Mattel (MAT) Expands Digital Partnership With Outright Games

Mattel, Inc. MAT has announced a strategic multi-year partnership with Outright Games, a top publisher of family-friendly interactive entertainment. This collaboration will launch three new games — Matchbox Driving Adventures, Monster High: Skulltimate Secrets and Barbie Project Friendship — across all consoles and PCs before the end of 2024.

This partnership is a significant step in Mattel's strategy to deepen engagement in the digital gaming sector. Leveraging its iconic brands, Mattel aims to create compelling digital experiences for a global audience. This move aligns with the recent success of Mattel’s digital games, which recorded 48 million monthly active players in 2023, fueled by hits like Barbie DreamHouse Tycoon and Hot Wheels Unleashed 2: Turbocharged.

As Mattel approaches its 80th anniversary, this partnership with Outright Games positions the company to expand its digital footprint. By introducing more games across various platforms, Mattel will enhance brand resonance with fans of all ages, driving both engagement and revenue growth.

This strategic partnership is expected to significantly bolster Mattel’s presence in the digital gaming market, making its iconic franchises more accessible and enjoyable for a broader audience. Investors can anticipate increased brand engagement and potential revenue growth as Mattel continues to innovate in the digital space.

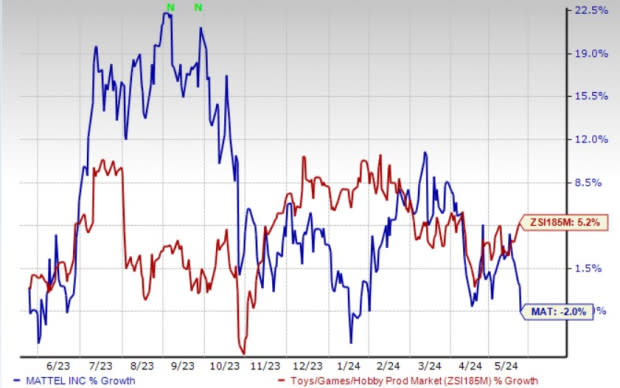

Image Source: Zacks Investment Research

Partnerships to Drive Growth

The company continues to focus on licensing partnerships to boost growth. On the first-quarter 2024 earnings call, Mattel talked about a new licensing partnership under digital gaming with Take-Two Interactive for publishing a new Barbie mobile game, expected to be launched later in 2024. Also, under location-based entertainment, the company announced a second Mattel Adventure Park through its existing licensing partnership with Epic Resort Destinations. This park is slated to open in Kansas City in 2026.

On Jul 25, 2023, the company renewed its multi-category licensing partnership with Warner Bros. Discovery Global Consumer Products. The product lines will include the DC Universe, Bat Wheels, Harry Potter, Fantastic Beasts and FRIENDS, among others.

Shares of this Zacks Rank #3 (Hold) company have declined 2% in the past year against the industry’s increase of 5.2%.

Key Picks

Here are some better-ranked stocks from the Consumer Discretionary sector.

Strategic Education, Inc. STRA currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

STRA has a trailing four-quarter earnings surprise of 36.2%, on average. The stock increased 47.9% in the past year. The Zacks Consensus Estimate for STRA’s 2024 sales and earnings per share (EPS) indicates an increase of 6.4% and 33.3%, respectively, from the year-ago levels.

Netflix, Inc. NFLX presently sports a Zacks Rank of 1. NFLX has a trailing four-quarter earnings surprise of 9.3%, on average. The stock has risen 76.8% in the past year.

The consensus estimate for NFLX’s 2024 sales and EPS implies a rise of 14.8% and 52.2%, respectively, from the year-ago levels.

AMC Entertainment Holdings, Inc. AMC currently carries a Zacks Rank of 2 (Buy). AMC has a trailing four-quarter earnings surprise of 38%, on average. The stock has risen 37.2% in the past month.

The Zacks Consensus Estimate for AMC’s 2024 EPS implies growth of 70.5% from the year-ago level.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

Mattel, Inc. (MAT) : Free Stock Analysis Report

AMC Entertainment Holdings, Inc. (AMC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance