Meta Platforms Inc's Chief Legal Officer Jennifer Newstead Sells Company Shares

Meta Platforms Inc (NASDAQ:META), a leading technology company specializing in social networking services and digital platforms, has reported an insider sale according to a recent SEC filing. Chief Legal Officer Jennifer Newstead sold 585 shares of the company on March 26, 2024.Jennifer Newstead, who holds a key executive position within the company, executed the sale at an average price of $505.29 per share, which resulted in a transaction amount of approximately $295,594.65. This transaction has been officially filed with the SEC, and the document can be viewed through this link.Over the past year, the insider has sold a total of 32,245 shares of Meta Platforms Inc and has not made any purchases of the stock. The insider transaction history for the company shows a pattern of sales by insiders, with a total of 211 insider sells and no insider buys over the past year.

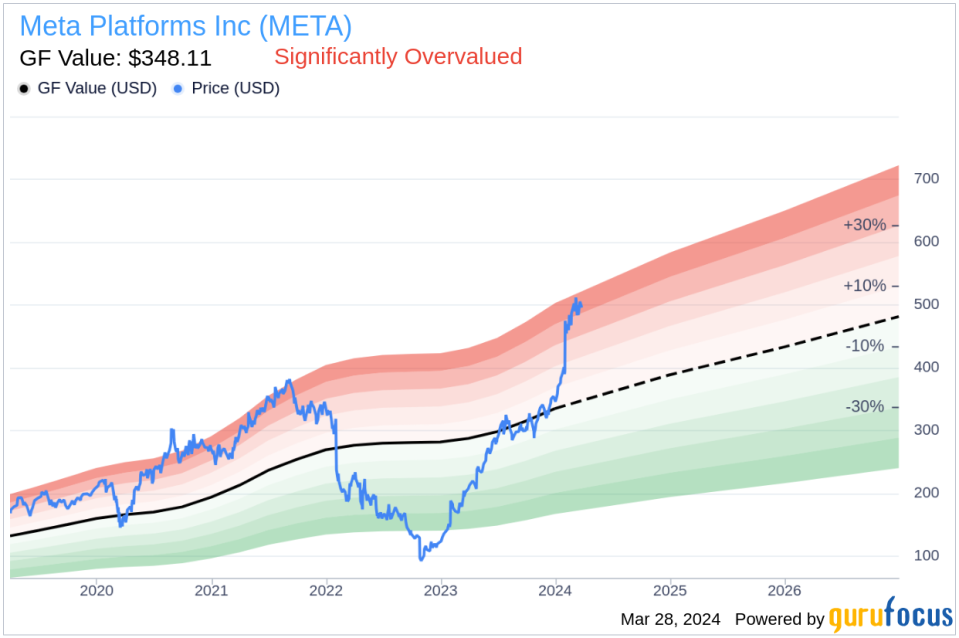

On the valuation front, Meta Platforms Inc's shares were trading at $505.29 on the day of the insider's recent sale, giving the company a market capitalization of approximately $1,259.28 billion. The price-earnings ratio stands at 33.14, which is above the industry median of 21.18 but below the company's historical median price-earnings ratio.According to the GuruFocus Value indicator, with a share price of $505.29 and a GF Value of $348.11, Meta Platforms Inc is considered Significantly Overvalued, with a price-to-GF-Value ratio of 1.45. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts.

Meta Platforms Inc operates a range of social networking sites and digital platforms, including Facebook, Instagram, and WhatsApp, among others. The company's platforms are used by a large global audience for communication, content sharing, and community building. Meta Platforms Inc continues to be a significant player in the technology sector, with a focus on innovation and expansion into new areas such as virtual reality and augmented reality through its Oculus products and services.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance