monday.com (MNDY) to Report Q1 Earnings: What's in the Cards?

monday.com MNDY is set to report first-quarter 2024 results on May 15.

The Zacks Consensus Estimate for first-quarter revenues is pegged at $210.33 million, indicating an increase of 29.63% from the year-ago quarter. The company expects total revenues in the range of $207-$211 million, indicating year-over-year growth in the band of 28-30%.

The consensus estimate for MNDY’s earnings has remained steady at 39 cents per share over the past 30 days, indicating a surge of 178.57% from the year-ago quarter.

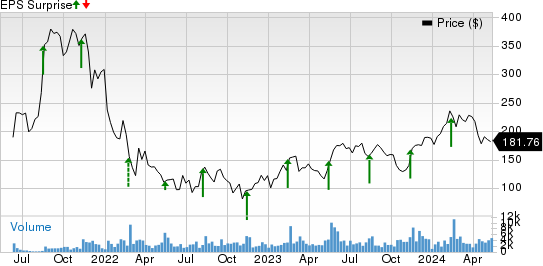

monday.com Ltd. Price and EPS Surprise

monday.com Ltd. price-eps-surprise | monday.com Ltd. Quote

Factors to Note

MNDY’s first-quarter results are expected to reflect strength in customer acquisition and expansion, especially with larger accounts. An increase in the adoption of new capabilities, including monday AI and monday workflows, is expected to have aided customer engagement.

The company also introduced an updated pricing model across its products, including monday work management, monday sales CRM and monday dev, which is likely to have aided top-line growth.

MNDY’s recent partnerships are likely to have positively impacted the company’s performance. It ended 2023 with 219 active partners, 612 new referral partners and 409 marketplace apps, which are expected to have enhanced monday.com’s overall performance.

At the end of the fourth quarter, total monday sales CRM accounts increased to 13,318, representing 21% growth from the prior quarter. This trend is expected to have continued in the to-be-reported quarter. Through a collaboration with Crunchbase, monday.com has made prospecting significantly easier. Users can now enter into the domain of a company in their Accounts board, and details, including industry, description and number of employees, will automatically appear.

The monday dev now includes unexpected detection with an “unplanned” column as a trigger for additional automations and workflows, which allows users to handle the state automatically. This is expected to have aided growth in total monday dev accounts. At the end of the fourth quarter, total monday dev accounts grew to 1,448, representing 39% growth from the prior quarter.

In 2023, the company added 821 enterprise customers (>$50k ARR), up from 681 customers added in 2022. This growth was driven by strengthening enterprise-grade capabilities, including the rollout of mondayDB. This trend is likely to have continued in the to-be-reported quarter.

What Our Model Indicates

According to the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

MNDY has an Earnings ESP of 0.00% and carries a Zacks Rank #3 at present. You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Stocks With a Favorable Combination

Here are some stocks that, according to our model, have the right combination of elements to beat on earnings this season.

NVIDIA NVDA has an Earnings ESP of +2.50% and a Zacks Rank #2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

NVIDIA’s shares have surged 79.2% year to date. NVDA is scheduled to release first-quarter fiscal 2025 results on May 22.

Agilent Technologies A has an Earnings ESP of +0.72% and a Zacks Rank #3 at present.

The stock has inched up 4.4% year to date. A is set to report its second-quarter fiscal 2024 results on May 29.

Applied Materials AMAT has an Earnings ESP of +0.31% and a Zacks Rank #3 at present.

Shares of Applied Materials have gained 27.3% year to date. AMAT is set to report second-quarter fiscal 2024 results on May 16.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

Applied Materials, Inc. (AMAT) : Free Stock Analysis Report

monday.com Ltd. (MNDY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance