Mandarin Gardens Collective Sale Committee raises price to $2.9b

Mandarin Gardens Collective Sale Committee raises reserve price to over $2.9 billion in a bid to win over more owners who have not consented to the condominium’s en bloc sale yet.

Just one month before its collective sales agreement is set to expire, Mandarin Gardens has raised its asking price to a new record of $2.927 billion. The Mandarin Gardens Collective Sales Committee (CSC) has raised the reserve price at least three times – from $2.48 billion, to $2.79 billion, to the current price – in an effort to get 80 per cent support from owners in their en bloc bid.

The Straits Times reported that as at March 12, only 67 per cent of owners have agreed to the Mandarin Gardens collective sale. 13 per cent short of the mandated 80 per cent for the sale to get through.

In a letter to owners on Feb 21, the CSC said it raised the reserve price by 5 per cent and adjusted total land cost to the developer to $1,250 psf ppr from $1,191 “to better help achieve the 80 per cent consensus required.”

“As the validity of the CSA ends on March 24, 2019, we appeal to all (owners) who are still considering, to make an immediate decision to sign the CSA,” the CSC said.

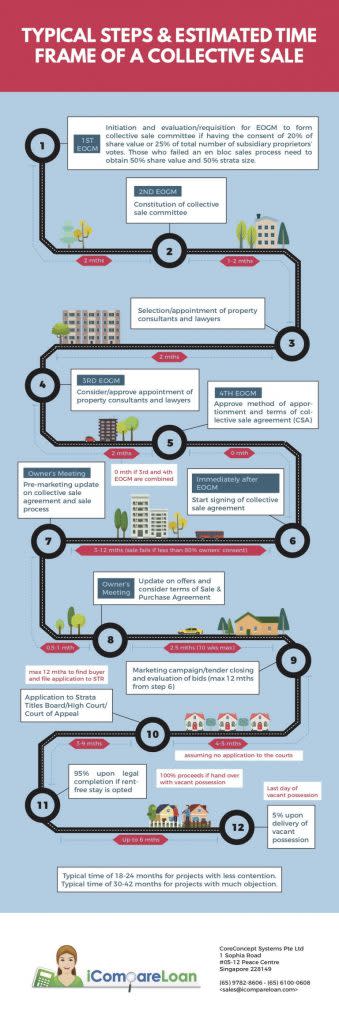

“If the 80 per cent consensus is not achieved by March 24, the whole en bloc sales process will come to a halt. … However if we achieve the 80 per cent, we are given a 12-month period to find a developer/buyer for our land,” it added.

If this new reserve price for Mandarin Gardens collective sale goes through, owners of the smallest unit (732 sq ft) can stand to get $1.86 million, while the largest unit at 3,800 sq ft can get $5.98 million. Owners of 1,500 square-foot to 2,000 square-foot units can get between $3.016 million and $3.5 million.

Paul Ho, chief mortgage consultant at iCompareLoan, said the Mandarin Gardens Collective Sale site, with 1,006 units, sitting on sites close to or over one million sq ft, is so big that given the current market conditions, even the big boys may not have a risk appetite for.

“Developers interested in bidding for collective sales of Mandarin Gardens have to be mindful of other cost factors like development charge and Additional Buyers’ Stamp Duty, which may push up the actual costs for them even higher,” Mr Ho said. Adding: “With the upgrading premium, the actual bill for the developer could be pushed to be in the region of $3 – $4 billion.”

The attempt to sell Mandarin Gardens en bloc failed 10 years ago when the sales committee pushing for the collective sales of the condominium was accused of trying to control the management council running the estate and voting down proposals to upgrade estate facilities.

Mr Ho asks if Mandarin Gardens Collective Sale will be the single biggest uniting force to let property developers come together and work together?

How to Secure the Best Home Loans Quickly

iCompareLoan is the best infomercial loans portal for home-seekers, buyers, investors and real estate agents alike in Singapore. On iCompareLoan, you will be able to find all the latest news and views, informational guides, bank lending rates and property buying trends, and research data and analysis.

Whether you are looking to buy, sell or refinance apartments, condominiums, executive condos, HDB flats, landed houses or commercial properties, we bring you Singapore’s most comprehensive and up-to-date property news and best home loans trends to facilitate your property buying decisions.

Our Affordability Tools help you make better property buying decisions. iCompareLoan Calculators help you ascertain the fair value of a property and find properties below market value in Singapore.

Our trademarked Home Loan Report is Singapore’s first one-of-a-kind analysis platform that provides latest updates of detailed loan packages and helps property agents, financial advisors and mortgage brokers analyse best home loan packages for their clients, so that they may give unbiased home loan/commercial loan analysis for their property buyers and home owners. Our distinguished Panel of Property Agents who are users of our Home Loan report can give the best all-rounded advise to real estate seekers.

All the services of our mortgage consultants are ABSOLUTELY FREE, which means it’s all worth it to secure a loan through us.

Whether it is best home loans, best commercial loans or refinancing of existing loans or SME loans, CONTACT US TODAY!

The post Mandarin Gardens Collective Sale Committee raises price to $2.9b appeared first on iCompareLoan Resources.

Yahoo Finance

Yahoo Finance