Mercantile Bank Corp (MBWM) Exceeds Q1 Earnings Estimates and Reports Revenue Growth

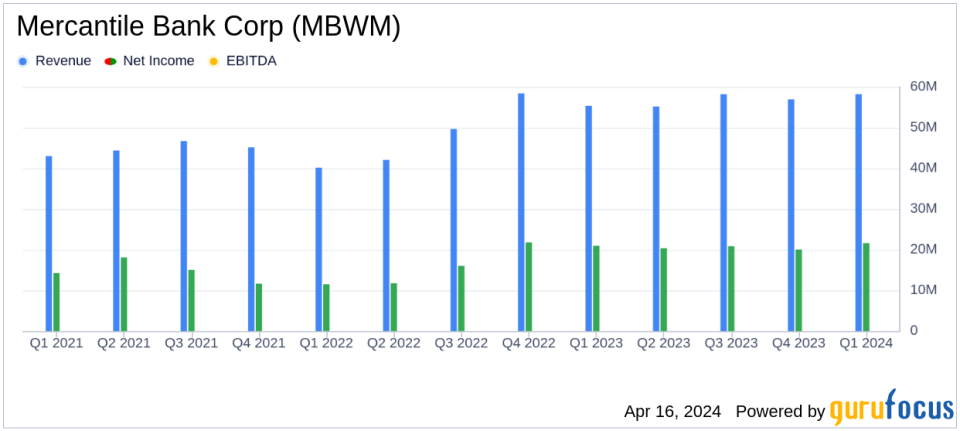

Net Income: Reported at $21.6 million, surpassing the estimated $18.31 million.

Earnings Per Share (EPS): Achieved $1.34 per diluted share, exceeding the estimated $1.14.

Revenue: Total revenue reached $58.2 million, outperforming the estimated $55.38 million.

Net Interest Margin: Recorded at 3.74%, despite a challenging interest rate environment.

Asset Quality: Remained strong with nonperforming assets at just 0.1% of total assets.

Balance Sheet: Total assets grew to $5.47 billion, with a notable increase in total loans.

Mercantile Bank Corp (NASDAQ:MBWM) released its 8-K filing on April 16, 2024, announcing robust financial results for the first quarter of the year. The bank, which provides comprehensive commercial banking services, reported a net income of $21.6 million, or $1.34 per diluted share, for Q1 2024. This performance exceeded both the estimated earnings per share of $1.14 and estimated net income of $18.31 million, signaling a strong start to the year.

President and CEO Robert B. Kaminski, Jr. expressed satisfaction with the quarter's results, highlighting the bank's healthy net interest margin and increases in various noninterest revenue streams. Despite challenges such as a higher cost of funds, the bank's focus on expanding deposit relationships and robust lending practices contributed to its financial achievements.

Performance and Financial Highlights

Total revenue for Q1 2024 reached $58.2 million, a 5.2% increase from the previous year, driven by a rise in noninterest income, which saw a 56.4% jump to $10.9 million. This was attributed to higher treasury management fees, mortgage banking income, and interest rate swap income. The bank's net interest margin, however, experienced a decline to 3.74% from 4.28% in the prior-year quarter, primarily due to the increased cost of funds which rose to 2.32% from 1.07%.

On the balance sheet, total assets grew to $5.47 billion, with total loans increasing by $18.2 million in the quarter. The bank also reported a solid growth in commercial loans and a strategic increase in on-balance sheet liquidity. Deposits showed a healthy increase, with local deposits growing by nearly 11% annualized during the quarter.

Asset quality metrics remained robust, with nonperforming assets at a mere 0.1% of total assets. The bank also maintained a "well-capitalized" position with a total risk-based capital ratio of 13.8%, and shareholders' equity increased to $537 million.

Operational Excellence and Future Outlook

Mercantile Bank Corp's operational results reflect its commitment to efficient practices and customer service excellence. The bank's strategic focus on treasury management and mortgage banking services has paid off, contributing significantly to the increase in noninterest income. Despite the impact of rising interest rates, the bank's net interest margin remains strong, and its cost-conscious operating approach positions it well for future challenges.

Looking ahead, the bank's leadership is optimistic about continued loan portfolio expansion and the ability to navigate potential economic shifts. With a robust loan pipeline and strong capital levels, Mercantile Bank Corp is well-positioned to maintain its performance and deliver value to shareholders.

For more detailed information, investors are encouraged to review the presentation materials available on Mercantile Bank Corp's website and the full 8-K filing with the U.S. Securities and Exchange Commission.

As a trusted financial institution, Mercantile Bank Corp continues to uphold its commitment to serving the community with a personalized banking experience, while achieving financial results that benefit both customers and investors alike.

Explore the complete 8-K earnings release (here) from Mercantile Bank Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance