Morgan Stanley (MS) Beats on Q2 Earnings Amid Trading Woes

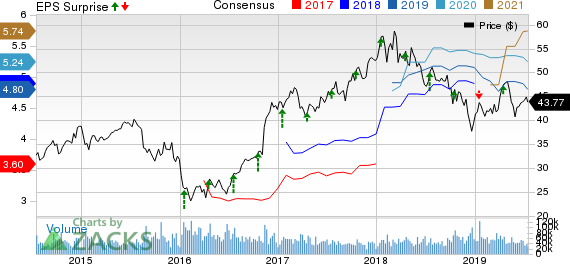

Despite disappointing capital markets performance, Morgan Stanley’s MS second-quarter 2019 earnings of $1.23 per share outpaced the Zacks Consensus Estimate of $1.13. However, the figure reflected a fall of 2% from adjusted earnings recorded in the year-ago quarter.

Shares of Morgan Stanley fell nearly 1.3% in pre-market following a steep decline in equity trading revenues. The stock’s price performance after the full day’s trading will give a better picture.

Higher net interest income, driven by rise in loan balance and higher rates, and investments supported the top line. Further, operating expenses witnessed a decline. Also, the company’s capital ratios remained strong.

Nonetheless, as expected, trading revenues declined as equity and fixed income trading income fell 14% and 18%, respectively. Additionally, overall investment banking performance was disappointing. Advisory fees fell 18% and debt underwriting revenues decreased 22%, while equity underwriting fees inched up 1%.

Net income applicable to Morgan Stanley was $2.20 billion, down 10% from the prior-year quarter.

Trading, Investment Banking Hurt Revenues, Costs Decline

Net revenues amounted to $10.24 billion, a decline of 3% from the prior-year quarter. However, the top line beat the Zacks Consensus Estimate of $9.98 billion.

Net interest income was $1.02 billion, up 14% from the year-ago quarter. This was largely due to a rise in interest income, partially offset by higher interest expenses.

Total non-interest revenues of $9.22 billion fell 5% year over year, primarily due to dismal investment banking and trading performance.

Total non-interest expenses were $7.34 billion, down 2% year over year.

Decent Segmental Performance

Institutional Securities: Pre-tax income from continuing operations was $1.46 billion, decreasing 19% year over year. Net revenues of $5.11 billion fell 11%. The decline was mainly due to lower trading income and investment banking revenues.

Wealth Management: Pre-tax income from continuing operations totaled $1.24 billion, up 7%. Net revenues were $4.41 billion, up 2% year over year as a rise in transactional revenues and asset management revenues was offset by lower net interest income.

Investment Management: Pre-tax income from continuing operations was $199 million, surging 42% from the year-ago quarter. Net revenues were $839 million, up 21%. The increase was mainly driven by stable asset management fees and higher investment revenues.

As of Jun 30, 2019, total assets under management or supervision were $497 billion, up 5% on a year-over-year basis.

Strong Capital Position

As of Jun 30, 2019, book value per share was $44.13, up from $40.34 as of Jun 30, 2018. Tangible book value per share was $38.44, up from $35.19 a year ago.

Morgan Stanley’s Tier 1 capital ratio Advanced was 18.9% compared with 19.0% in the year-ago quarter. Tier 1 common equity ratio Advanced was 16.7% compared with 16.6% a year ago.

Share Repurchase Update

During the reported quarter, Morgan Stanley bought back around 26 million shares for nearly $1.2 billion. This was part of the company's 2018 capital plan.

Dividend Hike

Concurrently, Morgan Stanley announced quarterly dividend of 35 cents per share, representing a 16.7% hike from the prior payout. The dividend will be paid on Aug 15 to shareholders of record as on Jul 31.

Our Viewpoint

Morgan Stanley’s focus on less capital-incentive operations like wealth management is commendable. However, continued slump in investment banking and trading remains a major near-term concern. This will likely have an adverse impact on its financials.

Currently, Morgan Stanley carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among banking giants, JPMorgan JPM, Bank of America BAC and Citigroup C have already come out with second-quarter results. Similar to Morgan Stanley, financials of these companies were hurt by dismal investment banking and trading performance.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Click to get this free report Bank of America Corporation (BAC) : Free Stock Analysis Report Citigroup Inc. (C) : Free Stock Analysis Report JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report Morgan Stanley (MS) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

Yahoo Finance

Yahoo Finance