Martin Midstream Partners LP Reports Q1 2024 Results: A Close Call with Analyst Estimates

Net Income: Reported at $3.3 million, aligning closely with analyst estimates of $3.73 million.

Earnings Per Share (EPS): Achieved $0.08 per share, slightly above the estimated $0.07.

Revenue: Posted $180.8 million, falling short of the expected $197.40 million.

Adjusted EBITDA: Recorded at $30.4 million, maintaining robust operational performance.

Quarterly Cash Distribution: Declared at $0.005 per common unit, reflecting cautious capital management.

Martin Midstream Partners LP (NASDAQ:MMLP) released its 8-K filing on April 17, 2024, detailing the financial outcomes for the first quarter of 2024. The company, primarily operating in the Gulf Coast region of the United States, focuses on a variety of midstream services including terminalling, transportation, and product handling.

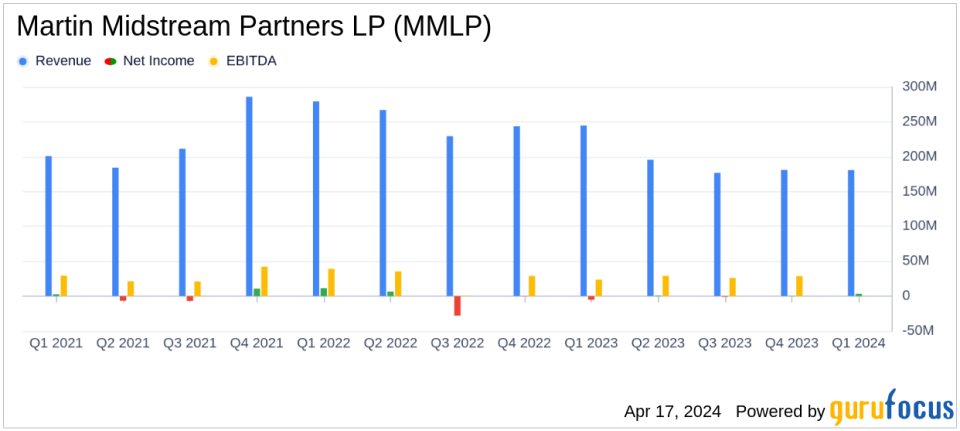

For Q1 2024, MMLP reported a net income of $3.3 million, a significant improvement from a net loss of $5.1 million in the same quarter of the previous year. This turnaround is primarily attributed to robust demand in marine and land transportation services, although partially offset by lower margins in the fertilizer and lubricants sectors and extended refinery turnarounds impacting sulfur services.

Revenue for the quarter stood at $180.8 million, a decrease from $244.5 million year-over-year, impacted by lower sales volumes and higher product costs in the lubricants business, and decreased sulfur prilling fees. Despite these challenges, the company managed to maintain a consistent adjusted EBITDA of $30.4 million.

The company's capital structure saw a slight increase in adjusted leverage, from 3.75 times at the end of 2023 to 3.81 times as of March 31, 2024. This was due in part to higher capital expenditures, totaling $17.4 million for the quarter, aimed at facility improvements and maintenance.

President and CEO Bob Bondurant commented on the results, highlighting the strength in transportation divisions and expressing confidence in achieving the full-year adjusted EBITDA guidance of $116.1 million. He noted:

"The Partnership had a strong quarter resulting in adjusted EBITDA of $30.4 million compared to guidance of $31.6 million. Demand in both the marine and land transportation divisions remain robust leading to outperformance in the transportation segment when compared to our forecast."

Looking ahead, Martin Midstream Partners anticipates continued robust performance in its transportation segments, which is expected to help offset some of the weaker margins in other areas of its operations. The company remains focused on strategic capital deployment to enhance shareholder value and improve its service offerings across its diverse operational landscape.

Investors and stakeholders are invited to join the upcoming earnings call on April 18, 2024, to discuss these results and forward strategies in further detail.

For more detailed financial analysis and future updates on Martin Midstream Partners LP, stay tuned to GuruFocus.com.

Explore the complete 8-K earnings release (here) from Martin Midstream Partners LP for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance