Meritage Homes' (MTH) Q2 Earnings Beat Estimates, View Up

Meritage Homes Corporation MTH reported second-quarter 2019 results, wherein earnings and revenues surpassed the respective Zacks Consensus Estimate, buoyed by strong homebuying activity.

Earnings of $1.31 per share topped the consensus mark of $1.03 by 27.2%. However, the reported figure was in line with the year-ago profit level. Lower home closing revenues and increased interest and SG&A expenses were offset by higher gross margin.

Home closing revenues of $863.1 million surpassed the consensus mark of $805 million by 7.2% but decreased 1.1% year over year.

Segment Discussion

Homebuilding/Total Closing Revenues: Revenues from the segment decreased 1.5% from the prior-year quarter to $864.6 million, impacted by 6% reduced ASP, which offset the 5.3% increase in volume. Home closing revenues in the West region were down 14.5% from the year-ago level due to a 9% reduction in ASP and 7% drop in closings. The decrease in the West region was primarily due to softness in California.

Homes closed during the quarter came in at 2,253, up 5.3% year over year. Despite higher closings, revenues declined due to lower ASP that reflects the company’s ongoing strategic shift toward more affordable entry-level and first move-up homes at lower price points. Notably, its entry-level LiVE.NOW. homes represented 52% of second-quarter orders, increasing from 44% a year ago.

Total orders increased 21.6% from the year-ago level to 2,735 homes. The value of net orders also increased 13.7% year over year to $1.04 billion. Quarterly order volume marked a 13-year record high, driven by a 19% improvement in absorption pace and marginal increase in average community count.

However, land closing revenues of $1.6 million were significantly down from $5.1 million a year ago.

Financial Services: The segment’s revenues increased 7.5% from the prior-year level to $4.2 million.

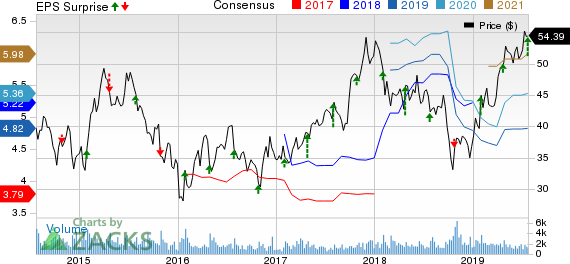

Meritage Corporation Price, Consensus and EPS Surprise

Meritage Corporation price-consensus-eps-surprise-chart | Meritage Corporation Quote

Margins

Home closing gross margin improved 10 basis points (bps) to 18.4% from the prior-year figure.

Selling, general and administrative expenses (as a percentage of home closing revenues) of 11% were up 10 bps from the prior-year figure of 10.9%.

Balance Sheet

As of Jun 30, 2019, cash and cash equivalents totaled $407.4 million compared with $311.5 million on Dec 31, 2018. The upside was backed by positive cash flow from operations.

As of Jun 30, 2019, debt-to-capital ratio of the company reduced to 42.1% from 43.2% on Dec 31, 2018. Also, net debt-to-capital ratio decreased to 33.4% from 36.7% on Dec 31.

2019 Guidance

Meritage Homes now expects full-year 2019 home closings in the range of 8,700-9,100 versus 8,200-8,700 projected earlier. The mid-point of the guided range is higher than the year-ago reported figure of 8,531 homes. The company expects total home closing revenues within $3.4-$3.6 billion versus $3.25-3.45 billion expected earlier. In 2018, it reported home closing revenues of $3.47 billion.

The company anticipates home closing gross margin in mid-18% and earnings within $5.20-$5.50 per share compared with $4.65-4.95 expected earlier. In 2018, the company had reported earnings of $5.58 per share.

Zacks Rank

Meritage Homes currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

PulteGroup Inc.’s PHM second-quarter 2019 earnings and revenues surpassed the respective Zacks Consensus Estimate. Both earnings and revenues, however, decreased 3.4% from the year-ago level.

NVR, Inc. NVR reported second-quarter 2019 results, wherein earnings surpassed the Zacks Consensus Estimate. Also, the reported figure increased 8.2% from the prior-year quarter. Total revenues (Homebuilding & Mortgage Banking fees combined) were $1.8 billion in the quarter, up 1% year over year on higher deliveries and prices.

Lennar Corporation LEN reported better-than-expected results in second-quarter fiscal 2019 (ended May 31, 2019), after missing estimates in the preceding quarter. Earnings and revenues increased on a year-over-year basis during the quarter.

This Could Be the Fastest Way to Grow Wealth in 2019

Research indicates one sector is poised to deliver a crop of the best-performing stocks you'll find anywhere in the market. Breaking news in this space frequently creates quick double- and triple-digit profit opportunities.

These companies are changing the world – and owning their stocks could transform your portfolio in 2019 and beyond. Recent trades from this sector have generated +98%, +119% and +164% gains in as little as 1 month.

Click here to see these breakthrough stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PulteGroup, Inc. (PHM) : Free Stock Analysis Report

Lennar Corporation (LEN) : Free Stock Analysis Report

NVR, Inc. (NVR) : Free Stock Analysis Report

Meritage Corporation (MTH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance