Microsoft may have alienated some of its most important partners

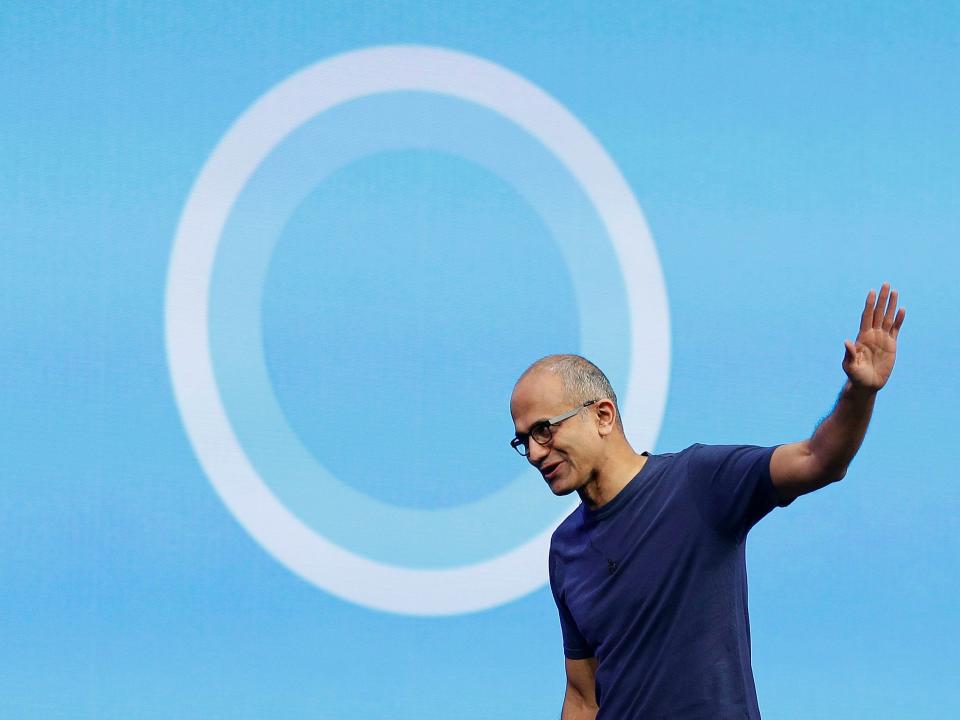

AP

Microsoft CEO Satya Nadella.

Some of Microsoft’s key business relationships could be souring after the company introduced the Surface Book, a laptop that can also double as a tablet, at an event on October 6.

Original equipment manufactures (OEMs), who work to produce the hardware that Windows runs on, were not pleased with Microsoft’s new product, according to people who spoke to Business Insider on the condition of anonymity.

Hardware partners, which include HP, Dell, Lenovo, ASUS, and Samsung, traditionally work alongside Microsoft by producing new products that can run Windows. With the introduction of Windows 10, Microsoft has been working especially closely with OEMs in order to compete with Apple.

This relationship took a turn when Microsoft moved away from the Surface Pro, a tablet/laptop hybrid, and moved into the fully fledged laptop market. OEMs fear that Microsoft is moving to edge them out of the market by making hardware themselves, eliminating the need for a third party.

The Sleeping Lion

One person Business Insider spoke to who works at an OEM described Microsoft as a “sleeping lion” which no manufacturer dared disturb or contradict, even when it moves into their territory, for fear of the consequences.

Outwardly, PC manufactures have welcomed — or, at least, not complained about — Microsoft’s move into producing a fully fledged computer.

HP told Business Insider that “it’s great…Microsoft is investing [in PCs]” while Lenovo said in a statement that “we…see Microsoft, as others have recently done, invest in the 2-in-1 category with their new announcements. For the past three years, the 2-in-1 category has been the fastest growing form factor in the market.”

Behind closed doors, however, many are uneasy.

Redmond Rules

Screenshot

Panos Panay holds up the Surface Book on stage at Microsoft’s October 6 event.

For its part, Microsoft has been making overtures to try to sooth relations with OEMs. In the midst of a rapidly declining PC market, many manufactures — who make money solely from hardware sales — are starting to feel the pinch, and having a notoriously aggressive company move in does not feel good.

Re/Code reports that Microsoft has described its new products as “complement[ary to] those [OEM-made] devices in every way,” as it seeks to keep everyone onboard.

Whether this strategy is working remains to be seen. Asus Chairman Jonney Shih is quoted as saying that the two companies “are going to have a serious talk about” the new Surface Book, while others Business Insider spoke to within the company felt that Microsoft had blindsided Asus despite Terry Myerson, the vice president of Windows and Devices, claiming the company had been “transparent” with OEMs.

Rebellion

The problem facing OEMs is this: there is no alternative to Windows for a mass market PC. Like it or loath it, all the manufactures have to remain on good terms with Microsoft in order to license Windows 10. At present, the reverse is also true: without OEMs, there is no one to distribute Windows.

However, the new direction of Microsoft into hardware could change this, and here lies the root of the angst surrounding the launch of the Surface Book. Put simply: Microsoft may be moving strategically toward a world without OEMs, evidenced by the Surface Book and updated Surface Pro 4.

Trojan Horse

Microsoft

The Surface Pro is a hybrid laptop/tablet which can be used with either a finger, stylus or mouse.

In fact, the Surface Pro 4 may be Microsoft’s ace in the hole. IDC analyst John Delaney told Business Insider that while the Surface Book was designed to “inject some pizzazz into the PC market,” the new Pro was actually a far larger threat to OEMs — and one that has gone ignored thus far.

By combining a laptop and tablet into one device — described as a “2-in-1″ — Microsoft is aiming at a far larger audience. Other OEMs, such as Lenovo, are also making 2-in-1 hybrids, but it is Microsoft that holds the keys to Windows 10.

The Surface Pro line, despite facing some challenges, is growing rapidly, recording over $888 million (£560 million) in revenue during the fourth financial quarter of 2015 (which the company measures in July). This comes after Microsoft had to write-off over $900 million (£590 million) in unsold stock during 2013.

The introduction of the Surface Book may start a chain reaction, with OEMs suddenly realising that Microsoft has quietly maneuvered itself into a commanding position when it comes to hardware manufacture. A source who works at an OEM told Business Insider that their office fell quiet when the Surface Book was announced during Microsoft’s October 6 event.

Let it play out

The Surface Book was compared to a MacBook on stage but it still has Microsoft’s OEM partners scared.

OEMs have no choice but to watch Microsoft’s latest foray, having won themselves a front row seat. Beyond building an entirely new operating system from scratch, the manufactures have no one else to turn to. Time and again people that Business Insider spoke to seemed to inwardly sigh before declaring that time would tell.

Some did point out that the Surface Book starts at over $1,400 (£920), placing it in a segment of the Windows computer market that represents around of 1% of total market share. HP told Business Insider that “we think it’s great that Microsoft is investing to build [out] an under-developed segment. Today, less than 1% of the total consumer PC industry is Windows PCs over $1500, and Apple dominates the premium segment.”

This optimistic view — that Microsoft is only focused on the high-end — may well be true, but just a few years ago the company wasn’t even making hardware. Times change.

What happens now?

The annoyance of the OEMs is largely un-actionable. While high profile people within companies may vent, both parties are still best served when they work together. Microsoft aims to have Windows 10 on a billion devices within three years — it’s already at over 100 million — and that isn’t going to happen on a $1,400 PC alone.

For its part, Microsoft told Business Insider that “[it] strives for a complementary approach with our OEM partners, with transparent communication on our vision for Microsoft devices.” No one from Microsoft was made available to comment for this article.

While the future of Microsoft seems bright, the future of its hardware partners seems muddied — and Redmond needs to be wary of this before it’s too late.

NOW WATCH: We got a hands-on look at the Surface Book — Microsoft’s first-ever laptop everyone’s freaking out about

The post Microsoft may have alienated some of its most important partners appeared first on Business Insider.

Yahoo Finance

Yahoo Finance