Mastercard (MA) Ties Up to Boost Africa's Cross-Border Payments

Mastercard Incorporated MA recently teamed up with the Nigeria-based multinational bank, Access Bank Group, to unveil an innovative cross-border money movement solution for enabling hassle-free cross-border payments to and from 150-plus African markets. The solution was made available for use from the very day of the collaboration announcement and further expansion plans across the continent remain in place. Its shares gained 0.3% on May 10.

The solution is built through utilizing the multiple complementary network assets of Mastercard and the treasury capabilities of Mastercard Move along with a comprehensive understanding of Access Bank about the African markets. This, in turn, is expected to offer increased payment choices as well as lower transaction costs incurred by consumers and businesses indulging in international payments.

In this case, the benefits of the solution can already be reaped by the client base of Access Bank residing in the regions wherein the new solution has been made available. They can leverage the Access Africa platform, and send and receive immediate cross-border payments across the globe through a varied set of channels such as bank accounts, mobile wallets, cards and cash.

Meanwhile, an Express Partner of the Mastercard Move Partner Program, Fable Fintech, worked closely with the experts of both Mastercard and Access Africa and performed the role of the technical implementation partner for the newly launched solution.

The recent partnership bears testament to Mastercard’s sincere efforts to upgrade payment experiences, gain more customers and boost greater digitization into the African continent. The presence of the Mastercard brand and an expansive delivery network allow the latest tie-up to infuse an element of security within remittances, thereby offering peace of mind for customers.

With the increased usage of the Mastercard Move platform, Mastercard is expected to benefit on the back of growth in revenues derived from the utilization of value-added services and solutions.

The latest move seems to be a time opportune move as well since remittance flows across certain African markets, such as Mozambique, Rwanda, Ethiopia and Nigeria, remain strong. The continent continues to witness a booming digital economy, spurred by the increased usage of mobile phones, steady increase in Internet penetration rates and favorable government policies. Therefore, the tech giant remains quite active in further deepening its presence in various African markets through partnerships with regional financial institutions or significant investments.

In April 2024, it teamed up with Kenya’s Equity Bank to enable the bank’s customers safely conduct cross-border money transfers across 30 countries, thanks to the usage of the Mastercard Cross-Border Services platform.

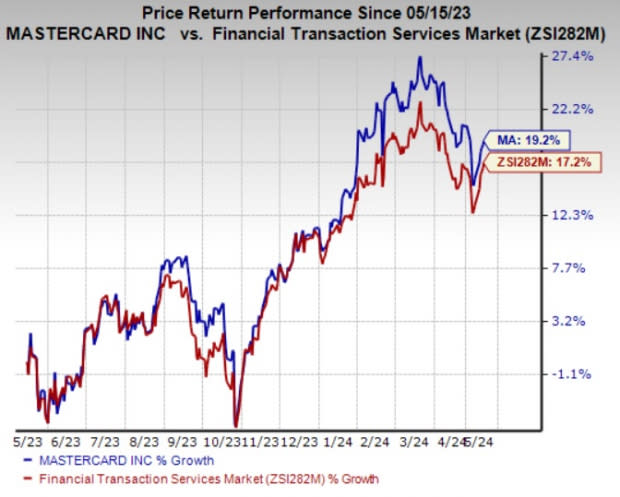

Shares of Mastercard have gained 19.2% in the past year compared with the industry’s 17.2% growth. MA currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the Business Services space are SPX Technologies, Inc. SPXC, Barrett Business Services, Inc. BBSI and Global Payments Inc. GPN. While SPX Technologies sports a Zacks Rank #1 (Strong Buy), Barrett Business Services and Global Payments carry a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The bottom line of SPX Technologies outpaced estimates in three of the last four quarters and matched the mark once, the average surprise being 13.92%. The Zacks Consensus Estimate for SPXC’s 2024 earnings suggests an improvement of 21.6% from the year-ago reported figure. The consensus mark for revenues suggests growth of 14.8% from the year-ago reported number. The consensus mark for SPXC’s 2024 earnings has moved 4.2% north in the past 30 days.

Barrett Business Services’ earnings outpaced estimates in each of the trailing four quarters, the average surprise being 38.56%. The Zacks Consensus Estimate for BBSI’s 2024 earnings suggests an improvement of 7.6% from the year-ago reported figure. The consensus mark for revenues suggests growth of 7% from the prior-year reading. The consensus mark for BBSI’s 2024 earnings has moved 2.2% north in the past 30 days.

The bottom line of Global Payments outpaced estimates in each of the last four quarters, the average surprise being 1.14%. The Zacks Consensus Estimate for GPN’s 2024 earnings suggests an improvement of 11.6% from the year-ago reported figure. The consensus mark for revenues suggests growth of 6.5% from the year-ago reported number. The stock has witnessed six upward estimate revisions for 2024 earnings compared to two downward revisions over the past 30 days.

Shares of SPX Technologies, Barrett Business Services and Global Payments have gained 90.3%, 55.8% and 17.5%, respectively, in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Mastercard Incorporated (MA) : Free Stock Analysis Report

Global Payments Inc. (GPN) : Free Stock Analysis Report

Barrett Business Services, Inc. (BBSI) : Free Stock Analysis Report

SPX Technologies, Inc. (SPXC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance