in Canada and strengthen its cost position in a competitive market.

Notably, the mine will be positioned in the care and maintenance phase, employ limited staff and allow operations to be resumed when necessary to meet the needs of customers.

Per management, the expansion of its Esterhazy K3 production coupled with sustained soft demand in North America has left the potash business of Mosaic with excess inventory and production capacity. Notably, the company continues to anticipate strong global demand for fertilizer as well as healthy business conditions in 2020.

The idling is expected to result in pretax charges of approximately $530 million in the fourth quarter of 2019. The pretax charges comprise mostly non-cash charges for asset write-offs and $15-$20 million in cash severance charges. Notably, the write-off is essentially the carrying value of its 2013 expansion project, which increased the operating capacity of Colonsay to 2.1 million tons.

Phosphates were also affected by the same market conditions (mainly a third consecutive soft fertilizer application season in North America) that affected potash.

The average realized price of phosphate continued to decline in the fourth quarter of 2019, affecting the annual goodwill impairment analysis and leading Mosaic to anticipate a write-off of up to $590 million of the Phosphates segment’s goodwill.

Notably, Mosaic will treat charges associated with the idling or changes in goodwill balances as notable items.

Shares of the company have lost 39.1% in the past year compared with the industry’s 19.4% decline.

In November 2019, Mosaic lowered the adjusted EBITDA view for 2019 to $1.4-$1.5 billion from $1.8-$2 billion mentioned earlier. Further, it now projects adjusted earnings of 50-60 cents per share, down from $1.10-$1.50 stated previously.

The company, in early November, expected phosphates sales volume of 2.1-2.3 million tons and potash sales volume of 1.7-1.9 million tons for the fourth quarter.

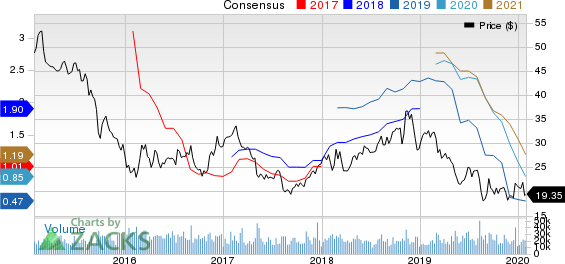

The Mosaic Company Price and Consensus

The Mosaic Company price-consensus-chart | The Mosaic Company Quote

Zacks Rank & Stocks to Consider

Mosaic currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the basic materials space are Daqo New Energy Corp. DQ, Royal Gold, Inc. RGLD and Commercial Metals Company CMC.

Daqo New Energy has a projected earnings growth rate of 326.3% for 2020. The company’s shares have rallied 51.4% in a year. It sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Royal Gold has an estimated earnings growth rate of 83.5% for fiscal 2020. It currently flaunts a Zacks Rank #1. Its shares have rallied 31.6% in a year.

Commercial Metals has a Zacks Rank #2 (Buy) and a projected earnings growth rate of 20.2% for 2020. The company’s shares have rallied 22.7% in a year.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DAQO New Energy Corp. (DQ) : Free Stock Analysis Report

The Mosaic Company (MOS) : Free Stock Analysis Report

Royal Gold, Inc. (RGLD) : Free Stock Analysis Report

Commercial Metals Company (CMC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance