Pound surges on Brexit deal hopes

BREXIT HOPES: Pound rises as Leo Varadkar says a Brexit deal by end of month is possible

UK economy shrank by 0.1pc in August, but July and June’s figures were both revised upwards, brightening the overall picture for British growth

TRADE TALK OPTIMISM: Chinese delegation arrives in Washington for trade talks

Stock markets advance as Trump tweets that he will meet with Chinese Vice Premier

Ambrose Evans-Pritchard: Germans living in ‘cloud cuckoo land’ as economic decline sets in

Wrap-up: A day of (tentative) hope for the markets

Let’s wrap things up: the pound (which Bloomberg tracks as reaching its closing price at 6pm London time) is on course for its biggest one-day rise since last November.

European markets, which closed just over an hour ago, were broadly positive, though the FTSE 100’s gains were more meagre than its continental rivals.

Elsewhere, this morning’s GDP figures were encouraging: it looks like, unless September was dire, Britain will swerve a technical recession.

Wall Street is broadly upbeat as those crucial US/China trade talks get underway in Washington.

That’s all from me today. Join us again tomorrow for the latest news on business, markets and economics.

…but Varadkar adds:

But Varadkar warned: "There is a many a slip between cup and lip"

— lisa o'carroll (@lisaocarroll) October 10, 2019

Varadkar says withdrawal agreement by end of October is ‘possible’

Just in:

BREAKING: Varadkar says withdrawal agreement is "possible" by end of October.

"It it is possible to come to an agreement to have a treaty agreed to allow the UK to leave the EU in an orderly fashion and to have that done by the end of October. "— lisa o'carroll (@lisaocarroll) October 10, 2019

Taoiseach says it is possible to negotiate a treaty for UK to leave EU in an orderly fashion by end of October

— seanwhelanRTE (@seanwhelanRTE) October 10, 2019

Pound on track for biggest jump since February

The pound is up 1.27pc on yesterday’s close, tracking for its biggest jump since February. Some early reports on the Johnson/Varadkar talks are less upbeat, however:

Commons majority otherwise. 3/ Objective is to tee up a real negotiation between @MichelBarnier & @SteveBarclay tomorrow. UK side continues to believe that @EU_Commission holds the key. "If they want to make it work they will." So both sides still holding to core principles ENDS

— Mujtaba Rahman (@Mij_Europe) October 10, 2019

FTSE closed up 0.3pc

The FTSE closed up 0.3pc, with the late strengthening of the pound apparently placing a little extra pressure on the blue-chip index in the closing minutes.

Pound leaps higher

Sterling has surged, tracking for its biggest jump in a month, after the Irish Times reported there was “significant movement” from the UK during talks between Leo Varadkar and Boris Johnson today.

https://twitter.com/PatLeahyIT/status/1182317110707593218

Reacting to the joint statement from earlier, the Economist Intelligence Unit’s Matthew Oxenford said:

This statement is consistent with both sides keeping their options open after an inevitable election. There's almost certainly not enough time to bridge the gaps between the UK and EU before October 31st, but with an extension legally mandated, there's a good chance Johnson will be back at this negotiating table in December with a cooperative parliament behind him. Varadkar knows that too, but also doesn't want to commit to anything now, since he could very well be negotiating with a different Prime Minister who wants a softer Brexit, or no Brexit at all in three months time.

Dyson gives up on electric car plans

Just out: Dyson is scrapping plans to launch an electric car just two years after unveiling the ambitious project, saying it "simply can no longer see a way to make it commercially viable". My colleague Hannah Boland writes:

In a letter to employees, Sir James Dyson said the company had been looking for a buyer for the automotive project, but had been unsuccessful and so had made the decision to close it down.

Dyson had set aside around £2.5bn for the project to develop a “radical” motor from scratch. It said it would now be investing this into "new technology" and to grow its education institute, The Dyson Institute of Engineering and Technology.

Read more here: Sir James Dyson scraps £2.5bn electric car saying project is ‘not commercially viable’

European stocks: A healthy green

Here’s how things stand across Europe with just minutes left. It has been a particularly good day for France’s CAC 40.

With a few minutes left of trading...

...it look the FTSE 100 will hold some moderate gains, amid a bigger rise across European stacks. The blue-chip index is likely feeling some pressure from a stronger pound.

...and more: ECB rate-setters split over stimulus, billionaire criticised for ‘horrifying’ remarks, Ukrainian investigators try to put Ferrexpo boss on wanted list

Our business team are putting out new articles left, right and centre — so here are some more:

Billionaire Ken Fisher slammed for likening business to ‘trying to get into a girls pants’: A billionaire investor is facing a furious backlash after telling an industry conference that success in business is like “trying to get into a girl’s pants”.

Ukrainian investigators seek to add billionaire Ferrexpo boss to international wanted list: Prosecutors in Ukraine are seeking to place the billionaire boss of Ferrexpo on an international wanted list after claiming he failed to show up for questioning about his former company.

Deep divides exposed at ECB as rate-setters rail against stimulus: Rebel rate-setters at the European Central Bank warned that its money-printing programme should only be used as a “last resort” as minutes from their September meeting revealed deep divides over its stimulus package.

Round-up: OECD warns over obesity rates, losses rise at OnTheMarket, and how to tell if you new £20 note might be worth much more

Here are some of this afternoon’s top business stories:

Obesity epidemic is bad for the world’s economic health, OECD warns: On the day the UK’s chief medical officer warned children are “drowning in a flood of unhealthy food and drink options”, the Organisation for Economic Co-operation and Development has produced a sobering new study on the impact of bulging waistlines on global growth.

Losses pile up at OnTheMarket: Online estate agent OnTheMarket has suffered widening losses as it fights to take on established rivals Rightmove and Zoopla.

New polymer Turner £20 note: how to spot if yours is worth thousands: Early adopters of the new £20 notes could be able to make a few pennies by watching out for rare serial numbers.

Trade talks: What does Trump’s intervention mean?

Markets are holding onto steady gains after Donald Trump’s announcement that he will meet with Chinese Vice Premier Liu He. SpreadEx’s Connor Campbell writes:

Despite a gloomy start to the week, there have been enough titbits in the last couple of days to keep hopes of trade progress alive. First there was Wednesday’s claim from a Chinese official that Beijing is open to a ‘partial trade deal’ in order to limit the negative impact to the country’s economy.

And then, this Thursday, Donald Trump tweeted that he would be meeting with Vice Premier Liu He at the White House on Friday – a step up from Washington’s usual high level negotiating team of Robert Lighthizer and Stephen Mnuchin, and perhaps a sign that something more substantial could come out of the talks.

Pound spikes after Varadkar statement

The pound have spiked sharply against the dollar and the euro following that tweet from the Taoiseach. We’ll have to wait and see whether it can hold gains — recent apparent breakthroughs have tended to wind off quite quickly as reality re-settles.

It appears that Number 10 may have issued the statement jointly, but the UK version has a repeated sentence. I’ll try to track down the corrected version.

Varadkar: Johnson and I can see pathway to a Brexit deal

Irish Taoiseach Leo Varadkar just tweeted following his meeting with Boris Johnson, saying the pair can see a “pathway” to a Brexit deal:

Here’s our joint statement following my meeting with @BorisJohnson in Cheshire this afternoon pic.twitter.com/RxjF9qFte8

— Leo Varadkar (@LeoVaradkar) October 10, 2019

Mr Varadkar says he will meet with EU authorities tomorrow.

WSJ: Renault board to vote on whether to remove CEO Thierry Bolloré

The Wall Street Journal, citring sources, says the board of French car giant Renault will vote on Friday on whether to remove boss Thierry Bolloré — setting the stage for a major slowdown.

The company is reportedly worried about the Frenchman’s tense relationship with ally Nissan, and about Renault’s performance under his leadership.

It follows similar reports in Japan’s Nikkei.

Wall Street grabs gains as Trump says he will meet Chinese vice-premier tomorrow

Donald Trump is certainly doing his best impression of his self-styled dealmaker persona, setting the stage for these meetings:

Big day of negotiations with China. They want to make a deal, but do I? I meet with the Vice Premier tomorrow at The White House.

— Donald J. Trump (@realDonaldTrump) October 10, 2019

After a flat-footed start, US stock indices have grabbed some moderate gains following Mr Trump’s tweet.

In Europe, similar moderate gains are being felt.

Miners rise on trade-talk hopes

Miners are providing the biggest upwards pull on a fairly flat FTSE 100 today, with the materials sector up nearly 2pc overall.

Hopes that trade talks between US and Chinese officials will result in a trade war breakthrough is lifting shares in the sector, which would stand to benefit strongly if the current malaise over global trade lifts.

Those hopes are increasing commodity prices, with base materials such as cipper, zinc, lead and tin all strengthening.

Chilean miner Antofagasta is the biggest riser, up more than 4pc currently, with Anglo American close behind at 3.7pc up. Glencore is up 3pc, Rio Tinto is up 2pc, and BHP is up 1.8pc. Royal Dutch Shell is also rising on expectations.

Here’s how mining firms have performed this year:

Here we go: Trade talks underway

The US-China trade talks are officially back underway.

Chinese vice-premier Liu He has arrived in Washington DC, and heads will soon be bashed together to resolve trade issues that has been casting a shadow over the global economy for months. Of course, that’s if they can all manage to get along...

US inflation sinks to near zero

Consumer prices in the United States were virtually unchanged in September, with inflation landing just above 0pc.

Analysts had been expecting a slightly higher figures of 0.1pc, so these is grist to those calling for the US Federal Reserve to cut interest rates.

Separately, weekly US jobless claims fell by 10,000 to 210,000, continuing a long-term trend of decline.

The measure tracks the number of people who filed jobless claims for the first time during the period., representing the number of new unemployment benefit claimants.

The Think Tank: Britain’s super-rich renters are likely to see their ranks swell

For today’s Think Tank column, Economics Editor Russell Lynch has taken a look at the impact the joint threat of a no-deal Brexit and a Jeremy Corbyn-led government is placing on super-rich renters. He writes:

Renting can conjure up images of damp walls, dodgy boilers and recalcitrant landlords but the age of Jeremy Corbyn and Brexit has helped foster a very different and altogether more niche market: the super-rich renter.

Upmarket estate agent Knight Frank keeps a close eye on the top end of the London rental market and it notes rising demand from well-heeled customers for so-called “super-prime” tenancies, where renters pay £5,000 a week or more.

Its latest snapshot showed 40 such deals struck in London in the second quarter — the highest for the period for seven years according to the agent — and a record 153 deals struck in the year to June.

Read more here: Thanks to Corbyn and Brexit, Britain's army of super-rich renters is going to get bigger

Varadkar and Johnson hold talks

Just to quickly patch in on the Brexiting process: Irish Taoiseach Leo Varadkar is currently meeting PM Boris Johnson at a top-secret location (Thornton Manor, located on the Wirral, Merseyside*) for last-ditch Brexit talks.

Follow the latest updates here: Brexit latest news: Boris Johnson to meet Leo Varadkar in last ditch effort for breakthrough in Brexit talks

*corrected from Cheshire, apologies!

Full report: Film industry shines as Britain looks set to swerve recession

My colleague Tom Rees has a full report on the morning’s GDP figures. He writes:

The booming film industry looks set to rescue the economy from a pre-Brexit recession, bolstering Boris Johnson’s electoral chances as a snap vote draws closer.

GDP unexpectedly slipped back for only the second time this year in August but a stronger-than-expected growth spurt during the previous month propped up the economy.

Read more here: Recession fears recede as booming film industry boosts economy

Extinction Rebellion attempt to blockade London City Airport

Activists from climate protest group Extinction Rebellion have attempted to blockade London City Airport, on their fourth day on demonstration in the capital.

Flights appear to have been broadly unaffected, with most delays no longer than 10 minutes. Protests also occurred at the airport’s DLR station.

We apologise for the disruption we are causing today at @LondonCityAir We are doing it to avoid the greater disruption expected if we don't take urgent action. The Airport plans to double flights. Continued Govt support for expansion of air travel incompatible with the Emergency https://t.co/bf7VFcAMvc

— Extinction Rebellion UK ��️ (@XRebellionUK) October 10, 2019

Here are some photos from the protest:

Mondi shares drop after weak third quarter

Paper and packaging manufacturer Mondi is one of the larger fallers on the FTSE 100 today, sinking about 2pc after it reported soft figures for the third quarter, missing earnings estimates by about 5pc.

The company is feeling the pressure from current political headwinds, with Goodbody analyst David O’Brien saying: “The corrugated box business can be viewed as a proxy indicator for European economic growth”.

The bigger victims of its weakness appears to be rival DS Smith, however, which fell as much as 3pc this morning.

PwC economist: GDP revisions put recession fears to bed

And here’s some reaction from Big Four auditor PwC’s chief economist, John Hawksworth:

Barring major future revisions, today’s GDP data has put to bed fears of the UK economy falling into recession in the third quarter of 2019. However, there could be problems ahead in the fourth quarter as heightened Brexit-related uncertainty takes a toll on both business investment and consumer confidence...

However, the recent trend has been less favourable, with services output flat in August and both construction and industrial production falling back. Furthermore, business surveys show a decline in both output and employment across the private sector economy in September as Brexit-related uncertainty has increased.

Here’s more reaction to those GDP figures...

RBC economist Cathal Kennedy says:

We’ve been saying for some time that we expected the UK economy to avoid a technical recession in the middle quarters of this year.

Today’s data just confirms that view. Indeed if anything, it places some upward risk around our forecast for Q3 GDP growth of 0.2pc q/q, particularly as the productive sector is likely to get another temporary boost from stockpiling in September ahead of the latest Brexit date at the end of October.

As we warned in our latest UK GDP growth projections, distortions to the timing of activity look set to plague GDP in the coming quarters.

In particular, further Brexit deadlines are likely to see swings from quarters of strong, positive, growth to quarters of negative growth. That will continue to distort the bigger picture which is that the underlying pace of UK growth has slowed.

Investec’s George Brown adds:

Looking at today’s figures holistically, we take comfort in the fact that the UK economy looks set to avoid a technical recession, with our full year 2019 GDP growth accordingly remaining unchanged at 1.2pc. But at the same time it is apparent that growth is fragile amid the uncertainty surrounding Brexit and the global economic backdrop. Manufacturing certainly looks to be bearing the brunt of this, although there are questions as to whether this will spread to the rest of the economy.

On the markets, the reaction has been fairly muted: the pound is up on the day against the dollar, while Europe-wide quite have swung to narrow positives after a shaky opening. All eyes on the White House.

But is the age of cash behind left behind?

Although there’s plenty of fanfare over the new £20 note, questions still remain about how long cash can remain a viable means of payment.

Britain’s cash infrastructure is becoming unsustainably expensive to maintain, my colleague Harry de Quetteville reports. He wirtes:

The latest statistics from UK Finance, the banking sector trade body, show that 11 billion transactions were conducted using cash in 2018, down from 22 billion a decade earlier.

With the average value of each transaction put at £13.56, Britons collectively spent £149bn in cash last year. But what the Treasury calls the “fixed costs of cash distribution” have risen to an estimated £5 bn, or 3.35pc of transactions.

With the value of cash transactions expected to fall again by almost two-thirds in the next decade, to about £50bn, one pound for every 10 spent will then be required to prop up the UK’s cash network – essentially moving and securing notes and coins around the country.

Read more here: The end of cash? Cost to circulate coins and notes could become unsustainable as more people switch to contactless

All about the new £20 note

Continuing our theme of legal tender, here’s what the £20 note will look like (minus, of course, the SPECIMEN watermark):

If that has piqued your interest in currency affairs, my colleague Adam Williams has all the details behind the newest member of the polymer cash family:

Mark Carney: Underlying UK growth is weakening

Speaking at an event in Margate to launch the new £20 note, Bank of England governor Mark Carney has said Brexit is producing volatile economic data, but added: “the underlying pace of growth is a bit softer”.

He also repeated some of his usual lines, including that the financial system is ready for any Brexit outcome, and that the Bank stands ready for whatever happens.

He said the Government will take as long as it needs to pick his successor at Threadneedle Street.

Regarding the £20, he said:

As the new Turner £20 testifies, money can be a work of art in everyone’s pocket. Far from being “barren”, our banknotes celebrate UK’s heritage, salute its culture and testify to the great achievements of its most notable citizens.

Bank of England sets date for new £20 note

The Bank of England says it will introduce a new, high-tech £20 note on February 2 next year, after having replaced the £5 and £10 notes recently.

The replacement polymer note, which will bear a picture of painter JMW Turner, contains new security features to fight against forgeries.

The new £20 is coming on 20 February 2020.

Find out about its design and security features: https://t.co/L45zDEHiAA#TheNew20pic.twitter.com/lG2GdYjLkr— Bank of England (@bankofengland) October 10, 2019

The Bank of England says the £20 is the mostly commonly-found counterfeit note:

Dunelm shares slip as it warns of currency pressures

Shares in homeware retailer Dunelm have slipped by more than 6pc this morning, after it warned foreign exchange fluctuations would impact margins for the first half of its new financial year.

The company said it had experienced a “particularly strong” first quarter, with like-for-like sales rising by 6.4pc on the same period a year before. It said September had been “mixed”.

Nick Wilkinson, its chief executive officer, said:

Despite the recent softness in the homewares market and the increased political uncertainty, we are confident we can continue to win market share and our expectations for the full year remain unchanged.

Chance of recession ‘banished’

Capital Economics’ Andrew Wishart says:

While GDP fell by 0.1pc m/m in August as we had expected (consensus 0.0pc), the fact that growth in July was revised up from 0.3pc m/m to 0.4pc m/m means fears that the economy is already in recession have been banished. In fact, the August GDP data suggest the economy might grow by 0.4pc q/q in Q3, up from our previous estimate of 0.3pc q/q.

He added:

With the surveys suggesting stockbuilding has been more muted than before the March and April Brexit dates, temporary factors are not providing much support to growth. The upshot is that there is good reason to think that the all-sector PMI, which suggests the economy will contract by around 0.1pc q/q, is being dragged down by sentiment. After all, the survey fell sharply immediately after the referendum only for activity to prove resilient. The big picture, though, is that the risk of a no deal Brexit every few months is weighing on both investment and consumer spending.

Pantheon Macroeconomics’ Samuel Tombs says the better-than-expected performance means the Bank of England should not be considering cutting interest rates.

Another better-than-expected U.K. GDP report. August's 0.3% 3m/3m% growth rate bettered the 0.1% rate expected by the consensus. Momentum in the services sector still in tact, despite the Brexit fiasco. Still no "hard" data supporting the case for the MPC to cut Bank Rate pic.twitter.com/rQ4LflScUq

— Samuel Tombs (@samueltombs) October 10, 2019

ING’s James Smith noted the improvements to figures for June and July, but said:

Most of this is ultimately noise though, and the broader economic trend remains pretty lacklustre. Much of the weakness is centred on investment. Uncertainty surrounding Brexit and global economic activity means firms are reluctant to expand, while preparations for a possible ‘no deal’ exit on October 31 will also be drawing time/resources away from potential investment projects.

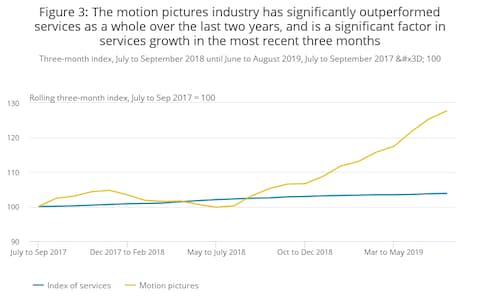

The Luvvie lift: Film, TV and music industries outperform

Let’s quickly drill down on one section of those numbers that the ONS seems particularly keen to highlight: the strength of the UK’s film, TV and music sectors.

The ONS says:

The main contributor to services growth in the three months to August was the professional, scientific and technical sector, which experienced broad-based growth across its sub-industries. However, the sub-industry that had the largest contribution to gross domestic product (GDP) growth was motion pictures (including TV and music), which has been one of the best performing sectors over the last year, growing at a notably faster rate than services as a whole.

Be nice to any Luvvies you meet today as they have been doing a sterling job for UK GDP over the past couple of years or so! https://t.co/wMH6iRXNG0

— Shaun Richards (@notayesmansecon) October 10, 2019

Manufacturing sector shrinks again,

Manufacturing output figures released alongside those GDP numbers show the sector is still oscillating between growth and contraction.

The ONS says:

The main contributor to gross domestic product (GDP) growth in the three months to August 2019 was the services sector, which grew by 0.4pc. This was driven by widespread strength across the services industries in June and July, following a period of largely flat growth in the previous three months. Meanwhile, the production sector fell by 0.4pc in the same period, while construction output grew by 0.1pc.

Here’s what that rolling three-month growth figure looks like:

ONS GDP head Rob Kent-Smith adds:

Growth increased in the latest three months, despite a weak performance across manufacturing, with TV and film production helping to boost the services sector.

Snap reaction: Has the UK swerved a recession?

Those figures only add to the question marks over whether the UK is heading towards a recession. Despite the contraction in August, over the June-to-August period there was an overall GDP increase of 0.3pc

That signals things may be healthy enough to avoid a technically recession, unless September’s result is particularly horrible.

The services sector drove most of the growth that occurred during the month, according to the Office for National Statistics:

GDP growth was driven by services, with production (including manufacturing) falling https://t.co/ZQ2XzwdDgTpic.twitter.com/DKYLIvaQFK

— Office for National Statistics (@ONS) October 10, 2019

Here’s some reaction:

UK economy contracts by 0.1% in Aug. Bit worse than expected. But July GDP growth revised up from 0.3% to 0.4%. At a glance it looks like the UK might have avoided recession. But much now depends on the final GDP figs for Q3, which we get in early Nov https://t.co/dwZCagVEep

— Ed Conway (@EdConwaySky) October 10, 2019

A mild contraction ion UK GDP in August -0.1% (0.0% exp) but a revision higher on July to +0.4% (+0.3% previous) still suggests that UK is bumping along with negligible growth.

Little reaction on #GBP with a couple of ticks lower on #GBPUSD.#Forex— Richard Perry (@HantecRich) October 10, 2019

UK GDP grew by 0.3%q/q in the 3 months to August. Main contributions came from the information & communications (0.1%) and professional services (0.11%) sectors. Manufacturing still the biggest drag (-0.1%). pic.twitter.com/RdVoaA5zcZ

— Rupert Seggins (@Rupert_Seggins) October 10, 2019

UK economy shrank 0.1pc in August

Just in: The UK’s economy shrank by 0.1pc in August. Analysts had been expected a flat figure of 0pc, so that is likely to rattle markets. However, July’s figures were revised up to 0.4pc growth, and June was adjusted up to 0.1pc.

Apologies for the delay to the last couple of posts, it looks like the Telegraph tech gremlins were adding some new features.

Trade tensions bubble ahead of summit

As trade talks between the US and China prepare to kick off, there are signs of bubbling tensions between the countries.

Adding to tensions today, Beijing has claimed the US smeared China by placing sanctions on companies and individuals linked to the claimed persecution of Muslims including the minority Uighur group in China’s Xinjiang province. US Secretary of State Mike Pompeo has called the situation an “enormous human rights violation”.

That could cause a rift between negotiators, with further pressure coming from Washington’s attempts to crack down on CHinese contraband goods.

There are also signs of hope, however: in particular, multiple outlets have reported that the two countries are considering formulating a currency pact, and that the US may allow Chinese tech giant Huawei to supply non-sensitive parts to US firms.

Coming up: UK growth figures for August

At 9:30am, we’ll get the latest GDP figures for the UK, which will show how much the economy grew in August.

Britain’s economy underwent a contraction during the second quarter amid a post-Brexit-delay winding-down period, shrinking by 0.2pc. If it slips again in the third quarter, the UK will be deemed to have entered a technical recession.

July’s performance was more bullish however, with a 0.3pc overall increase. Analysts expect August’s figures to show stagnation.

SpreadEx’s Connor Campbell says:

After a better than forecast reading for July, August’s monthly GDP reading is set to act as a reminder, if it was needed, that the UK economy is struggling with the uncertainties of pre-Brexit. Analysts are expecting a dreary 0.0pc reading, a sharp comedown from the previous 0.3pc – let’s just hope it doesn’t turn negative.

July’s numbers was a positive surprise, but news since then has been mixed: consumer spending appears to still be strong, but activity across factories and the service sector has shown a marked slowdown according to purchasing managers’ index surveys.

FTSE whipsaws to a fall, European stocks drop

The FTSE, which opened slightly higher, has reversed course and is now down about 0.45pc. The pound is slightly higher against the dollar, which may be increasing pressure on the blue-chip index.

The Europe-wide STOXX 600 is down about 0.5pc, with investors apparently showing signs of nerves ahead of those US-China talks, and with Brexit on a knife’s edge.

Later today, Prime Minister Boris Johnson will meet his Irish counterpart Leo Varadkar for last-ditch talks ahead of next week’s European summit. Expectations are not particularly high for the meeting, given the deadlock reached over recent weeks.

CMC Markets’ Michael Hewson said:

The Asia session doesn’t tell us the whole story given that we’ve seen some significant swings between negative and positive territory, on news chatter that the talks had either stalled, or may well get cut short on the negative side of the ledger, as well as reports that next week’s tariffs may get delayed on the other side.

European markets initially opened higher, however the positive tone has started to disappear over concern that there is unlikely to be any indication that these talks will show any significant sign of progress, or that next week’s tariffs won’t kick in as scheduled.

Hargreaves Lansdown shares volatile after boosting customer numbers

Hargreaves Lansdown shrugged off any reputational damage from its support for troubled investor Neil Woodford's funds by boosting customer numbers in the third quarter, my colleague Michael O’Dwyer reports. He writes:

The investment platform added a total of 35,000 customers net in the three months to September and eclipsed the £100bn barrier for assets under administration for the first time.

The value of assets invested with the firm rose 3pc from the end of June to £101.8bn. The increase helped boost net revenue 6pc against the same period in 2018 to £128m.

But the FTSE 100 company warned it had “seen new business in the period being impacted by weak investor sentiment arising from continuing Brexit and political uncertainty in the UK and wider global macro issues such as trade tariffs”.

The company’s shares initially rose around 2pc, but have since pared down to stand more or less flat.

Philip Hammond: Post-Brexit trade deals ‘are of very limited potential value’

Today’s Telegraph front page splash is one not to miss: former Chancellor Philip Hammond has said Brexiters should give up on their ambitions of striking post-Brexit trade deals, saying such arrangements would be of “very limited” value.

In an exclusive interview with Europe Editor Peter Foster, Mr Hammond said:

We all know these trade deals are of very limited potential value and likely to be very hard to negotiate without serious domestic economic and political consequences.

As you'd expect from 'Spreadsheet Phil' he's not making it up - he's run the numbers. (See research by LSE, HMT, @jdportes and others).

They are mad:

UPSIDE from FTAs all FTA is less than 0.5% additional GDP by 2030

DOWNSIDE of Canada minus deal? Negative 4-7% 'lost' GDP /3 pic.twitter.com/0so5wnAfez— Peter Foster (@pmdfoster) October 10, 2019

You can read Peter’s full interview and report here: Exclusive: Philip Hammond suggests new Brexit plan as he slates ‘do or die’ pledge and questions free-trade deals

Agenda: US and China get set for trade talks

Good morning. Today is a big day — though immediate shifts are unlikely, the arrival of Chinese envoys in Washington puts us on the road to a possible breakthrough on one of the biggest issues casting a cloud over markets.

The FTSE 100 managed a moderate rally yesterday, closing up 0.33pc amid a broader burst of relief across European stocks after some sharp falls on Tuesday. The day was light on major Brexit news, and traders had little macro news to move on.

5 things to start your day

1) The boss British of Airways owner IAG has slammed “flight-shaming” environmental campaigners who want to curb air travel. Willie Walsh said holidaymakers and workers should not feel ashamed about boarding a plane — and insisted that commercial flying is a force for good which has lifted the horizons of millions of people.

2) Renting can conjure up images of damp walls, dodgy boilers and recalcitrant landlords but the age of Jeremy Corbyn and Brexit has helped foster a very different and altogether more niche market: the super-rich renter. Upmarket estate agent Knight Frank keeps a close eye on the top end of the London rental market and it notes rising demand from well-heeled customers for so-called “super-prime” tenancies, where renters pay £5,000 a week or more.

3) UK drivers on Shell’s loyalty scheme will soon be able to offset their environmental impact by planting more trees as Big Oil responds to fears about climate change. From next week, customers can opt into the carbon credit initiative, which will see Shell invest £10m towards the restoration of forests to atone for drivers’ emissions.

4) Homeowners looking to sell their property are shunning the market amid political turmoil over Brexit – dragging new listings down to a three-year low. The housing market stumbled again in September as new sales fell to within a whisker of their lowest level since the European Union referendum, according to the Royal Institution of Chartered Surveyors (RICS).

5) But Britain, while on the podium, is not the world champion in cashless. That title goes to Sweden, where demand for notes and coins is so limp that cash is literally disappearing: the amount in circulation has fallen from 80bn kronor (£6.6bn) to Skr58bn (£4.8bn) in the last four years, a reduction of 27.5pc. The same period has seen ATM withdrawals fall by more than half.

What happened overnight

MSCI’s broadest index of Asia-Pacific shares were flat, while both Japan’s Nikkei gained 0.3pc. Shanghai shares also rose 0.35pc.

US S&P 500 mini futures traded down 0.2pc, with a big part of early losses cut after the New York Times reported Washington will soon issue licences allowing some US firms to supply non-sensitive goods to China's Huawei.

Another report, from Bloomberg, that the White House is looking at rolling out a previously agreed currency pact with China also raised hopes of a partial deal and helped to lift assets.

In Hong, the Hang Seng index has added 0.32pc as investors cautiously await the resumption later in the day of high-level trade talks between China and the United States.

Earlier, US stock futures slumped as much as 1.3pc, as the South China Morning Post (SCMP) reported the Chinese delegation, headed by Vice Premier Liu He, was planning to leave Washington after just a day of minister-level meetings, instead of on Friday, as originally planned .

Coming up today

Two announcements worth paying particular attention to today: a trading update from Dunelm, and interim results from Hargreaves Lansdown.

“It’s difficult not to like Dunelm,” says CMC Markets’ Michael Hewson. Solid results have allowed it to post strong results so far this year, which have been matched by outperformance in its share price. There’s reason to believe “that the good news may be priced in”, however, says Hewson, so even meeting expectations might lead to a mixed response from investors.

“As it continues to invest in securing its online position in homeware, there is a risk that profits may well start to flat line, as profit margins shrink,” he says.

Investment supermarket Hargreaves Lansdown’s shares have had a tough few sessions of trading – registering as the FTSE 100’s biggest faller at several points last week. The fall followed some critical analyst commentary that said Hargreaves’ core product was struggling to justify its price premium over rivals in a heated sector. Investors will look for reassurance the group’s strategy is paying off in today's results.

Interim results: Hargreaves Lansdown

Trading update: Dunelm, Mondi, Sabre Insurance

Economics: GDP, RICS house price balance, industrial and manufacturing production, construction output, trade balance (UK), CPI inflation, jobless claims (US)

Yahoo Finance

Yahoo Finance