Mastercard (MA) Q2 Earnings Beat Estimates on Volume Growth

Mastercard Incorporated MA reported second-quarter earnings of $1.89 per share, beating the Zacks Consensus Estimate by 3.9%. Earnings improved 3.9% year over year.

Better-than-expected results were primarily backed by higher switched transactions, increase in cross-border volume and gross dollar volume, and gains from acquisitions. An increase in rebates and incentives year over year was a partial dampener.

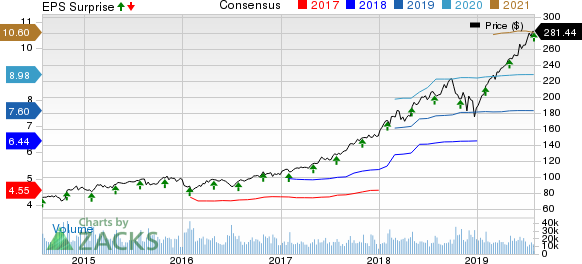

Mastercard Incorporated Price, Consensus and EPS Surprise

Mastercard Incorporated price-consensus-eps-surprise-chart | Mastercard Incorporated Quote

Strong Operational Performance

Mastercard’s revenues of $4.1 billion were in line with the Zacks Consensus Estimate and were up 15% year over year.

Total adjusted operating expenses rose 17% to $1.7 billion, due to the company’s continued investments in strategic initiatives. Interest expenses of $51 million increased 6.3% year over year.

Adjusted operating margin contracted 40 basis points to 58.3%.

Gross dollar volume increased 13% to $1.6 trillion while cross-border volumes were up 16% on a local-currency basis.

The company’s margins gained from a lower tax rate of 18.5% in the second quarter compared with 18.8% in the year-ago quarter.

As of Jun 30, 2019, the company’s customers had issued 2.6 billion Mastercard and Maestro-branded cards.

Financial Update

As of Jun 30, 2019, the company’s cash and cash equivalents were $5.86 billion, down 12.3% year over year. Long-term debt was $5.8 billion, almost unchanged relative to Dec 31, 2018 levels.

Share Repurchase and Dividend Payment

During the reported quarter, Mastercard repurchased shares worth $1.9 billion and paid out $337 million in dividends.

Our Take

Mastercard is poised to grow, given its solid market position, ongoing expansion and digital initiatives, plus significant opportunities from the secular shift toward electronic payments. Its numerous acquisitions have aided revenue growth.

However, escalating costs will put pressure on the company’s bottom line. In order to gain customers and new business, Mastercard has been incurring quite high levels of costs under rebates and incentives, which remains a concern. Nevertheless, its strong balance sheet enables business investment, thereby driving growth.

Mastercard carries a Zacks Rank #3 (Hold).

Among the companies in the same space that have reported earnings, Visa Inc. V, American Express Co. AXP and Discover Financial Services DFS, each beat their respective Zacks Consensus Estimate by 3.01%, 0.98% and 9.95%, respectively.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Discover Financial Services (DFS) : Free Stock Analysis Report

American Express Company (AXP) : Free Stock Analysis Report

Visa Inc. (V) : Free Stock Analysis Report

Mastercard Incorporated (MA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance