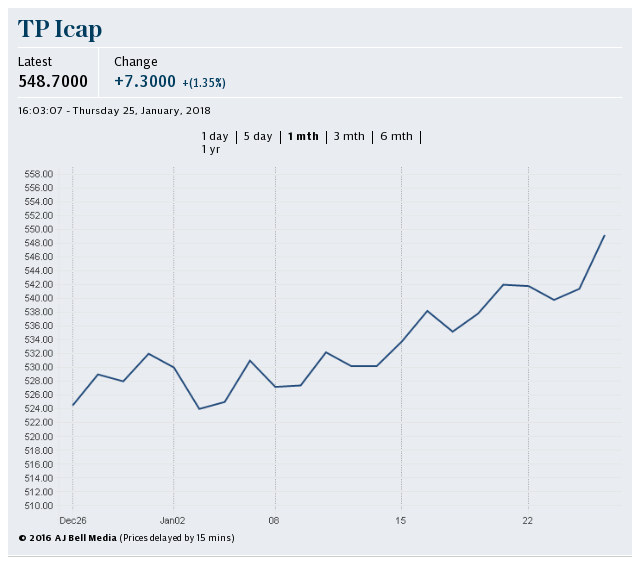

Market report: Merger costs send TP Icap tumbling

The world’s largest interdealer broker, TP Icap, suffered its worst day of trading since its creation via a merger 15 months ago, after the costs of the deal doubled.

Tullett Prebon and Icap’s broking businesses combined in a landmark deal in 2016. TP Icap was forced to admit today that integration costs climbed out of control to £79m, however.

It also flagged a £14m hit from adjusting to Mifid II, a sweeping set of financial regulations designed to protect investors, and warned that the cost of Brexit preparations will creep higher.

The City broker, which is known for its celebrity charity days, conceded that exceptional costs were “unlikely to abate” in 2018. It revealed it is also plotting to create a post-Brexit European hub with Paris and Frankfurt in the running to snap up its services.

TP Icap said a lack of clarity on Britain’s final relationship with the EU had forced it to move some of its business across the Channel.

The surprise surge in costs overshadowed a stronger start to 2018, sending its shares sliding 56.7p to 482.7p. Elsewhere, Computacenter’s year-long share price rally came to an abrupt halt after warning investors that 2018 would be a “challenging” year for the IT strategy and technology infrastructure firm.

The FTSE 250 company upgraded its profit expectations in 2017 four times, boosting its shares by 44pc last year.

Despite warning that its profits would feel the strain from significant contract renewals and the lack of a growth-boosting project being completed recently, Computacenter insisted that it will continue its expansion abroad.

Investec told clients to expect a “consolidation” year for the company but the warning of turbulent trading ahead weakened it 99p to £10.36.

Insurer Direct Line slipped 9.9p to 383.3p after Deutsche Bank warned impatient investors in a downgrade to “hold” that it will be years until it feels a tangible benefit from its strategy revamp. Direct Line is implementing a sweeping overhaul of its IT systems and admitted last year that it will have to set aside between £80m and £100m each year until 2019 to complete the makeover.

Off-licence operator Conviviality tumbled a further 13.6p to 101.2p after confirming that the error in its financial forecasts would hit earnings this year by around 20pc, bringing its total share price slide in the last week to 66pc.

The pound’s climb on currency markets ramped up the pressure on the FTSE 100’s dollar earners with the index sinking 75.98 points to 7,138.78, as investors brushed aside Rex Tillerson’s sacking and inflation in the US nudging higher.

Yahoo Finance

Yahoo Finance