Rising Brexit deal expectations send pound and bank shares soaring - live updates

Brexit latest: Michel Barnier gets green light for 'tunnel' negotiations

UK-focused shares leap as investors price in increased expectations of a deal

Pound continues to gain ground as Brexit talks gain momentum

Ryan Bourne: How can we reach political agreement when economists can't decide on the facts?

Stocks soar on US-China trade hopes

David Madden of CMC Markets sums up today's markets...

"Equity markets in Europe have been lifted on the back of the hopes surrounding the US-China trade talks as well as Brexit discussions. Later today, President Trump will meet with China’s Vice Premier, Liu He, and dealers are optimistic as Trump tweeted that ‘good things are happening’ at the trade talks. Dealers have been taking their cues from the US president, so hopes are running high.

"In a nice change of pace, we heard positive mood music yesterday from the meeting between Prime Minister Johnson, and Ireland’s Leo Varadkar. The politicians said there is a ‘pathway’ for an agreement being struck, but both sides have been guarded when it comes to the finer details. Nonetheless, dealers are hopeful of progress being made, which explains the drive higher in UK banks in addition to home builders.

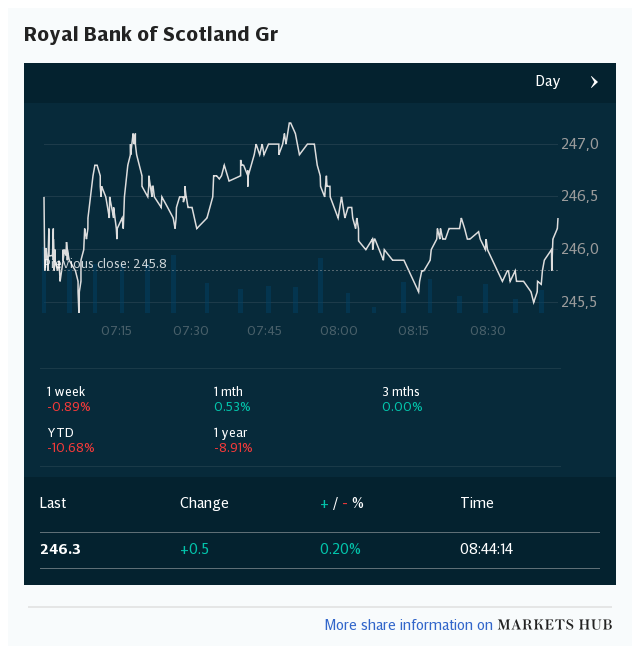

"The optimism surrounding Brexit has given British banks a boost as UK government bond yields have ticked up. Bank’s lending margins usually improve in an environment of higher bond yields, hence why RBS, Lloyds, Barclays and HSBC are higher today. The fear of a disorderly Brexit has been hanging over the property sector. In light of the upbeat sentiment, traders are snapping up Bovis Homes, Persimmon, Taylor Wimpey, in addition to Berkeley Homes."

Rangers chairman Dave King 'cold-shouldered' by City watchdog

Rangers chairman Dave King has been handed a so-called 'City Asbo' for breaking takeover rules when he swooped on the Scottish football club in 2015.

The Takeover Panel found that he had committed an offence of “utmost gravity” by working with a group called the Three Bears to seize control of the top flight team.

He will be “cold-shouldered” for four years - a rarely used sanction that blackballs him from the financial community, barring him from working with others on further takeovers.

Read Oliver Gill's full report here

UK banks and house-builders still on a high

Well, there's less than an hour to go until European stock's close.

Let's take a quick look how those biggest risers are doing now...

RBS is up more than 12pc, as is Lloyds Banking Group.

Housebuilder Persimmon is currently 11.44pc ahead, Taylor Wimpey is 10.86pc higher and Barratt Developments up 10.67pc.

Wait for it... there's more!

Trump has said that when the deal is fully negotiated with China, that he sign it myself with no approval by Congress...

One of the great things about the China Deal is the fact that, for various reasons, we do not have to go through the very long and politically complex Congressional Approval Process. When the deal is fully negotiated, I sign it myself on behalf of our Country. Fast and Clean!

— Donald J. Trump (@realDonaldTrump) October 11, 2019

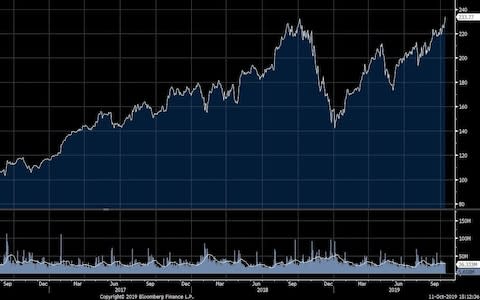

Apple share's touch all time high

Apple shares, which have significant exposure to the Chinese market, jumped 3pc after Donald Trump's tweet.

Wall Street joins the surge as Trump tweets of "good things happening"

Shares are rallying in New York following strong gains in European and Asian markets.

Both the Dow Jones and the S&P 500 are 1.45pc higher at 26,880.47 and 2,980.69, respectively.

The tech-heavy Nasdaq is 1.66pc up at 8,083.37.

US and China officials are holding a second day of talks in Washington and the first day of negotiations stirred optimism.

Trump's latest tweet seems to have increased optimism too. He said that "good things are happening at China trade talk meeting."

The president added: "Warmer feelings than in recent past, more like the Old Days. I will be meeting with the Vice Premier today. All would like to see something significant happen!"

Good things are happening at China Trade Talk Meeting. Warmer feelings than in recent past, more like the Old Days. I will be meeting with the Vice Premier today. All would like to see something significant happen!

— Donald J. Trump (@realDonaldTrump) October 11, 2019

Nissan's new CEO and COO 'brings clarity'

Motoki Yanase, a vice president at Moody’s, Japan, says that the car maker's new appointees "brings clarity to Nissan’s governance arrangements".

"In addition, both Mr Uchida, the new CEO, and Mr Gupta, the new COO, have long-standing relationships with Renault, which would be helpful in maintaining Nissan’s alliance with Renault and Mitsubishi Motor, and promoting synergies between the three companies.

"Such cooperation is increasingly critical in the competitive global automotive market, which is undergoing changes related to autonomous driving, electrification and ridesharing, with increasing requirement for R&D and capital spending.”

Renault boss ousted in 'coup' as car maker seeks to rebuild ties with Nissan

Renault's chief executive claims he was the victim of a "coup" after being sacked by the car maker's board.

Thierry Bollore denounced his ousting in a newspaper interview prior to being officially told of the decision on Friday.

French car giant Renault has appointed chief financial officer Clotilde Delbos to the top job on an interim basis, as it looks to make a fresh start and rebuild relations with its Japanese partner Nissan.

Mr Bollore had only held the job since January, when he was parachuted in to steer Renault following the arrest of former boss Carlos Ghosn in Japan on charges of taking millions of pounds of secret pay.

Read Jon Yeoman's full report here

BP shares in the red after it takes $3bn hit from asset sales

Oil giant BP is 1.6pc lower at 493.95p after it admitted it took a $3bn hit from asset sales and warned of storm disruption.

My colleague Vinjeru Mkandawire writes:

BP will take a hit of up to $3bn (£2.4bn) from asset sales and warned that a storm in the Gulf of Mexico dented its production in the middle of this year.

It comes as BP, which last week announced the departure of chief executive Bob Dudley, looks to sell off non-essential assets worth around $10bn by the end of this year - one year ahead of schedule.

The company sold its entire Alaska business to Houston-based Hilcorp Energy for $5.6bn this year.

It has also signed a deal to divest some of its legacy gas assets from its US Lower 48 business, which recently rebranded to BPX Energy.

US opening calls

We've got less than 10 minutes until the opening bell in New York.

Looks like it could be a positive finish to the week all round...

US Opening Calls:#DOW 26796 +1.09%#SPX 2971 +1.08%#NASDAQ 7836 +1.19%#RUSSELL 1506 +1.43%#FANG 2610 +1.62%#IGOpeningCall

— IGSquawk (@IGSquawk) October 11, 2019

Sterling gains strength

Despite it trading higher today the FTSE 100 seems to be weighed down slightly by the pound's strength amid optimism of a securing a Brexit deal.

Michael Brown of Caxton says:

“Sterling continues to strengthen across the board, gaining ground as markets price in the increased probability of a Brexit deal as a result of UK-EU discussions entering the ‘tunnel’ – a period of intense, confidential negotiations aimed at finalising a deal.

“Looking ahead, the less that is heard from the negotiations, the better the outlook for the pound."

Pound takes another leg higher as Tusk sees ‘promising’ signs on #Brexit. Optimism that deal could be reached has been increasing following meeting betw BoJo, and Irish PM Varadkar on Thur, after which the two said they could see “pathway” to Brexit deal.

https://t.co/DFTRt6abMFpic.twitter.com/5pIqhuQaci— Holger Zschaepitz (@Schuldensuehner) October 11, 2019

Good afternoon

Hello everyone, LaToya Harding here, I'll be taking you through the rest of the afternoon and keeping you posted with all the latest breaking news.

The FTSE 100 is currently 0.75pc higher at 7,240.67 while the FTSE 250 has soared more than 3pc ahead at 19,814.22.

European stocks are similarly in positive territory, with the CAC and the DAX up 1.2pc and 2.07pc respectively.

Hopes of a deal 'reduce likelihood' of a Corbyn government

Whether or not caution is warranted, there is little disagreement among analysts that the pound's end of week surge is remarkable.

It may be that the prospect of dodging a no-deal exit is not the only thing buoying markets though. A deal could also reduce the chances Jeremy Corbyn reaching No. 10, according to Seema Shah of Principal Global Investors:

“The pound’s jump versus both the euro and the dollar is propelled by twin jets – firstly, the prospect of an end to Brexit limbo and secondly, the fact that a deal reduces the likelihood of a Corbyn-led government at the next election, together with the spectre of nationalisation and aggressive corporate tax hikes.

Further gains are possible, Shah said but there is a limit to what investors can hope for:

“Sunnier prospects, if sustained, could see sterling pushing even higher within the coming weeks - although a return to the pre-referendum $1.50 remains unlikely. After all, the endless negotiations and haze of uncertainty of the past three years has taken its toll on the UK economy.

Furthermore, the UK will still likely endure some economic pain on leaving the EU, even with a deal. Investors should be mindful of over-exuberance in the months ahead, especially while the new deal remains in negotiation stage.”

And some more from Neil Wilson at Markets.com:

“The rally over the last two days has been astonishing - up four big figures in less than two sessions, it's on course for one of its best two-day rallies in about 25 years.

Now that negotiations are in the tunnel phase we should anticipate a lot less news flow but there will be just as much speculation as ever - watch for how the Lab and Lib Dem, ERG and DUP sound on the state of things - ultimately MPs have to back it.”

Brexit negotiations - a note of caution

Markets have responded positively to news that the EU is preparing for negotiations with UK officials. But some are sounding a note of caution.

The Telegraph's Europe Editor Peter Foster warns those hoping for a deal not to ice the champagne just yet:

Right. Before we ice the champers, am hearing notes of caution.

So definitely a 'negotiation'...but at this point somewhat exploratory.

Understand @SteveBarclay didn't bring hard details to meet with @MichelBarnier today. /1 https://t.co/gCnKmX2UvI— Peter Foster (@pmdfoster) October 11, 2019

Neil Wilson, analyst at Markets.com, also urged a little scepticism:

"[The prospect of closed-door negotiations] does not, however, mean a final deal will be presented, nor that MPs will back the deal that may be presented to them in due course. There are yet some considerable barriers to clear before we can say that a deal is going to be done.

Theresa May's team didn't have it easy in the tunnel, but it did lead to a deal on paper that could be voted on. And at least it does suggest we've come a fair distance in the last few days - something that did not appear possible."

Prospect of detailed negotiations sends sterling to three-month high

Sterling just keeps on rising...

The EU looks set to give the green light for in-depth negotiations on the detail of a possible Brexit deal.

The move would see UK and EU negotiators enter into intensive confidential negotiations, in a process known as "entering the tunnel".

The reports have led currency traders to strengthen their bets on the pound, which reached its highest level since the beginning of July. The pound rose as high as $1.2671 and €1.1462.

Biggest two-day rally for sterling since Brexit referendum

Biggest two day rally on GBP since June 2016 - approaching 1.26 handle#GBP +0.92% against other currencies#GBPUSD 1.25884 +1.17%#EURGBP 0.87632 -0.93%#GBPAUD 1.85242 +0.68%#GBPJPY 136.296 +1.47%#GBPCAD 1.67135 +1.1%#GBPCHF 1.25647 +1.31%#GBPEUR 1.14114 +0.94%

— IGSquawk (@IGSquawk) October 11, 2019

The pound almost hit $1.26 a few minutes ago and is now on its biggest two-day tear in over three years.

Pound rises again after 'constructive' UK-EU talks

Stephen Barclay's meeting with the EU's chief negotiator Michel Barnier has ended. Irish broadcaster RTE is reporting that the talks were "constructive".

The Commission was in contact with Ireland and President Tusk, continuous contacts in order to be "on the same page." We are working towards a deal, if there is a will there is a way

— Tony Connelly (@tconnellyRTE) October 11, 2019

The pound has now jumped to more than $1.25 against the dollar and €1.138 against the European single currency.

Banks and builders lift off on hopes of a Brexit deal

Turning back to the FTSE, UK-focused companies have risen sharply this morning.

Shares in Royal Bank of Scotland and Lloyds banking group are both up more than 8pc.

Investors in British housebuilders are also sitting on big paper gains.

The following FTSE 100 builders have all made major in-roads today:

Barratt Developments: +8pc

Persimmon: +7.7pc

Taylor Wimpey: +6.8pc

Berkeley: +6.8pc

EXCLUSIVE: Coventry Building Society boss to retire

Breaking news from our Banking Editor Lucy Burton. The boss of Coventry Building Society is set to step down. Here are the details:

Sources have told The Telegraph that Mark Parsons, the chief executive of Coventry Building Society and one of the best paid building society bosses in Britain with a £863,000 salary, is retiring after five years in the role. It is not clear who will be replacing him. The company could announce his exit as soon as today, sources said.

Parsons has led the building society since 2014, having previously worked in Barclays' retail and business banking divisions for eight years. Earlier in his career, he spent time at Abbey National and PwC. He remains a board member of industry body UK Finance.

Renault axes boss in bid to cut Carlos Ghosn links

Renault has ousted chief executive Thierry Bollore just days after partner Nissan selected a new boss as the two car manufacturers try to move past the fallout from Carlos Ghosn's arrest over allegations of financial misconduct, which he has denied.

Bollore, who served as Ghosn’s second-in-command before taking the helm in January, will leave immediately.

Long-time boss Ghosn led the Renault-Nissan alliance for years but the partnership unravelled following his arrest last year. The saga lifted the lid on severe tensions in the relationship and shortcomings in corporate governance.

Renault’s board has named finance boss Clotilde Delbos as interim chief executive.

Rollercoaster ride for the pound as Tusk speaks

Sterling has had a rollercoaster ride in the past 30 minutes.

President of the European Council Donald Tusk sent currency traders scrambling when he said that the "time is practically up" for Britain to reach a Brexit deal.

Sterling had been at 3-week high but sank to just above $1.24 just minutes after eclipsing the $1.25 barrier. The pound recovered as Tusk continued speaking.

The chances of a no-deal outcome were considered to have reduced after he spoke of "promising signals" from Irish prime minister Leo Varadkar that a deal was possible.

Here is what Tusk said on Brexit:

President Tusk's remarks today on #Brexit, ahead of next week's #EUCO

Full statement text: https://t.co/a1WUsL82HE

Video: https://t.co/oyTqZwjxDApic.twitter.com/Q1Nv93HsY5— EU Arauzo (@EU_Arauzo) October 11, 2019

Thomas Cook's demise is competitors' gain

Travel company Dart Group, the owner of Jet2, has boosted its profit outlook this morning, saying the the collapse of Thomas Cook has led to a surge in customer interest.

Shares jumped more than 15pc in morning trading. Fellow travel companies Tui and On The Beach also saw gains of 6pc and 3pc, respectively, as investors bet on other travel companies benefiting from the collapse of Britain's oldest travel company.

Pound at highest in over two weeks

The pound has jumped to within a whisker of $1.25 in the past few minutes as its rally continues.

Brexit Secretary Stephen Barclay is in Brussels this morning, where he had a working breakfast with the EU's chief negotiator Michel Barnier in search of a breakthrough on the current Brexit impasse.

Pound rallies on Brexit deal optimism

The pound rallied strongly yesterday, delivering its best performance in seven months as traders priced in rising expectations of a transition deal being struck between the UK and the EU.

Talks between Prime Minister Boris Johnson and his Irish counterpart Leo Varadkar lasted almost three hours. They went well enough that the Taoiseach felt a deal was possible by the end of October.

But Michael Hewson at CMC markets is among those urging caution:

"Given we’ve been here so many times before this optimism needs to be tempered by the fact that any deal would have to be approved not only by the EU, but by MPs here as well, and MPs track record on agreeing on anything in recent months hasn’t been particularly great.

With this in mind this optimism could well be short-lived with any progress likely to be as elusive as the pot of gold at the end of the rainbow.

You can keep up with the latest developments on Brexit on our separate live blog here:

Morning round-up

Telegraph Business is littered with exclusives this morning. Here are two more.

First, Business Secretary Andrea Leadsom is prepared to seek further assurances on the foreign takeover of defence firm Cobham after its sale was blasted by the former head of MI6.

You can read what the Business Secretary told our reporter James Cook here:

If you need to get up to speed on the proposed deal, take a look at this timeline of the bid:

Second, a shadow was cast over the rescue deal for Thomas Cook's travel stores last night as it emerged that almost a tenth of the 555 shops bought by Hays Travel are within 100 metres of its existing estate.

You can read the story here:

Hays Travel boss John Hays started the business at the back of his mother's childrenswear shop in 1980. Now it has 745 branches, including the Thomas Cook shops.

Hays told The Telegraph last night that between 50 and 100 of the 555 stores had already reopened yesterday, the first day after the deal was announced.

Hays faces an uphill battle to make a success of the plan in the face of a struggling high street and fierce online competition. But there are important differences between it and the collapsed Thomas Cook, not least that it does not have to prop up an ailing airline.

I've taken a look at the challenges facing the deal and the reasons for Hays' optimism here:

And here is a look at some of the key numbers behind the acquisition and the industry:

Markets rising but pound holds back FTSE big-hitters

Time to check in on the stock markets...

The FTSE 100 has slipped after signals of a possible compromise on a Brexit deal sparked a the surge in the pound yesterday evening. The blue-chip index is down 0.5pc this morning.

The more domestically-focused FTSE 250 is up, however. The mid-cap index is less exposed to currency fluctuations.

In Europe, the main indices are all trading between 0.2 and 0.8pc higher.

For more details, use the tool at the top of this blog to follow UK and global equity markets as well as currency movements.

US economy: Who decides the facts?

US negotiators are busy trying to find common ground with Chinese officials but they're harder pressed than ever to do the same with their domestic opponents.

Ryan Bourne writes for that whatever our disagreements it’s comforting to believe that certain realities are beyond reasonable dispute. But in the present fraught political and economic discourse, that is no longer the case, he says - even among economists:

"...even basic “facts” about the economy in the US are today wrangled over. Republicans and Democrats there don’t just disagree about the wisdom of certain policy ideas or whether observed trends in certain metrics are worrisome."

Read Ryan's column:

Trump teases China over trade talks

Big day of negotiations with China. They want to make a deal, but do I? I meet with the Vice Premier tomorrow at The White House.

— Donald J. Trump (@realDonaldTrump) October 10, 2019

US and Chinese negotiation teams are set to continue discussions today after a seemingly positive start to two days of meetins in Washington yesterday.

US President Donald Trump said "we had a very, very good negotiation with China". A White House official said the talks had gone "probably better than expected".

But Trump couldn't resist teasing his Chinese counterparts via his favourite social media platform:

"Big day of negotiations with China. They want to make a deal, but do I? I meet with the Vice Premier tomorrow at The White House."

BREAK: Oil price jumps on reports of oil tanker 'missile strike'

Two missiles struck the Iran-owned Sinopa oil tanker setting it ablaze off the Saudi port of Jeddah, Iranian state TV reported this morning.

"Two missiles hit the Iran-owned ship near the Jeddah port city of Saudi Arabia," local media said, quoting the National Iranian Oil Company.

The oil price has jumped 1.3pc. We will bring you more news as the story develops.

Exclusive: Hargreaves Lansdown clashes with pro-Brexit founder

Hargreaves Lansdown has clashed with its eponymous founder and largest shareholder Peter Hargreaves over how the company handles its political donations.

The FTSE 100 company postponed a routine vote on political donations at its annual meeting yesterday following "shareholder feedback".

My colleague Harriet Russell has more:

Sources familiar with the fund investment platform told The Telegraphthat Mr Hargreaves, a staunch Brexiteer, believes the company he founded should be able to hold stronger political convictions. Executives at Hargreaves Lansdown favour a more neutral approach.

Hargreaves pulled the vote from the AGM schedule at the start of the meeting citing "shareholder feedback", before later stating it was "consulting with shareholders in relation to this resolution."

Read Harriet's full report:

City watchdog slaps broker with £15m fine for misconduct by brokers

The City watchdog has this morning fined broker Tullett Prebon £15.4m for improper trading and for not being open and co-operative with investigators.

Tullett Prebon, now part of FTSE 250 firm TP Icap, had "ineffective controls around broker conduct", the Financial Conduct Authority (FCA) found.

The company carried out "wash trades" - transactions with no legitimate commercial purpose - to generate "unwarranted and unusually high amounts of brokerage for the firm", the FCA said.

Read the full report here:

Agenda: Sterling and markets jump on Brexit and trade talks

Good morning. Sterling rose from just over $1.22 to $1.24 during two hours of intense trading yesterday, climbing 1.4pc as Prime Minister Boris Johnson and his Irish counterpart Leo Varadkar tried to reach a compromise over the term of Britain’s exit from the EU.

At one point sterling was on track for its best day in more than three years before a slight pullback late in the day.

5 things to start your day

1) HMV’s rescuer is taking a punt on the revival of vinyl and the British high street with a new mega-store in Birmingham. Canadian music mogul Doug Putman is today opening the Vault, a 25,000 sq ft site in the city centre which it claims will be one of Europe's biggest entertainment shops.

2) The three chilling charts keeping central bankers up at night. Who would be a central banker in the post-financial crisis world? After single-handedly dragging the economy out of one mess, rate-setters around the globe have the thankless task of battling new threats, ranging from credit bubbles to deflation.

3) Business Secretary Andrea Leadsom is prepared to seek further assurances on the foreign takeover of defence firm Cobham after its sale was blasted by the former head of MI6. Mrs Leadsom said that she has already demanded guarantees from the contractor's US buyer Advent that jobs and factories will not be axed in Britain - but added “other agreements” may still be reached in the interests of national security.

4) The acquisition of Thomas Cook’s entire UK store estate by family-run Hays Travel is a fairytale ending to a nightmare month for staff of one of Britain’s best-loved brands. But the hard work to make the deal a success starts now.

5) British Airways boss says Heathrow is unlikely to get a third runway due to environmental concerns: Willie Walsh said the huge project to boost capacity at Europe's busiest air travel hub is likely to fall flat despite finally winning approval from Parliament last year.

What happened overnight

Asian shares rose on Friday after U.S. President Donald Trump said he would meet with China's top trade negotiator, stirring hopes for an agreement, while sterling was flat after earlier jumping on optimism over a potential Brexit deal.

The Hang Seng index added 2.2pc, putting it on course for its best day since September 4.

The CSI300 index rose 0.5pc at the end of the morning session, while the Shanghai Composite Index gained 0.4pc. Japan's Nikkei stock index gained 1pc.

MSCI's broadest index of Asia-Pacific shares outside Japan rose 1.2pc, following on from gains on Wall Street.

Top US and Chinese negotiators wrapped up a first day of trade talks in more than two months on Thursday as business groups expressed optimism the two sides might be able to ease a 15-month trade war and delay a US tariff hike scheduled for next week.

US President Donald Trump said "we had a very, very good negotiation with China", while a White House official said the talks had gone "probably better than expected".

Coming up today

Trading update: Jupiter Fund Management, Man Group

Economics: Consumer price index (Germany), Import and export price indices (US)

Yahoo Finance

Yahoo Finance